Technique (MicroStrategy) right now asserted it could possibly absolutely cowl its $6 billion debt even when Bitcoin falls 88% to $8,000. Nonetheless, the larger query is what occurs if the Bitcoin value falls under that line?

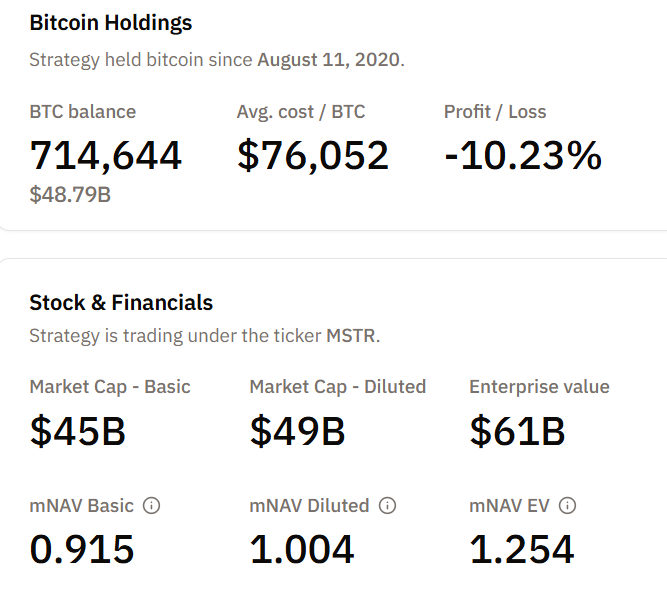

The corporate’s submit highlights its $49.3 billion Bitcoin reserves (at $69,000/BTC) and staggered convertible be aware maturities working by means of 2032, designed to keep away from rapid liquidation.

Technique Reiterates What Occurs If Bitcoin Worth Drops to $8,000

Solely days after its earnings name, Technique has reiterated the $8,000 potential Bitcoin value and what would occur to the corporate in such an occasion for the second time.

Sponsored

Sponsored

“Strategy can withstand a drawdown in BTC price to $8,000 and still have sufficient assets to fully cover our debt,” the corporate said.

At first look, the announcement indicators resilience within the face of utmost volatility. Nonetheless, a deeper dive reveals that $8,000 could also be extra of a theoretical “stress floor” than a real protect in opposition to monetary peril.

MicroStrategy’s infographic reveals debt protection at numerous Bitcoin value ranges (Technique by way of X)

At $8,000, Technique’s property equal its liabilities. Fairness is technically zero, however the agency can nonetheless honor debt obligations with out promoting Bitcoin.

“Why $8,000?: This is the price point where the total value of their Bitcoin holdings would roughly equal their net debt. If BTC stays at $8,000 long-term, its reserves would no longer cover its financial obligations through liquidation,” investor Giannis Andreou defined.

Convertible notes stay serviceable, and staggered maturities give administration respiratory room. The agency’s CEO, Phong Le, lately emphasised that even a 90% decline in BTC would unfold over a number of years, giving the agency time to restructure, challenge new fairness, or refinance debt.

“In the extreme downside, if we were to have a 90% decline in Bitcoin price to $8,000, which is pretty hard to imagine, that is the point at which our BTC reserve equals our net debt and we’ll not be able to then pay off of our convertibles using our Bitcoin reserve and we’d either look at restructuring, issuing additional equity, issuing an additional debt. And let me remind you: this is over the next five years. Right, so I’m not really worried at this point in time, even with Bitcoin drops,” stated Le.

But beneath this headline determine lies a community of monetary pressures that would rapidly intensify if Bitcoin drops additional.

Sponsored

Sponsored

Under $8,000: Covenant and Margin Stress

The primary cracks seem at roughly $7,000. Secured loans backed by BTC collateral breach LTV (Mortgage-to-Worth ratio) covenants, triggering calls for for extra collateral or partial reimbursement.

“In a severe market downturn, cash reserves would deplete rapidly without access to new capital. The loan-to-value ratio would exceed 140%, with total liabilities exceeding asset value. The company’s software business generates approximately $500 million annually in revenue—insufficient to service material debt obligations independently,” defined Capitalist Exploits.

If markets are illiquid, Technique could also be compelled to promote Bitcoin to fulfill lenders. This reflexive loop may depress BTC costs additional.

At this stage, the corporate is technically nonetheless solvent, however every compelled sale magnifies market threat and raises the specter of a leverage unwind.

Insolvency Turns into Actual at $6,000

An extra slide to $6,000 transforms the state of affairs. Whole property fall properly under whole debt, and unsecured bondholders face possible losses.

Fairness holders would see excessive compression, with worth behaving like a deep out-of-the-money name choice on a BTC restoration.

Sponsored

Sponsored

Restructuring turns into possible, even when operations proceed. Administration may deploy methods similar to:

- Debt-for-equity swaps

- Maturity extensions, or

- Partial haircuts to stabilize the stability sheet.

Under $5,000: The Liquidation Frontier Comes

A decline under $5,000 crosses a threshold the place secured lenders might power collateral liquidation. Mixed with skinny market liquidity, this might create cascading BTC sell-offs and systemic ripple results.

On this state of affairs:

- The corporate’s fairness is probably going worn out

- Unsecured debt is deeply impaired, and

- Restructuring or chapter turns into an actual risk.

“Nothing is impossible…Forced liquidation would only become a risk if the company could no longer service its debt, not from volatility alone,” commented Lark Davis.

Sponsored

Sponsored

Velocity, Leverage, and Liquidity As The Actual Hazard

The vital perception is that $8,000 is just not a binary loss of life line. Survival depends upon:

- Velocity of BTC decline: Fast drops amplify margin stress and reflexive promoting.

- Debt construction: Closely secured or short-dated debt accelerates threat under $8,000.

- Liquidity entry: Market closures or frozen credit score exacerbate stress, doubtlessly triggering liquidation spirals above the nominal flooring.

What Would It Imply for the Market?

Technique is a serious BTC holder. Compelled liquidations or margin-driven gross sales may ripple by means of broader crypto markets, impacting ETFs, miners, and leveraged merchants.

Even when Technique survives, fairness holders face outsized volatility, and market sentiment may shift sharply in anticipation of stress occasions.

Due to this fact, whereas Technique’s assertion right now suggests the agency’s confidence and balance-sheet planning, under $8,000, the interaction of leverage, covenants, and liquidity defines the actual survival line past value alone.