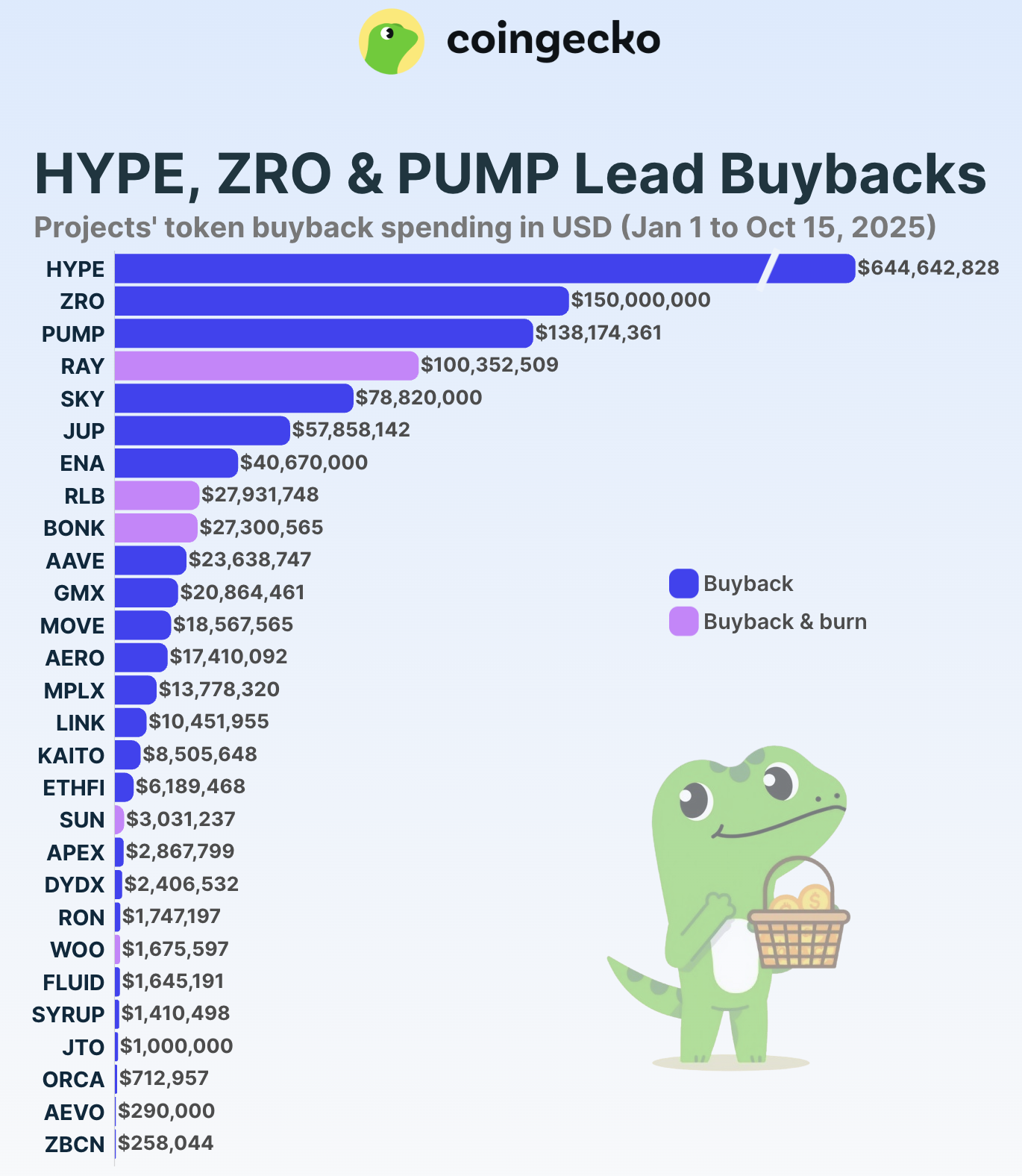

Cryptocurrency tasks have poured over $1.4 billion towards token buybacks in 2025, with simply 10 tasks capturing 92% of the whole expenditure.

