Picture supply: Getty Pictures

A £250,000 ISA seems like a serious monetary milestone. However with regards to changing a wage, the fact is much extra sobering than it first seems.

That’s as a result of retirement outcomes aren’t decided by how a portfolio was constructed. They’re decided by how a lot revenue it might probably sustainably present as soon as withdrawals start.

Sustainable revenue

As soon as contributions cease, the maths turns into remarkably easy. A portfolio both helps a given degree of inflation-adjusted revenue, or it doesn’t – no matter how lengthy it took to get there.

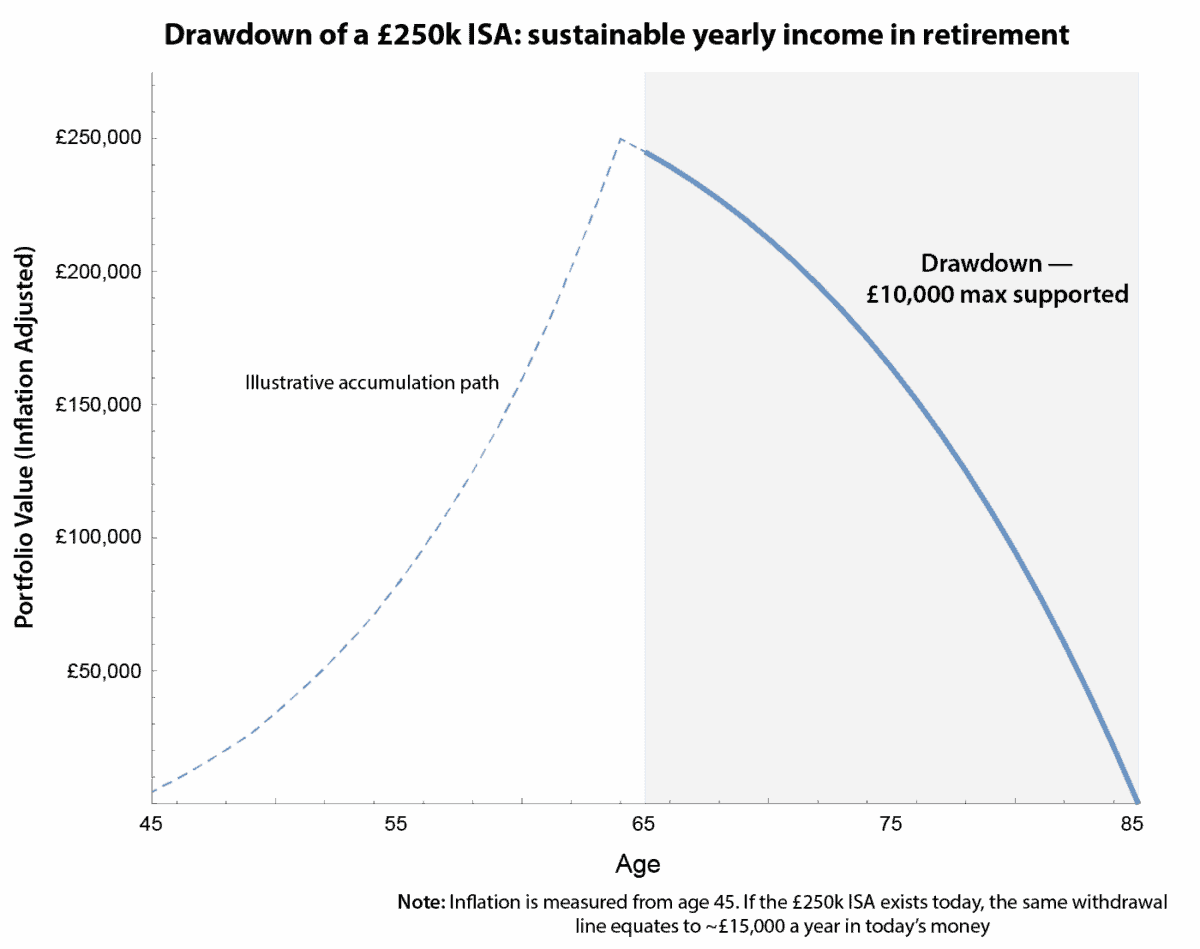

The chart under focuses solely on this drawdown part. It assumes a cautious long-term return of 4% a 12 months and inflation of two%, and runs the portfolio all the way down to zero by age 85. This successfully stress-tests the utmost sustainable revenue over a 20-year retirement.

Chart generated by creator

Beneath these assumptions, a £250,000 ISA can generate round £10,000 a 12 months, or roughly £833 per 30 days, in actual phrases. Which will cowl some necessities or complement different revenue, nevertheless it falls effectively wanting changing a typical wage.

Permitting for market volatility or longer life expectancy reduces sustainable revenue to round £750 per 30 days, whereas leaving a residual stability of roughly £57,000.

Inflation timing

The place traders typically get confused is inflation. In case you already maintain the complete £250,000 at this time, the beginning capital is in place instantly, which helps revenue nearer to £15,000 a 12 months, or about £1,250 per 30 days in at this time’s cash.

Crucially, this isn’t a special withdrawal technique. The sustainable revenue line in actual phrases is unchanged – having the capital at this time merely will increase the equal revenue in at this time’s cash. Prior accumulation improves flexibility, nevertheless it doesn’t change the underlying drawdown maths.

The message is obvious: a £250,000 ISA is a strong basis, however not life-changing by itself. Its actual worth lies in offering flexibility by supplementing pensions and spending, moderately than totally changing earned revenue.

A unique means to have a look at Authorized & Basic

When traders discuss revenue shares, the main focus is normally on yield. However with Authorized & Basic (LSE: LGEN), the extra attention-grabbing query is why that revenue exists – and why it retains exhibiting up 12 months after 12 months.

At its core, it’s a cash-recycling enterprise. It takes in long-dated liabilities from pensions and annuities, invests towards them conservatively, and steadily releases capital over time. That capital is then returned to shareholders by way of dividends and buybacks.

This issues whether or not you’re nonetheless constructing an ISA or already drawing revenue from one. Throughout accumulation, reinvested dividends quietly do the heavy lifting. In drawdown, those self same funds can cut back how a lot you want to promote – smoothing the journey by way of risky markets.

What makes the shares stand out at this time is predictability. Administration has dedicated to a modest 2% dividend progress, backed by long-term pension contracts moderately than short-term market optimism. It’s not thrilling, nevertheless it’s deliberate – and that’s typically what revenue traders really need.

In fact, it comes with dangers. Sharp strikes in bond yields, regulatory adjustments, or weaker capital technology might strain dividends, whereas the excessive yield leaves little margin for operational missteps.

Backside line

Authorized & Basic isn’t about maximising returns. It’s designed to generate and return money steadily over time, which might make the shares related throughout a number of levels of an investor’s journey. That long-term money focus is why I personal the shares.