- The enterprise worth of the businesses within the $250 billion index elevated by 1.9%.

- Progress in earnings earlier than curiosity, taxes, depreciation and amortization (Ebitda) amongst corporations which have issued personal debt is in decline, largely as a result of the variety of high-growth corporations is in decline, reducing the typical degree of profitability throughout the index.

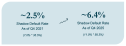

- The “shadow default” charge — which means the share of corporations that took on surprising further lending circumstances halfway by means of the phrases of their offers — elevated from 2.5% of all offers to six.4% over the past yr.

- Firm leverage (the quantity borrowed in opposition to the Ebitda of the corporate) ought to have declined over time as debtors work off their loans however actually it has gone up not too long ago, consuming into returns for lenders.

- A decline in rates of interest provided by the Fed plus extreme demand for personal credit score investments has decreased yields for traders.

Ebitda development in This autumn 2025 was 4.7%, down from the file excessive of 6.5% in Q2 2025. That occurred due to a decline within the variety of high-growth corporations, in accordance with Brian Garfield, Lincoln’s managing director and head of U.S. portfolio valuations. 57.5% of corporations had earnings development of 15% or extra again in 2021. As we speak, solely 48.2% of corporations are that worthwhile — implying that almost 10 proportion points-worth of high-growth corporations have slipped right into a lower-growth mode, Garfield mentioned.

“There’s essentially a slowing of growth that’s occurring, and that’s just a takeaway of what might come,” Garfield mentioned. It’s not clear why revenue development is slowing, Garfield mentioned, however tariffs might be one issue.

Good PIK, unhealthy PIK

The portion of corporations using “PIK” — a time period describing riskier debt — rose to 11%, up from 10.5% the yr earlier than and up from 7% in 2021. “PIK” stands for “payments in kind.” A PIK provision means an organization has agreed to make further funds if it can not pay the curiosity on the money owed initially agreed to.

Of the businesses with PIK, 58.3% had “Bad PIK,” indicating the PIK provision was inserted unexpectedly into the deal halfway by means of the course of the settlement — usually a destructive signal.

The “shadow default rate” in Lincoln’s index — which means the share of corporations carrying unhealthy PIK — greater than doubled from This autumn 2021 when it was 2.5% of all offers to six.4% in This autumn 2025.

The rise in shadow defaults isn’t inherently alarming, Garfield says. Personal credit score is a dangerous market and lenders know prematurely {that a} proportion of all their bets will finish in some sort of default.

Yields in decline

Relatively, the decline in yield for traders might be extra of a priority, he says.

Rates of interest on personal credit score are based mostly on the Fed’s Secured In a single day Financing Charge (SOFR) plus a further “spread” to reward traders for taking the danger.

On the peak of the market, SOFR was round 5.4% and traders have been demanding an additional 6% on high of that, for yields totalling 11% or extra. As we speak, SOFR is priced at 3.73% and a typical all-in yield is just 8.5%, Garfield mentioned.

The unfold above SOFR has declined as a result of extra traders have entered the market chasing personal credit score offers, permitting corporations to insist on extra favorable phrases.

“The real input that’s going to be impacting your returns is going to be the pricing, not a 6% default,” Garfield mentioned.

“There’s a lot of capital in the market, all chasing high-quality deals, so the competition is causing the compression [of yields] to occur.”