On Could 3, 2025, Warren Buffett, the famed investor, philanthropist, and Chairman/CEO of Berkshire Hathaway, introduced that he can be retiring on the finish of 2025.

- What’s Warren Buffett’s internet price in 2025?

- Warren Buffett’s portfolio

- Warren Buffett’s formative years and investing profession

- Warren Buffett and Benjamin Graham

- How did Warren Buffett get wealthy?

- When did Warren Buffett purchase Berkshire Hathaway?

- What are Warren Buffett’s guidelines for investing?

- Warren Buffett’s private life

- Warren Buffett’s actual property portfolio

Although the 95-year-old admitted in a 2023 letter that he was “playing in the extra innings,” the information nonetheless got here as a shock, since he made the announcement on the finish of Berkshire’s annual shareholders assembly, and solely his kids, Howard and Susie, knew upfront.

As arguably the world’s most profitable investor, Buffett leaves behind an unparalleled legacy—one which started along with his very first inventory buy. At simply 11 years outdated, he purchased three shares of Cities Service most popular inventory at roughly $38 per share—the primary instance of his long-term, value-based strategy to investing.

Over the course of his seven-decade profession, Buffett took over a struggling textile mill and turned it right into a $1.1 trillion funding conglomerate that owned Geico, Duracell, and Dairy Queen and had main stakes in Apple (AAPL) , Coca Cola (KO) , Financial institution of America (BAC) , and American Categorical (AXP) , to call just a few.

Between 1964 and 2024, he elevated Berkshire Hathaway’s per-share worth by 5,502,284%, based on firm paperwork, averaging 19.9% a yr development — a powerful annual price in comparison with a mean of simply 10.4% a yr for the S&P 500.

💵💰Do not miss the transfer: Subscribe to TheStreet’s free day by day e-newsletter 💰💵

Within the course of, Buffett constructed an empire that spanned 15 U.S. Presidents, 16 bull markets, and 13 financial recessions—and have become one of many world’s wealthiest individuals.

However maybe Buffett’s best attribute, and a takeaway for all buyers, isn’t that he had superior brains or good timing; reasonably, it was his persistence. Buffett prevented making an attempt to foretell market tendencies and as an alternative took the lengthy view by figuring out high quality companies with sturdy fundamentals.

And, he all the time stored some cash in his again pocket, which allowed him to behave when the chance was proper.

So, what’s Buffett’s internet price in 2025 as he prepares to step down from the helm of Berkshire Hathaway?

Vice-Chairman of Berkshire Hathaway Charlie Munger, Warren Buffett, and Invoice Gates go to a Dairy Queen retailer in Beijing whereas on a visit to China to encourage philanthropy in 2013.

Visible China Group by way of Getty Photos

What’s Warren Buffett’s internet price in 2025?

In response to Forbes, as of September 2025, Warren Buffett has a internet price of $146.6 billion. This makes him the tenth-richest particular person on Earth, behind billionaire businessmen Larry Ellison, whose internet price stands at $367.9 billion, Jeff Bezos ($245.3 billion), Mark Zuckerberg ($266.7 billion), and Elon Musk ($477.6 billion).

Enterprise Insider did the mathematics and broke Buffett’s earnings down even additional, estimating that the famed investor makes roughly $37 million per day, which is the equal of $1.54 million per hour, or $25,694 per minute.

Warren Buffett’s portfolio

Buffett’s success at Berkshire Hathaway comes from investing in a small variety of high quality shares, usually dividend payers, that present an everyday stream of earnings along with capital appreciation.

