Almost $2.3 billion value of Bitcoin and Ethereum choices expire immediately, putting crypto markets at a vital inflection level as merchants put together for a possible volatility reset.

With positioning closely concentrated round key strike ranges, worth motion into and instantly after expiry may very well be pushed much less by fundamentals and extra by mechanical hedging flows.

Sponsored

$2.3 Billion Crypto Choices Expiry Places Bitcoin and Ethereum at a Volatility Crossroads

Bitcoin accounts for the majority of the notional worth, with roughly $1.94 billion in BTC choices rolling off.

Forward of the expiry, Bitcoin is buying and selling for $89,746, beneath its $92,000 max ache degree, the worth at which the best variety of choices contracts expire nugatory.

Whole open curiosity stands at 21,657 contracts, break up between 11,944 calls and 9,713 places, leading to a put-to-call ratio of 0.81.

Bitcoin Expiring Choices. Supply: Deribit

The skew suggests a modest bullish bias, although not an excessive one, leaving room for two-way volatility.

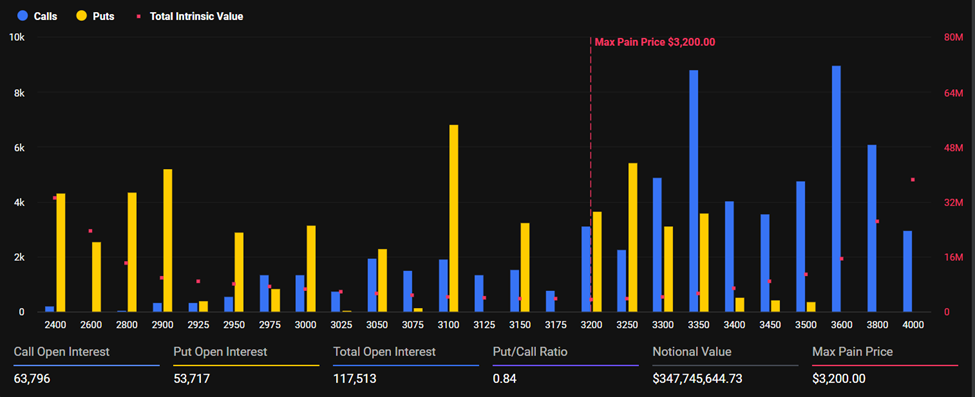

In the meantime, Ethereum choices make up the remaining $347.7 million in notional worth. ETH is buying and selling round $2,958, nicely beneath its $3,200 max ache degree.

Sponsored

Open curiosity is considerably bigger in absolute phrases, with 117,513 contracts excellent, comprising 63,796 calls and 53,717 places. This produces a put-to-call ratio of 0.84. As with Bitcoin, positioning factors to cautious optimism, although significant draw back safety stays in place.

Notably, nevertheless, this week’s expiring choices are barely decrease than the almost $3 billion that rolled off final week.

Sponsored

Deribit Flags Strike Clustering as Macro Dangers Maintain Volatility Elevated

In line with analysts at Deribit, the clustering of open curiosity close to main strikes is more likely to heighten short-term worth sensitivity.

“Expiry positioning is tightly clustered around key strikes, keeping spot sensitive into the cut. Geopolitics and trade policy uncertainty remain the macro backdrop, supporting hedging demand and keeping vol reactive. Watch strike magnets, dealer hedging flows, and post expiry vol repricing,” they wrote.

That dynamic displays a broader setting wherein macro dangers proceed to dominate dealer psychology.

Ongoing geopolitical tensions, shifting commerce insurance policies, and uncertainty round international financial circumstances have pushed buyers to rely extra on hedging choices than on outright directional bets.

This has saved implied volatility (IV) elevated and reactive, even during times of comparatively secure spot costs.

Sponsored

Heading into expiry, so-called “strike magnets” can exert a gravitational pull on costs as sellers regulate hedges to stay delta-neutral.

If spot costs drift nearer to max ache ranges, hedging flows can reinforce the transfer. Conversely, a pointy deviation away from key strikes can set off fast repositioning, amplifying volatility somewhat than suppressing it.

As soon as the contracts expire, consideration is more likely to shift to how volatility reprices heading into the weekend. A big expiry can launch pent-up gamma publicity, generally resulting in sharper post-expiry strikes because the market recalibrates.

Accordingly, Bitcoin and Ethereum merchants may witness a renewed directional push. This might both be a reduction rally if promoting strain fades, or a draw back transfer if macro fears reassert themselves.

With positioning dense, macro dangers unresolved, and technical ranges clearly outlined, immediately’s expiring choices could show to be extra about setting the tone for the subsequent leg in BTC and ETH markets.