Bitcoin offered off sharply early Friday Asian time, plunging greater than 5% from $89,000 to a low of $83,400 throughout US daytime buying and selling. In contrast to gold and equities, it did not get better—exposing a troubling id disaster for the so-called “digital gold.”

The market is re-pricing belief in currencies and establishments, however that belief is flowing to gold vaults, not crypto wallets.

Sponsored

Sponsored

Identical Storm, Totally different Outcomes

The sell-off was triggered by an escalation in US-Iran tensions after President Trump issued warnings on Fact Social, threatening army strikes except Tehran agrees to a nuclear deal. Center Jap governments try to push either side into talks, however efforts have failed to realize traction because the US strikes extra firepower into the area. A looming authorities shutdown added to the risk-off temper.

Gold responded with excessive volatility, dropping 7% to $5,250 inside an hour earlier than staging a dramatic V-shaped restoration. The Kobeissi Letter famous that gold’s market cap swung by $5.5 trillion in a single session—the most important each day swing in historical past. By early Asian buying and selling on Friday, spot gold had climbed again above $5,400, up round 1%.

That is completely insane:

Gold simply posted its largest each day swing in market cap in historical past, at $5.5 TRILLION.

Between 9:30 AM ET and 10:25 AM ET, gold misplaced -$3.2 trillion in market cap, or -$58 billion PER MINUTE.

Then, between 10:25 AM ET and 4:00 PM ET, gold added again… pic.twitter.com/9BmnY9g6Ap

— The Kobeissi Letter (@KobeissiLetter) January 29, 2026

US equities, in the meantime, confirmed resilience. The Nasdaq shed simply 0.7%, weighed down by Microsoft’s 10% plunge on AI spending issues. However Meta surged 10% on sturdy earnings, and the Dow closed barely optimistic.

Bitcoin informed a special story. It dropped to a low of $83,400 and managed solely a tepid bounce to $84,200, far in need of gold’s V-shaped restoration or tech’s selective rally.

Sponsored

Sponsored

The divergence is stark. Gold has risen greater than 25% this month alone, almost doubling since Trump’s second time period started a 12 months in the past. Silver has nearly quadrupled since April’s “liberation day” tariffs, surging from beneath $30 to over $118 an oz. Some analysts describe the value strikes as parabolic, with all of the hallmarks of a speculative mania.

Analysts say the valuable metals rally displays greater than short-term stress—it indicators eroding confidence in currencies, establishments, and the post-Chilly Warfare financial order.

Supply: CoinGecko

Trump’s aggressive insurance policies—punitive tariffs, threats in opposition to Greenland and Iran, and mounting stress on the Federal Reserve, together with a prison case in opposition to Chair Jerome Powell—have pushed buyers towards conventional secure havens. The greenback fell to a four-year low in opposition to a basket of currencies on Wednesday.

Central banks have been including to gold reserves as a modest diversification away from US Treasuries. Retail buyers are piling in too, drawn by each the safe-haven narrative and easy momentum.

Sponsored

Sponsored

Structural Weak spot Beneath

But Bitcoin, which shares gold’s theoretical attraction as a hedge in opposition to forex debasement, has not joined the shopping for spree.

The value motion uncovered vulnerabilities that had been constructing in crypto markets. Bitcoin spot ETFs have seen persistent outflows all through January, with complete property declining from a peak of $169 billion in October to round $114 billion—a 32% drop.

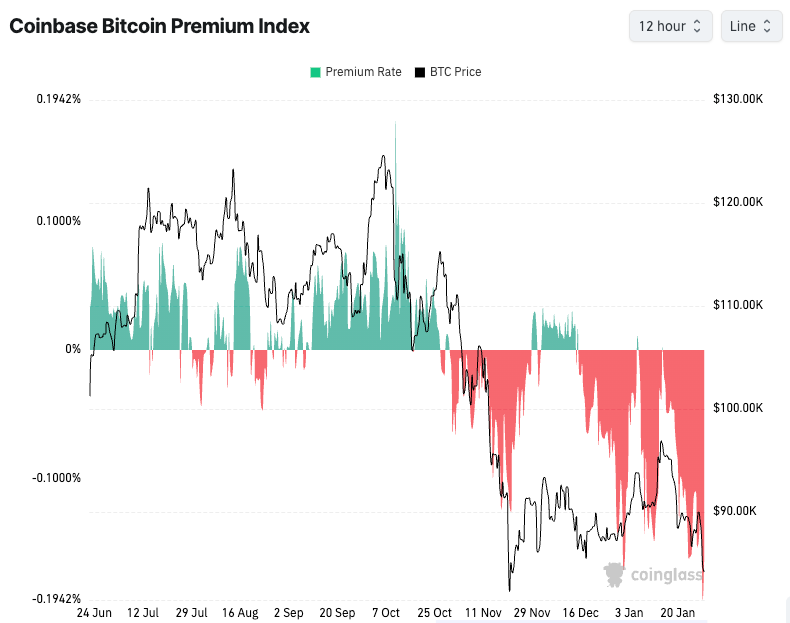

The Coinbase Premium Index, which tracks the value hole between Coinbase and world exchanges and serves as a barometer for US institutional curiosity, has additionally turned unfavourable. Each indicators level to a waning urge for food amongst institutional patrons who drove a lot of the 2024-2025 rally.