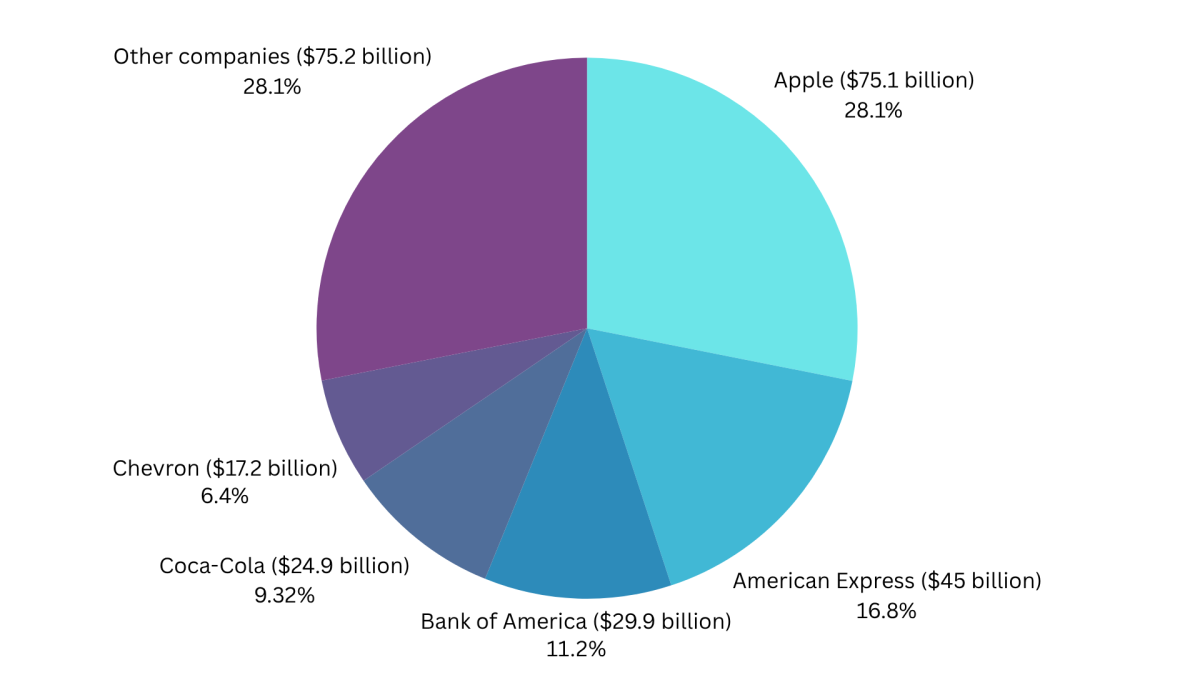

Berkshire Hathaway’s greatest holdings

Berkshire Hathaway’s holdings as of the corporate’s mid-Could 2025 disclosure

Forbes/Canva

In response to Berkshire’s newest 13F submitting with the SEC, the corporate’s prime 5 holdings, as of Could 2025, included:

- Apple (AAPL)

- American Categorical (AXP)

- Coca-Cola (KO)

- Financial institution of America (BAC)

- Chevron (CVX)

However in contrast to his firm, Buffett isn’t making an attempt to keep wealthy. In his remaining shareholder handle, he urged buyers to care about extra issues than cash, saying, “Be kind and the world is better off. I’m not sure the world will be better off if I am richer.”

Associated: Invoice Gates’ internet price in 2025: How a lot has he made (& given away)?

Placing his phrases into observe, in 2010, Buffett, alongside along with his pals Invoice Gates and Melinda French Gates, launched the Giving Pledge, vowing to donate 99% of their fortune to charity inside their lifetimes.

Warren Buffett’s charities

The vast majority of Buffett’s charitable donations have been to the Invoice & Melinda Gates Basis, which focuses on world well being and academic initiatives. In response to the Gates Basis, Buffett has donated $43.3 billion by items of Berkshire Hathaway inventory between 2006 and 2024.

Buffett additionally helps nonprofits that target well being and academic initiatives, together with the Susan Thompson Buffett Basis, the Sherwood Basis, the NoVo Basis, and the Howard G. Buffett Basis.

Reuters reviews that Buffett has given away greater than $58 billion, or 37% of his complete wealth. That leaves him with a whopping $96.73 billion but to offer away.

You possibly can say he’ll have an lively retirement.

