Picture supply: Getty Pictures

So that you’d like to show a few of your spare money into passive revenue? Nice – the inventory market generally is a excellent spot to look and the most effective methods includes investing a set quantity every month.

Geopolitics and macroeconomics make it laborious to inform precisely what future returns will likely be. However over the long run, the money returned to shareholders by companies has been forward of different belongings.

Investing within the inventory market

Whether or not it’s the UK, the US, or anyplace else, the inventory market generally is a risky place. Share costs can go down – and this may be annoying – however issues do are likely to work out ultimately.

During the last decade, for instance, the typical return from the FTSE 100 has been round 7.5% a 12 months. That’s much better than what you possibly can have earned in money, nevertheless it hasn’t all been plain crusing.

Numerous companies made no cash and share costs fell sharply throughout Covid-19. However regardless of shares doing worse than money throughout this time, they’re nonetheless forward during the last 10 years.

This isn’t an accident. Whereas there may be instances when shares underperform and also you’d fairly be in money, the most effective companies discover methods to do higher than what they will get from a financial savings account.

How a lot are you able to make?

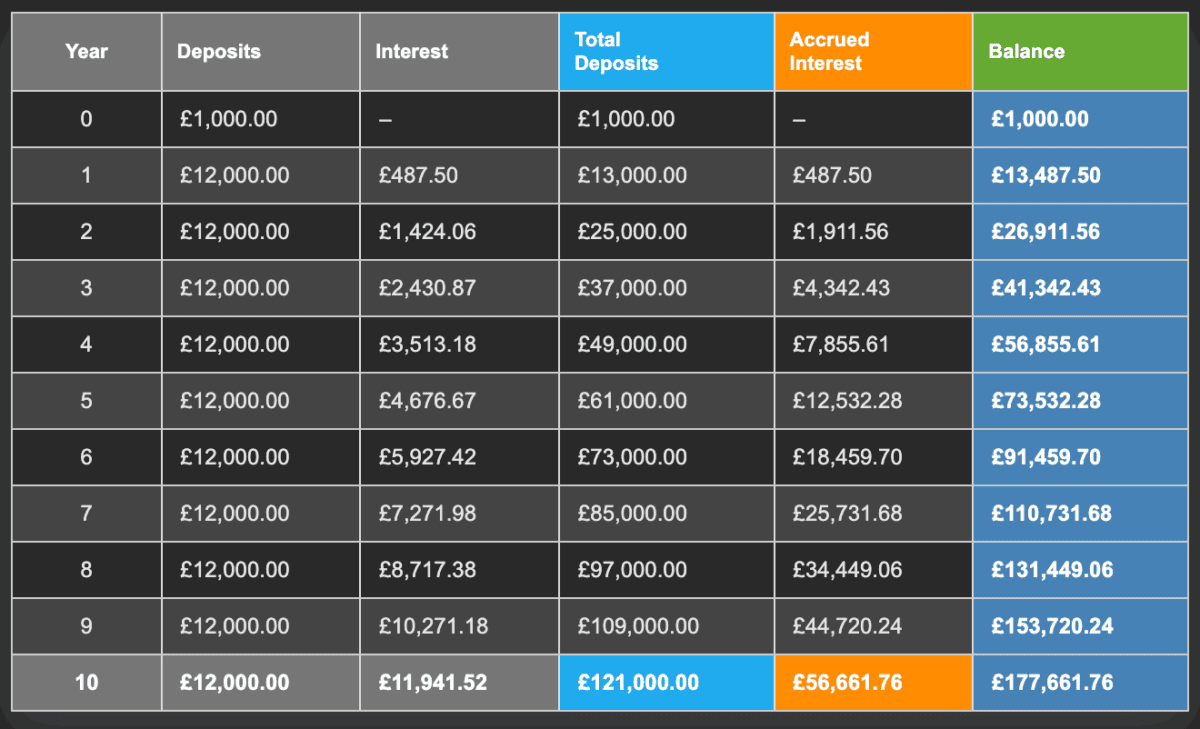

That is simply an illustration, however investing £1,000 a month with a 7.5% return in dividends generates £487.50 within the first 12 months. And doing it for 10 years means £4,875 a 12 months on the finish of a decade (so long as the dividend isn’t lower).

That’s not dangerous, nevertheless it isn’t the top of the story. That’s not dangerous, nevertheless it isn’t the top of the story. By staying invested and utilizing dividends to mechanically purchase extra shares at any time when they’re paid, the long-term returns of a portfolio can dramatically enhance.

Supply: The Calculator Website

Totally different FTSE 100 firms have totally different approaches – some retain and reinvest their earnings and others return them to shareholders as dividends.

With firms that retain their earnings internally, you’ll be able to nonetheless generate passive revenue. Bear in mind, share value rises will add to the last word returns and promoting a part of the funding if it grows over time may contribute to passive revenue.

Investing concepts

One inventory that buyers ought to check out is Rightmove (LSE:RMV). The UK’s largest on-line property platform has an excellent file of producing enormous earnings with not a lot money.

The agency’s property, plant, and tools has a price of round £8m on its steadiness sheet. It turns this into working revenue of £270m a 12 months – and this quantity has been going up.

The dividend yield is just one.5%, however the agency has a much bigger concentrate on share buybacks. And given the corporate’s progress, I don’t assume this by itself ought to put buyers off.

Rightmove’s greatest power – the community of patrons and sellers on its platform – doesn’t value a lot to take care of. That permits it to return a whole lot of the money it generates to buyers by means of dividends and share repurchases that might drive the share value larger.

Dangers and rewards

The inventory market generally is a risky place and Rightmove isn’t any exception. If the UK housing market falters – particularly because of weak mortgage demand – this might threaten earnings progress.

Traders all the time must be attentive to potential dangers, however I absolutely count on shares to be a greater long-term selection than money. Particularly ones in rising companies with low prices.