Picture supply: Getty Photos

The BT (LSE:BT.A) share value has risen a formidable 23% within the 12 months to this point. And Metropolis analysts don’t assume the FTSE 100 inventory is completed but.

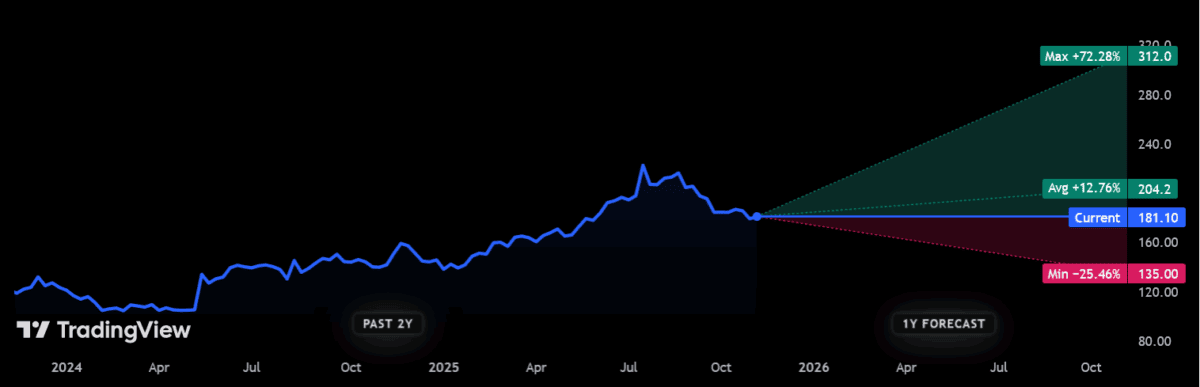

BT shares had been final altering fingers at 181p per share. If forecasts are right, they are going to surge by means of the 200p marker over the following 12 months, to 204.2p per share. That may signify a 12% rise from present ranges.

Supply: TradingView

Supply: TradingView

When one additionally components in predicted dividends, buyers in BT might realise a complete return of 16% to 17% through the subsequent 12 months. However how life like are these forecasts?

Progress

Firstly, it’s necessary to say that brokers aren’t unanimously bullish of their estimates. That 200p-plus goal is a mean among the many 15 forecasts presently on provide from the analyst neighborhood.

One analyst believes BT’s share value might drop greater than 1 / 4 between now and subsequent Remembrance Day. Having mentioned that, one other reckons it might print value good points north of 70% over the interval.

What do Metropolis analysts imagine might drive the corporate ever greater? Bulls reckon BT’s restructuring programme won’t solely assist it proceed its spectacular cost-cutting technique. They see it as a manner of streamlining its product ranges to assist it rescuscitate its dragging revenues.

BT’s restructuring plan achieved a strong £1.2bn price of financial savings within the 18 months to September, smashing forecasts.

Optimism additionally abounds over the agency’s high-margin Openreach infrastructure division as new fibre connections proceed to develop. It’s heading in the right direction to attach 25m premises by the tip of subsequent 12 months, and 30m by the shut of the last decade.

Issues

But whereas BT’s been making progress on these fronts, I concern the inventory could also be operating out of highway as issues proceed elsewhere.

It’s nonetheless proven no manner of overcoming its continued gross sales issues — adjusted revenues dropped once more within the six months to September, by 3%, with reversals recorded throughout its Shopper, Enterprise, and Worldwide divisions. Towards a backdrop of accelerating competitors and a weakening UK economic system, I can’t see its revenues points easing any time quickly.

On the similar time, capital expenditure continues to tick up, rising 8% within the half 12 months. Which means that internet debt can also be heading steadily greater, up one other 3% 12 months on 12 months to finish September at £20.9bn.

It makes for much more grim studying when one considers the price of BT’s huge pension deficit. That is costing the corporate round £800m a 12 months.

Costly

There’s additionally a valuation drawback I really feel might restrict additional good points for BT’s share value. This 12 months’s speedy ascent leaves it buying and selling on a ahead price-to-earnings (P/E) ratio of 10.3 occasions.

That’s above the 10-year common of 8.8 occasions. Given the enduring issues the enterprise faces, this rising premium is very onerous to fathom.

Added to this, BT shares now additionally command a price-to-book (P/B) ratio of 1.4. That is up from beneath one simply 14 months in the past, and signifies that the agency trades at a premium to its asset values.

I wouldn’t be shocked if BT’s share value had been to proceed rising. However I feel the chances are stacked in opposition to it, so I’d somewhat purchase UK shares that supply a lot decrease threat.