If I’ve realized something over the previous 30 years of professionally monitoring the inventory market, it is that shares have a knack for predicting information earlier than it occurs.

The truth is that inventory costs fluctuate primarily based on expectations quite than historic occasions. Since they signify the mixture of each investor’s opinion, they typically establish developments lengthy earlier than any particular person investor. That predictive energy seems to have been in play in December, given vitality shares’ current rally forward of President Donald Trump’s shock raid and seize of Venezuela’s President, Nicolás Maduro Moros.

Associated: Longtime fund supervisor lays out stunning S&P 500 goal for 2026

I’ve analyzed knowledge to trace inventory market sector developments since I entered the enterprise in 1997. My first job was as a analysis assistant for an unbiased analysis agency that supplied sector and trade cash circulate analysis to mutual and hedge fund managers. Finally, I turned a associate earlier than leaving to create my very own shares and sector rating system in 2003.

For years, cash managers used my analysis to establish new inventory concepts and inform choices on whether or not to chubby or underweight sectors, industries, and shares. My mannequin, which remains to be out there at Limelight Alpha, remains to be at work analyzing knowledge, and curiously, it famous a shift towards vitality shares in December, regardless of ongoing weak spot in crude oil costs.

In truth, final week, the vitality sector moved to the highest of my large-cap sector rating primarily based on Friday’s shut, earlier than the U.S. formally took motion towards Venezuela, which put a whole lot of billions of barrels of crude oil reserves in play.

The transfer greater in vitality shares is especially intriguing if you dig into the info to see what particular industries and shares have been chargeable for the sector climbing the rating.

Limelight Alpha Sector Rating (January 3, 2026):

The vitality sector moved to the highest of Limelight Alpha’s large-cap sector rating earlier than the U.S. took motion in Venezuela over the weekend.

Limelight Alpha&interval;

Venezuela reshapes oil bets for 2026

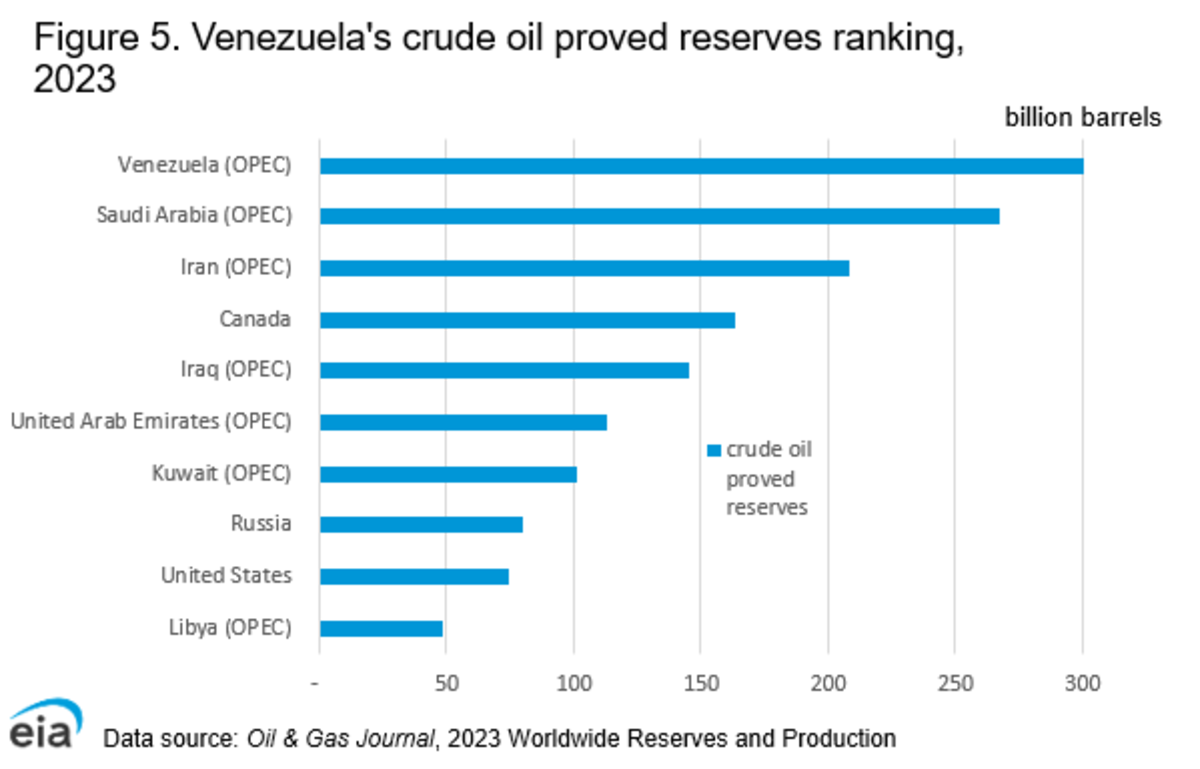

Venezuela ought to be an oil market powerhouse. It boasts the world’s largest reserves (roughly 303 billion barrels, equal to 17% of world reserves, in accordance with the U.S. Vitality Data Administration, or EIA), but oil manufacturing has declined considerably through the years because of underinvestment.

Venezuela has the biggest crude oil reserves on the earth.

E

The Venezuelan authorities formally nationalized its oil trade on January 1, 1976, below the Presidency of Carlos Andrés Pérez. It established the state-owned firm PDVSA (Petróleos de Venezuela, S.A.) to handle oil operations. In 2007, below former President Hugo Chávez, the state took majority management of the remaining overseas joint ventures.

