Sam-Altman linked WLD has emerged as as we speak’s standout performer, hovering 25% prior to now 24 hours.

The token has been trending upward since September 5, pushed by the undertaking’s current launch of its anonymized multi-party computation (APMC) initiative. At present buying and selling at a two-month excessive of $1.26, WLD’s development is supported by sturdy market alerts that recommend the rally might proceed.

Sponsored

Sponsored

Worldcoin Rally Good points Traction

WLD futures market individuals show bullish conviction, as evidenced by the token’s spiking lengthy/brief ratio. The metric stands at 1.09 at press time.

Sponsored

Sponsored

WLD Lengthy/Quick Ratio. Supply: Coinglass

The lengthy/brief ratio measures the variety of merchants holding lengthy positions in comparison with these holding shorts. A studying above 1 signifies that extra merchants are betting on value appreciation fairly than decline. Conversely, a ratio under one signifies that almost all merchants are positioning for a value drop.

WLD’s climbing ratio alerts heightened optimism throughout derivatives markets and confirms that many merchants anticipate the rally to proceed.

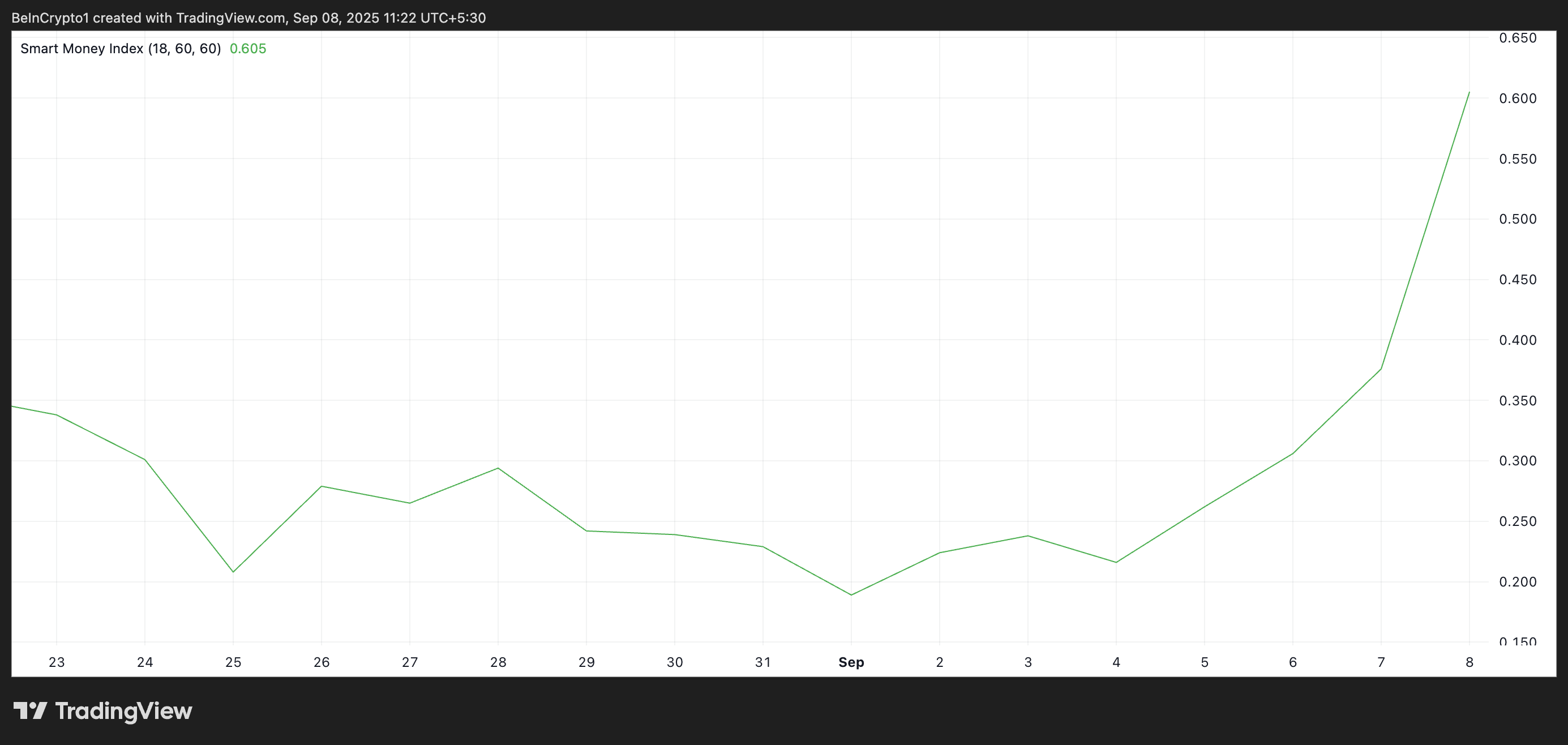

Furthermore, on the every day chart, WLD’s Good Cash Index (SMI), which tracks participation from key institutional and influential traders, can also be rising. At press time, this sits at a 48-day excessive of 0.605, indicating that capital from subtle market gamers is flowing into WLD, additional strengthening the bullish outlook.

Worldcoin SMI. Supply: TradingView

Worldcoin SMI. Supply: TradingView

The SMI indicator refers to capital managed by institutional traders or skilled merchants who perceive market traits and timing extra deeply. It tracks the habits of those traders by analyzing intraday value actions. Particularly, it measures promoting within the morning (when retail merchants dominate) versus shopping for within the afternoon (when establishments are extra energetic).

Sponsored

Sponsored

A rising SMI like this alerts that sensible cash is accumulating an asset. If this backing continues, it might assist propel WLD to new value highs within the close to time period.

Can Bulls Defend $1.14 and Push Towards $1.64?

WLD rests considerably above the help ground fashioned at $1.14. If demand grows and this ground strengthens, WLD might break above the barrier at $1.34, opening the door for a rally towards $1.64.

Worldcoin Value Evaluation. Supply: TradingView

Worldcoin Value Evaluation. Supply: TradingView

Alternatively, if profit-taking begins, WLD might lose a few of its current features and try and breach the $1.14 help. If profitable, WLD’s value might plummet to $0.57.