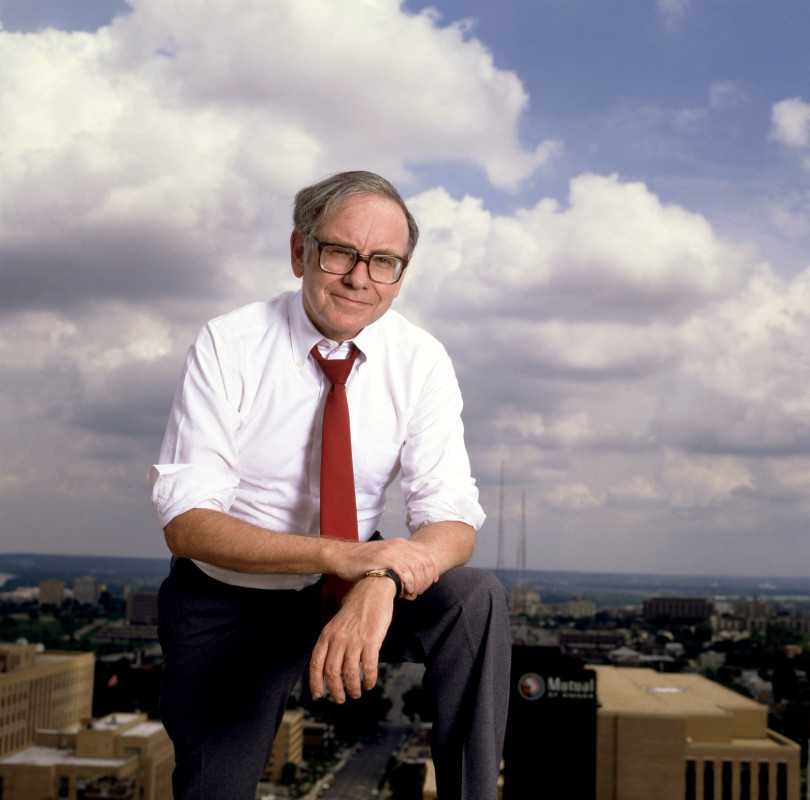

Warren Buffett poses for a portrait overlooking the skyline of his hometown, Omaha, Nebraska, circa 1984.

Bonnie Schiffman/Getty Photos

Warren Buffett’s formative years and investing profession

On August 30, 1930, Warren Edward Buffett was born in Omaha, Nebraska. His father, Howard Buffett, was a four-term U.S. Congressman in addition to a businessman, and his mom, Leila Stahl Buffett, was a homemaker who managed the household’s investments. She handed her frugality all the way down to her kids, Warren, Roberta, and Doris, usually clipping coupons and purchasing at low cost shops. She additionally volunteered her time and donated to charitable causes.

(Her famously modest son capped his personal wage at simply $100,000 in 1980 and has been dwelling within the first home he purchased since 1958.)

When Howard was elected to the USA Congress, younger Buffett moved along with his household to Washington, D.C. In 1947, he graduated from Woodrow Wilson Excessive Faculty and said in his yearbook: “likes math; a future stockbroker.”

Associated: Melinda French Gates’ internet price: Life after her billion-dollar divorce

Buffett’s entrepreneurism was obvious early on: He went door-to-door promoting Coca-Cola, delivered newspapers, and offered golf balls, amongst different ventures. At age 13, he filed his first earnings tax return, taking a $35 deduction for utilizing his bicycle on his paper route.

When he was in highschool, Buffett and a good friend paid $25 to purchase a pinball machine, which they arrange in a neighborhood barber store. Just a few months later, they’d a number of machines throughout Omaha and later offered the enterprise for $1,200.

When Buffett was 14, he used $1,200 of his financial savings to put money into a 40-acre working farm. By means of a profit-sharing settlement with the farmer, by the point he graduated from school in 1951, Buffett had $9,800 in financial savings—the equal of $123,717 in 2025 {dollars}.

Benjamin Graham, the “father of value investing,” had a fantastic affect on Warren Buffett’s life.

Public Area by way of Wikimedia Commons; Canva

Warren Buffett and Benjamin Graham

Buffett initially needed to skip school and develop into a full-time entrepreneur, however his father insisted he enroll at a college. He studied on the Wharton Faculty of the College of Pennsylvania between 1947 and 1949 earlier than transferring to the College of Nebraska, the place he graduated with a BS in Enterprise Administration.

He later went on to check with famend worth investor Benjamin Graham at Columbia College and acquired his MS in Economics from the college in 1951.

Associated: Charlie Munger’s internet price: The late Berkshire Hathaway vice chair’s wealth

Buffett credited Graham for educating him the elemental ideas of worth investing, and after commencement, he labored for 2 years as a safety analyst at Graham’s funding agency, the Graham-Newman Company. Buffett even named his son, Howard Graham Buffett, after his mentor.

In 1956, Buffett returned to his hometown, incomes his nickname “The Oracle of Omaha.”

How did Warren Buffett get wealthy?

Between 1957 and 1962, Buffett made a fortune off the success of a number of funding partnerships. His analysis centered closely on weighing a inventory’s present value in opposition to its intrinsic worth after which shopping for undervalued or “bargain” shares that had sturdy fundamentals and the potential for future development. It is a core tenet of worth investing.

For instance, Buffett had found that certainly one of his investments, the Sanborn Map Firm, was being undervalued by as a lot as $20 per share. So, he bought 23% of the corporate’s excellent shares and took a seat on its board of administrators. Finally he had management of 44% of its shares; so as to keep away from a proxy battle, the board provided to repurchase firm shares at honest worth—and Buffett earned a 50% return on his funding in simply two years’ time.

