Picture supply: Getty Photos

The quantities disclosed have been all approximations however it seems as if the gross sales value was round 70.5p, which is barely above the present share value of 68.9p.

Nothing to see right here

It’s additionally executed effectively out of its shareholding and I believe it’s cheap for it to wish to money in at some stage. At 31 December 2024, Liberty’s accounts present that it was sitting on an unrealised revenue of $46.9m from its funding. Since then, ITV’s share value has fallen almost 7%, though a lot of this fall may very well be blamed on Liberty’s personal choice to scale back its stake.

And I believe it’s price reflecting that it’s solely been three months since ITV printed its half-year outcomes, which have been higher than anticipated.

Trying forward, Carolyn McCall, the group’s chief government, is optimistic. In July, she stated: “We’re on observe to ship our 2026 key monetary targets, with sustained good development in ITV Studios and ITVX… as we reshape our value base to replicate the dynamics of the trade by which we function.“

Additionally, the inventory may very well be engaging to earnings buyers. Primarily based on dividends paid over the previous 12 months, it’s at the moment yielding a powerful 7.4%. This places it within the high 10% of these on the FTSE 250.

Attainable challenges

In fact, there can by no means be any ensures in terms of dividends. And structural modifications within the trade may threaten ITV’s future earnings and, subsequently, its payout.

Altering viewing habits means there’s a decline in linear viewing. And with advertisers following the viewers, that is affecting the quantities spent with mainstream broadcasters.

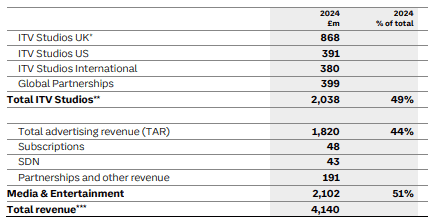

But when it will probably get issues proper, there’s big potential because the group has a foot in two camps. In 2024, ITV generated 51% of income from promoting and 49% from making programmes. The worldwide content material market is estimated to be price $233bn. And the quantity spent on UK promoting is over £40bn a 12 months. Subsequent 12 months, this might enhance considerably as a result of Fifa World Cup.

Supply: annual report and accounts 2024

Supply: annual report and accounts 2024

My view

In my view, ITV is a inventory worthy of consideration.

Regardless of the specter of elevated competitors, attributable to its sturdy earnings and robust steadiness sheet, it’s nonetheless anticipating to seek out ample money to spend £1.25bn on content material creation this 12 months.

And there appears to be persistent hypothesis that the broadcaster will quickly turn out to be a takeover goal. I’m not advocating shopping for shares on the premise of a hearsay. However this may very well be a sign that others view the group as being undervalued. Certainly, the inventory’s buying and selling on a modest 7.2 instances its 2024 earnings per share of 9.6p.

Subsequently, immediately’s share value drop may very well be a chance to think about relatively than an indication of something basically improper.