Hyperliquid, a decentralized perp trade protocol, led the market with roughly $645 million dedicated. That represented almost half of all token buyback exercise recorded throughout the crypto market this yr.

Sponsored

Token Buybacks Speed up In 2025

Based on the most recent report by CoinGecko, 28 cryptocurrency tasks devoted substantial sources to token buybacks this yr. The tempo picked up within the second half of 2025, with buyback spending surging by 85% month over month in July.

“Although a jump in token buyback spending was attributed to September, this was due to the one-off LayerZero repurchase announcement, which did not specify when it was carried out. Excluding the ZRO buyback, September only saw $168.45 million in token buyback spending,” CoinGecko’s analysis analyst Yuqian Lim famous.

By mid-October, buyback spending had already reached $88.81 million. This means the market is on observe for a fourth straight month exceeding the first-half month-to-month common of $99.32 million.

On common, round $145.93 million has been spent every month, signaling rising enthusiasm for the mechanism throughout the sector.

Token Buyback Spending. Supply: CoinGeckoSponsored

Hyperliquid Dominates Token Buybacks This Yr

Hyperliquid stands out because the undisputed chief in token repurchases this yr. The undertaking has spent greater than $644.64 million in income via its Help Fund. This quantity equals the mixed complete of the following 9 largest tasks.

Moreover, the protocol accounted for 46% of all token buyback exercise in 2025. To this point, the community has purchased again 21.36 million HYPE tokens, representing 2.1% of the whole provide.

Based on earlier OAK Analysis estimates, Hyperliquid’s mannequin has the potential to repurchase as much as 13% of its complete provide annually.

LayerZero adopted Hyperliquid with a $150 million one-off buyback of ZRO tokens, buying 5% of its provide. Pump.enjoyable invested $138 million in PUMP repurchases since July, protecting 3% of provide.

“While this puts PUMP buyback spending on the lower end compared to HYPE so far, it is worth noting that Pump.fun has already bought back a higher 3.0% share of total supply,” Lim highlighted

Sponsored

In the meantime, Raydium directed $100 million towards buybacks and burns of RAY tokens. Lastly, rounding out the highest 10 checklist had been Sky Protocol (SKY), Jupiter (JUP), Ethena (ENA), Rollbit (RLB), Bonk (BONK), and Aave (AAVE).

When it comes to the share of provide retired, GMX outperformed with repurchases equating to 12.9% of its provide for $20.86 million, highlighting effectivity in smaller-scale efforts.

“Excluding buyback-and-burn programs, the 23 token buybacks examined here have repurchased on average 1.9% of their respective total supply. So far, 14 out of the 23 projects have only bought back less than 1.0% of total supply,” the report added.

Sponsored

Token Buybacks: What’s Driving the Surge?

A number of forces fueled the 2025 buyback growth. Based on DWF Labs, the surge stemmed from a convergence of profitability, governance maturity, and market psychology throughout the Web3 area.

“With an increasing number of projects achieving profitability, buybacks have become an essential strategy to reward long-term users, reduce circulating supply, and generate positive feedback loops that benefit both users and projects,” the report learn.

As extra decentralized protocols achieved sustainable income, they started channeling earnings into token repurchases to bolster long-term worth and neighborhood belief. DWF identified that mature DAO governance and disciplined treasury administration—comparable to Aave’s structured “Aavenomics” buybacks—helped institutionalize these practices.

On the identical time, buyers gravitated towards scarcity-based token fashions following a risky 2024. In the meantime, automated on-chain programs from tasks like Hyperliquid and Raydium turned buybacks into clear, steady mechanisms.

Collectively, these dynamics reworked buybacks into an indicator of disciplined tokenomics and a defining development in 2025’s decentralized economic system.