By 1962, at age 32, Buffett was formally a millionaire, based on Nasdaq, and his partnerships have been valued at over $7 million. Buffett’s subsequent transfer was to merge his numerous partnerships into one entity, Buffett Partnership, Ltd.

Extra on sensible buyers:

- Robert Herjavec’s internet price & greatest ‘Shark Tank’ offers

- Kevin O’Leary’s internet price as he eyes TikTok buy

- Barbara Corcoran’s internet price: The ‘Shark Tank’ star’s wealth & investments

When did Warren Buffett purchase Berkshire Hathaway?

In 1965, Buffett took management of Berkshire Hathaway, an ailing New England textile producer. Whereas the textile enterprise by no means made him cash (he ultimately shut it down in 1985), Buffett used Berkshire as the bottom for his operations, reworking the enterprise right into a diversified holding firm for his strategic investments. A few of his greatest successes embody:

- Insurance coverage corporations, equivalent to Geico and Normal Reinsurance: Berkshire profited from insurance coverage “float,” or the cash that’s held by insurance coverage corporations that has not but been paid out to coverage claims. On the finish of Q1 2025, this float totaled $173 billion.

- Worth buys, like American Categorical, Coca-Cola, and Financial institution of America: Shares that, for one cause or one other, have fallen out of favor with the market. These shares are price a mixed complete of $100 billion greater than what Buffett initially paid for them, not even together with dividends.

- Apple Inc.: Whereas Buffett prevented investing in tech shares throughout the Dot-Com Bubble of the late Nineteen Nineties and early 2000s, certainly one of his most profitable investments has been a expertise firm: Apple. At Berkshire’s most up-to-date shareholder assembly, he even joked that Apple CEO Tim Prepare dinner made extra money for Berkshire buyers than he has himself. Beginning in 2016, Buffett purchased greater than $31 billion price of AAPL, which grew to greater than $174 billion earlier than he started promoting off shares in late 2023.

- See’s Sweet: Buffett’s greatest good friend and right-hand man, Berkshire Hathaway Vice President Charlie Munger, persuaded him to buy the California-based confectioner for $25 million in 1972—although it was buying and selling at six instances its earnings and thrice its e-book worth. Buffett thought of this a turning level in his profession, since he now not needed to buy groceries within the cut price bin, and it could result in later investments in corporations like Coca-Cola and Apple. As Yahoo! Finance reviews, See’s Sweet has offered Berkshire with earnings of over $2 billion.

By 1985, Buffett had develop into a billionaire. He was 55 years outdated.

Associated: Mark Cuban’s internet price forward of ‘Shark Tank’ departure

What are Warren Buffett’s guidelines for investing?

Little doubt, when Buffett speaks, his folksy allure and sage classes gleaned from a long time of success make buyers sit up and pay attention.

He has offered a great deal of knowledge in his annual letters to Berkshire shareholders—in 1983, he cheekily offered simply two guidelines to observe:

“Rule No. 1: Never lose money. Rule No. 2: Never forget rule No. 1.” —Warren Buffett

In a 1986 letter to shareholders, he introduced the concept of fear and greed as “contagious diseases” that impair investment decisions. He emphasized the importance of contrarian thinking, encouraging investors to “Be greedy when others are fearful and be fearful when others are greedy.”

In his 2013 letter, he outlined what has develop into referred to as the “90/10 Rule:” which is to allocate 90% of an investor’s portfolio to a low-cost S&P 500 index fund and 10% to short-term authorities bonds.

His core philosophy emphasizes investing in corporations you perceive. Buffett buys stakes in corporations he personally enjoys, equivalent to Dairy Queen, McDonald’s, and Coke.

As well as, he encourages buyers to all the time keep knowledgeable, solely purchase when the market value is under an organization’s intrinsic worth (referred to as the “margin of safety”), preserve money readily available for surprising bills and alternatives, and keep away from making choices based mostly on hypothesis.

