Bitcoin (BTC) has prolonged its downward trajectory. Over the previous 24 hours, the asset has declined 1.39%, pushing its whole losses for the month past 30%.

Whereas the broader bear market surroundings stays the first driver of weak spot, rising on-chain indicators recommend that concentrated whale exercise may reportedly be amplifying BTC’s draw back.

Sponsored

Whale Exercise Raises Considerations Over Brief-Time period Bitcoin Volatility

In a put up on X (previously Twitter), blockchain analytics agency Lookonchain reported {that a} whale’s (3NVeXm) deposits have coincided with Bitcoin’s worth drops. Information from Arkham confirmed that the whale began depositing Bitcoin to Binance three weeks in the past, beginning out with modest quantities.

Nevertheless, exercise accelerated this week. On February 11, the whale transferred 5,000 BTC into the trade. The string of transfers has continued with the pockets sending one other 2,800 cash simply at the moment.

Whale 3NVeXm Bitcoin Transfers. Supply: Arkham

Lookonchain steered that the timing of those deposits might have influenced short-term worth motion.

“Every time he deposits BTC, the price drops. Yesterday, I warned when he made a deposit — and soon after, BTC dropped over 3%,” the put up learn.

Sponsored

As of the most recent obtainable knowledge, the deal with nonetheless holds 166.5 BTC, valued at over $11 million at present market costs. Giant trade inflows are sometimes interpreted as a precursor to promoting, as traders sometimes transfer property to buying and selling platforms to liquidate or hedge positions.

Whereas correlation doesn’t essentially indicate causation, the size and timing of those transfers may have elevated instant sell-side stress in an already fragile market construction. In intervals of heightened sensitivity, even the notion of whale-driven promoting can amplify draw back strikes as merchants react to on-chain indicators and regulate positions accordingly.

Capitulation Alerts Level to Market Stress

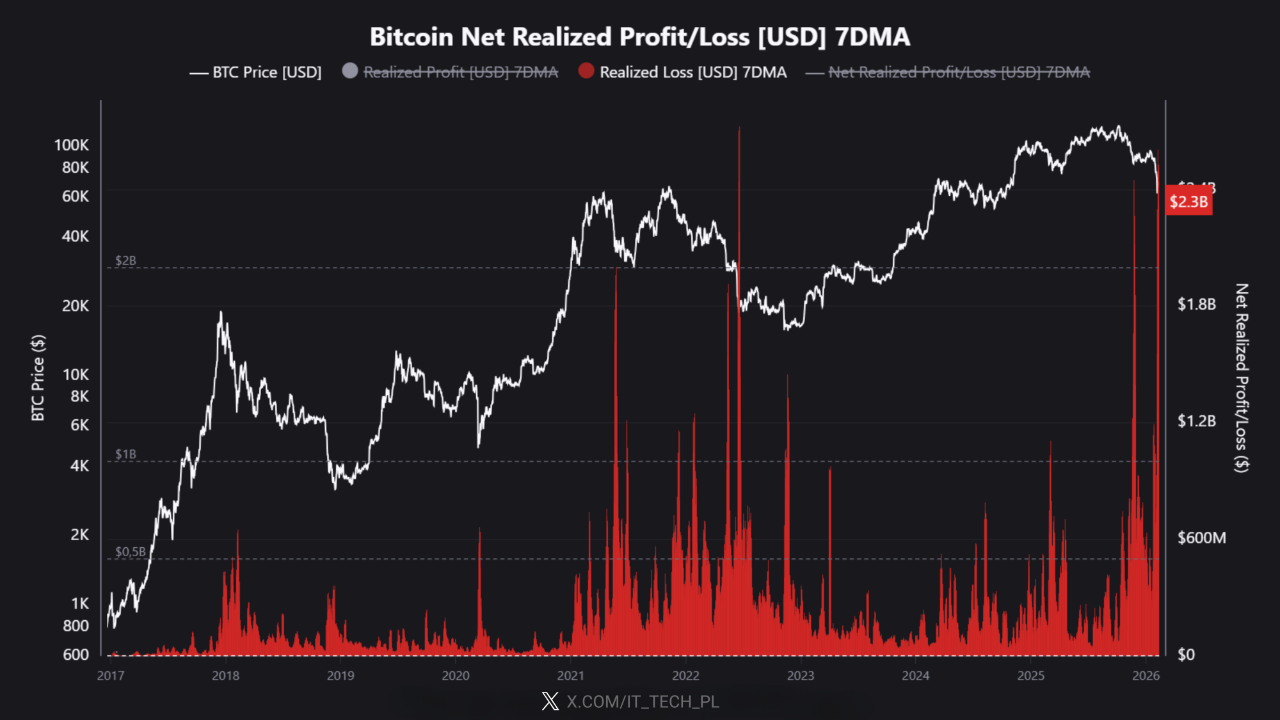

The transfers come at a time of pronounced weak spot throughout the Bitcoin market. An analyst famous that Bitcoin’s realized losses surged to $2.3 billion.

Sponsored

“This puts us in the top 3-5 loss events ever recorded. Only a handful of moments in Bitcoin’s history have seen this level of capitulation,” the evaluation learn.

The analyst added that short-term holders, outlined as these holding cash for lower than 155 days, look like driving a lot of the present capitulation. Traders who gathered BTC at $80,000-$110,000 at the moment are locking in important losses, suggesting that overleveraged retail contributors and weaker arms are exiting their positions.

In distinction, long-term holders don’t look like the first supply of this newest wave of promoting. Traditionally, this cohort tends to carry by drawdowns.

Sponsored

“In the past, extreme loss spikes like this triggered rebounds. We’re seeing it now: BTC bounced from $60K to $71K after the capitulation. But this could still be the beginning of a deep and slow bleed-out. Relief rallies happen even in prolonged bear markets,” the analyst acknowledged.

In the meantime, BeInCrypto beforehand highlighted a number of indicators suggesting that BTC should be within the early phases of a broader bear cycle, leaving room for additional draw back danger. CryptoQuant analysts have pointed to the $55,000 stage as Bitcoin’s realized worth, a stage traditionally related to bear market bottoms.

In earlier cycles, BTC traded 24% to 30% under its realized worth earlier than stabilizing. At present, Bitcoin stays above that stage.

When BTC approaches its realized worth zone, it has traditionally entered a interval of sideways consolidation earlier than staging a restoration. Some analysts argue {that a} deeper correction towards the sub-$40,000 vary may mark a extra definitive backside formation.