XRP is sending blended indicators to begin 2026. Change reserves on South Korea’s Upbit and Bithumb have dropped sharply, echoing a sample that preceded XRP’s 560% rally in late 2024. Whale transactions on the XRP Ledger hit a three-month excessive of two,802. But on January 7, US spot XRP ETFs recorded their first web outflow since launching in November—$40.8 million exiting in a single day.

The divergence between Korean change exercise and softening institutional demand complicates the outlook for XRP’s subsequent transfer.

Sponsored

Korean Change Outflows Mirror Earlier Rally Sample

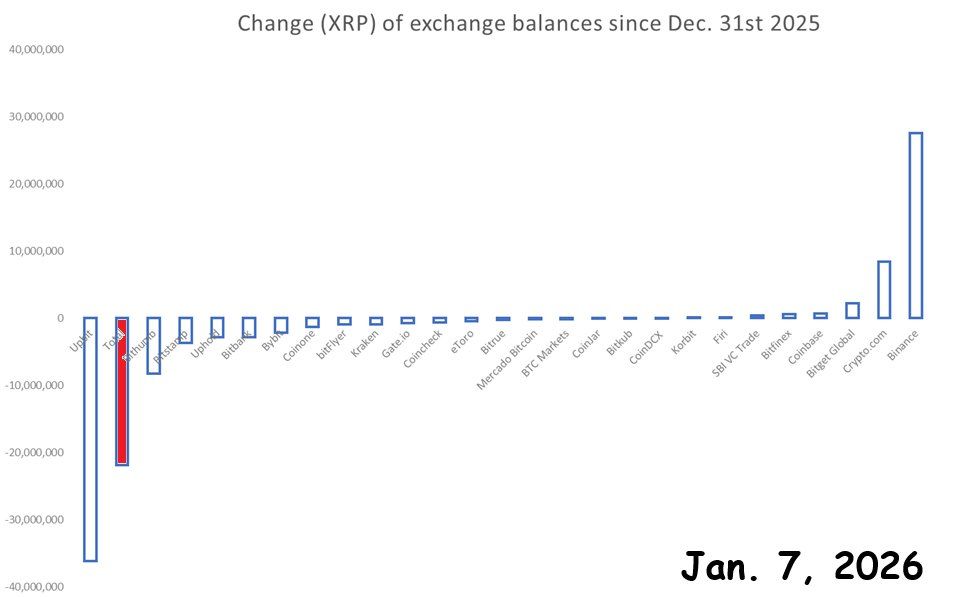

XRP balances on main South Korean exchanges dropped considerably in the course of the first week of 2026. Guide evaluation of wallets holding over 1 million XRP exhibits reserves dropped by about 22 million tokens—0.14% of complete provide—since December 31, 2025. Upbit misplaced round 40 million XRP, Bithumb about 20 million, whereas Binance gained 25 to 30 million in the identical interval.

CryptoQuant chart exhibiting XRP reserves on Upbit declining alongside worth will increase from November 2024 to January 2026. Supply: CryptoQuant by way of CW8900

The sample attracts consideration due to its historical past. When XRP started leaving Upbit in November 2024, the value rose from $0.50 to $3 over the next months. South Korean exchanges stay amongst XRP’s largest buying and selling hubs, that means reserve modifications there can affect world worth discovery.

Change outflows can sign that traders are transferring property into long-term non-public storage quite than for quick sale. Analysis from main exchanges exhibits massive outflows typically mirror accumulation by long-term holders. That always ends in a provide scarcity on buying and selling platforms, lowering short-term promoting stress.

Giant on-chain exercise has intensified in early January. The XRP Ledger logged 2,170 whale transactions—transfers value $100,000 or extra—on January 5. The following day, that determine jumped to 2,802, the best in three months.

The 29% spike inside a day suggests energetic positioning by massive holders, typically a precursor to heightened volatility.

XRP ETFs Document First Outflow Since Launch

US spot XRP ETFs broke their influx streak on January 7, recording a web outflow of $40.8 million—the primary since merchandise launched in mid-November 2025. The 21Shares XRP ETF (TOXR) led the withdrawals at $47.25 million, whereas Grayscale’s GXRP was the one fund to submit an influx at $1.69 million.

Sponsored

The outflow follows weeks of constant institutional shopping for. Cumulative web inflows nonetheless stand at $1.2 billion, with complete property beneath administration at $1.53 billion. However the reversal raises questions on whether or not institutional urge for food is cooling simply as Korean retail traders look like transferring property off exchanges.

Not All Outflows Result in Rallies

CryptoQuant knowledge for Binance present reserves hit related lows in mid-2024, but costs stayed range-bound round $0.50 for months. The rally that started in November 2024 got here solely after reserves had climbed again above earlier ranges—not in the meanwhile of tightest provide.

Sponsored

Some analysts additionally be aware that generally cited change knowledge could understate complete obtainable provide. Broader monitoring throughout 30 platforms exhibits roughly 14 billion XRP on exchanges, far above figures from sources monitoring fewer platforms.

Outlook

XRP traded close to $2.30 in early January 2026, properly off its July 2025 peak of $3.65. The token surged from $0.50 to over $3 between November 2024 and January 2025, then spent a lot of 2025 in consolidation.

The present setup presents conflicting indicators. Korean change outflows and surging whale exercise mirror patterns seen earlier than XRP’s late-2024 rally. However the first ETF outflow and historic precedent counsel these indicators alone don’t assure upside. Whether or not retail exercise in Korea can offset softening institutional flows stays the important thing query heading into the remainder of January.