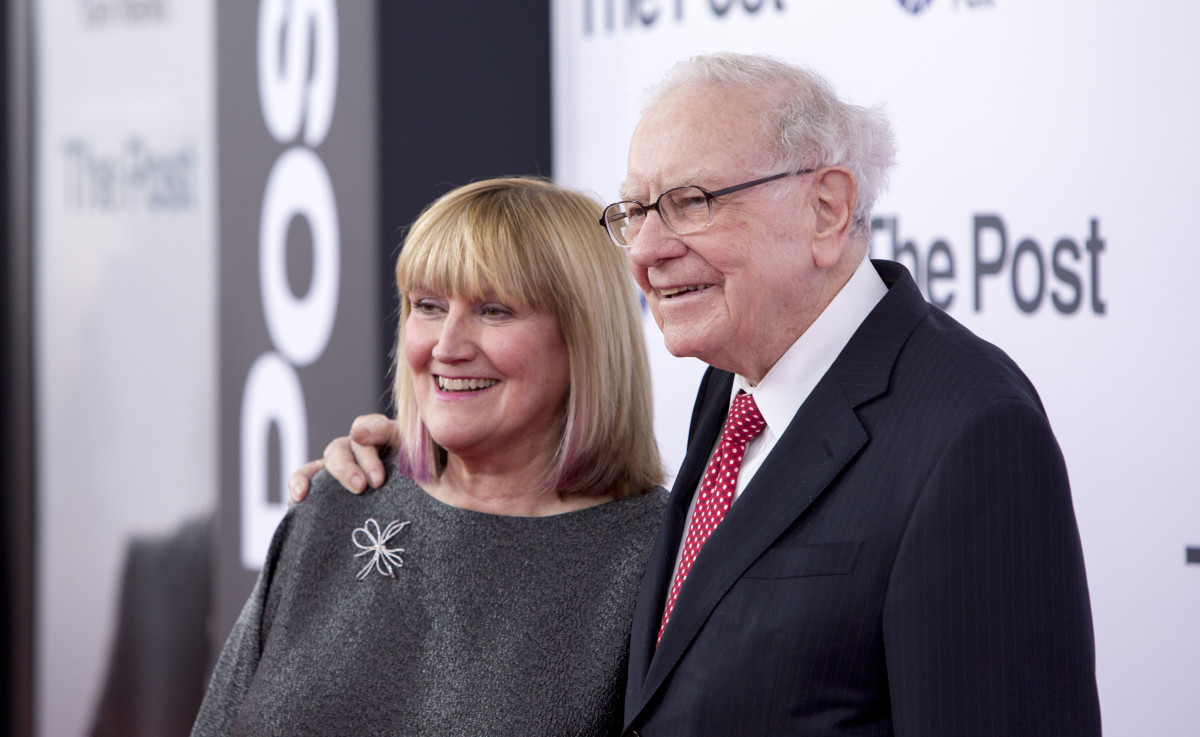

Buffett and his second spouse, Astrid Menks, at a movie premiere in 2017.

Tasos Katopodis/FilmMagic

Warren Buffett’s private life

Buffett wooed his first spouse, Susan Thompson, by studying learn how to play the ukulele. They married in 1952 and shared three kids: Susan Alice (b. 1953), Howard Graham (b. 1954), and Peter Andrew (b. 1958). Buffett and Susan separated in 1977, and he or she moved to San Francisco; nevertheless, they remained married till her loss of life from a stroke in 2004.

On August 30, 2006, Buffett’s seventieth birthday, the famed investor married Astrid Menks, his longtime companion. She was really launched to Buffett by his then-wife, Susan, when she launched into her singing profession in 1977.

The three shared an uncommon relationship, signing their names collectively on vacation playing cards to family and friends. Astrid had even moved into Buffett’s house when he and Susan separated.

Buffett paid $31,500 for his house in 1958; he nonetheless lives there right now.

Paul Harris/Getty Photos

Warren Buffett’s actual property portfolio

It is a well-known undeniable fact that Buffett has lived in the identical home since 1958: a 6,570-square-foot, five-bedroom, 2.5-bathroom abode positioned on a nook lot.

Realtor.com estimates its worth has elevated to $1.44 million in 2025, however Buffett’s not going wherever anytime quickly, telling the BBC, “I’d move if I thought I’d be happier someplace else. I couldn’t imagine having a better house.”

Along with his “forever home,” Architectural Digest reviews that Buffett invested in a Laguna Seashore, Calif., trip house in 1971, paying $150,000 for a six-bedroom, seven-bathroom property in a gated group that boasted ocean views and had a “museum quality” really feel. He later added an adjoining property the place company might keep.

However Buffett admitted that he solely purchased his SoCal house as a result of his then-wife, Susan, appreciated it, so after she handed away in 2004, he offered it for $7.9 million in 2018.

And what grew to become of his farm? Buffett has solely added to his parcels of farmland, investing by the years in analysis farms in South Africa and Arizona. In 1986, he paid $280,000 for 500 further acres of arable Nebraska soil, telling Berkshire shareholders in an annual letter that he “calculated the normalized return from the farm to then be about 10%. I also thought it was likely that productivity would improve over time and that crop prices would move higher as well. Both expectations proved out.”

Associated: The ten most dependable automobile manufacturers in 2025 based on Client Studies