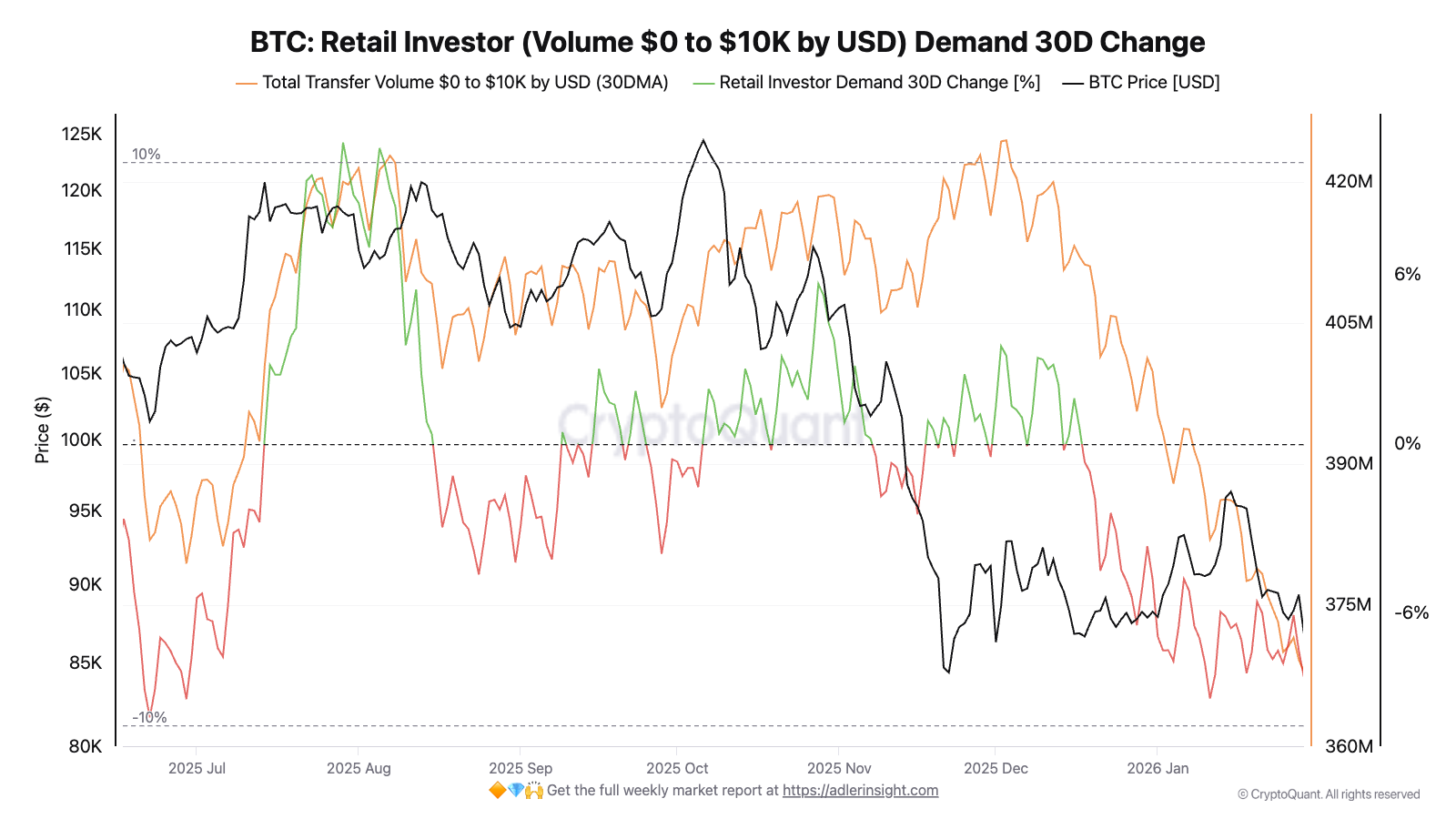

Retail demand has contracted sharply, based on on-chain knowledge. With each institutional and retail patrons stepping again, rallies wrestle to maintain momentum whereas drawdowns change into extra violent.

Sponsored

Sponsored

On the retail aspect, on-chain knowledge from CryptoQuant reveals small transactions between $0 and $10,000 declining steadily, with 30-day demand development falling from above 10% in October to round -6% now.

With each institutional and retail demand weakening, rallies wrestle to maintain momentum whereas drawdowns change into extra violent.

What It Means

Wednesday’s session supplied a real-time stress check. Gold proved it stays the market’s disaster hedge of selection. Tech shares confirmed that sturdy fundamentals can override macro fears. Bitcoin did neither—absorbing the draw back of danger property whereas lacking the upside of secure havens.

For the “digital gold” narrative to regain credibility, Bitcoin might want to display safe-haven conduct when it issues most. Till then, the label stays extra aspiration than actuality.