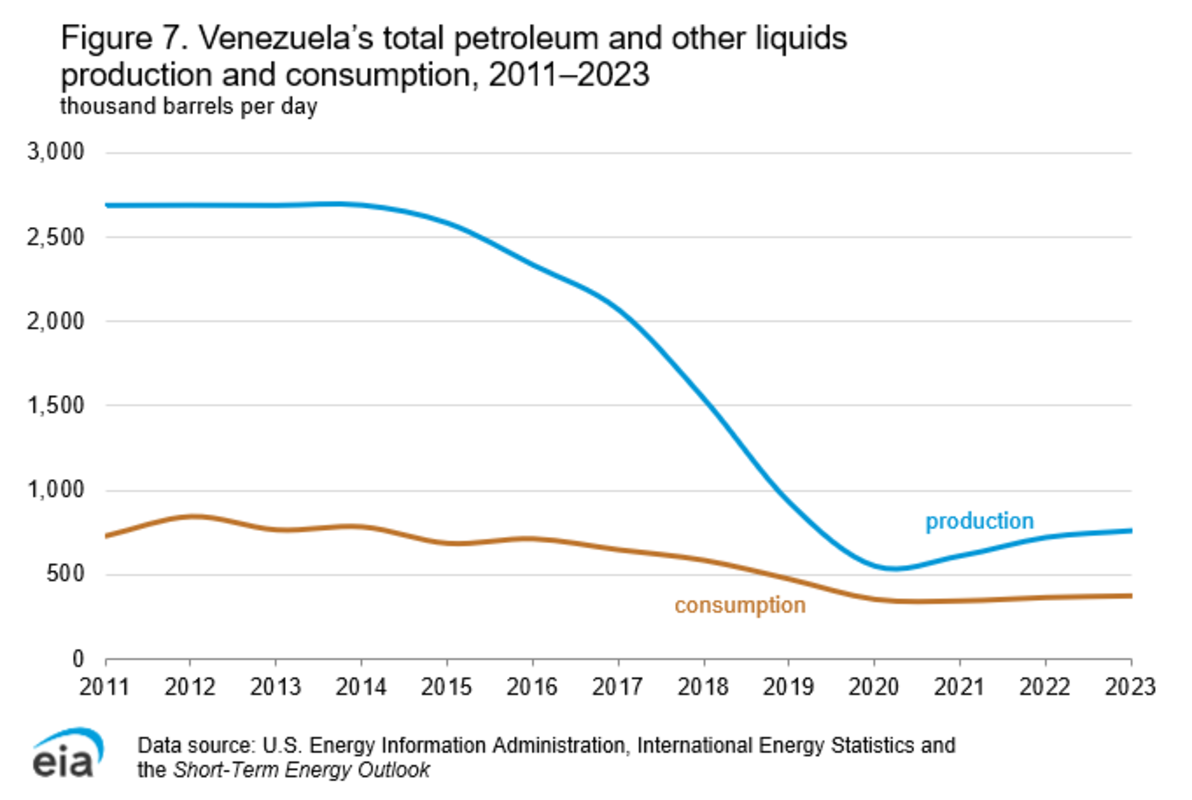

Venezuela takes 40% to 45% of PDVSA’s revenue. Through the years, underinvestment, mixed with the damaging impacts of an oil trade “brain drain” and U.S. sanctions, has resulted in Venezuela’s whole vitality manufacturing lowering at an annual common price of 8.2% from 2011 to 2021. Venezuela produced 742,000 b/d of crude oil in 2023, down 70% from 2013, in accordance with the EIA.

Venezuela’s oil manufacturing has fallen considerably since 2011.

E

“Venezuela currently produces ~900 kb/d of oil (~1% of global supply) and exported ~800 kb/d in 2025,” wrote Morgan Stanley analysts in a analysis word shared with me. “China was the largest destination for this oil over the past year, taking ~510 kb/d, while ~140 kb/d came to the US. The country’s production peaked around 3.5 mb/d in the late 1990s.”

The nation’s oil is generally extra-heavy crude, a thick, gooey oil that is tough to move and course of, requiring specifically designed refineries. The reserves are primarily discovered within the Orinoco Belt within the southern strip of the japanese Orinoco River Basin.

The character of Venezuela’s crude oil reserves and U.S. sanctions has led to elevated cooperation with Iran and China, together with Iranian shipments of diluents obligatory for transporting and processing extra-heavy crude oil, in addition to technical help from China Nationwide Petroleum Company (CNPC).

These nations have additionally assisted PDVSA’s 5 refineries, which have a complete nameplate processing capability of 1.46 million b/d as of 2022. Venezuela’s refinery throughput is beneath 300,000 b/d, or roughly one-fifth of its nameplate capability, in accordance with IPD Latin America estimates reported by the EIA.

General, Venezuela possesses enormous reserves which might be largely hamstrung by a long time of underinvestment, suggesting an enormous alternative throughout oil firms, from main built-in gamers like ExxonMobil, which already operates subsequent door in Guyana, to Chevron, which nonetheless maintains an curiosity in Venezuela.

“CVX is the one US operator that has retained a presence in Venezuela and is arguably best positioned to scale up production if conditions warrant, while COP and XOM both have unpaid arbitration awards for asset expropriation by the Venezuelan Government (most material for COP),” wrote Morgan Stanley.

It is not simply the large exploration and manufacturing firms who may gain advantage from a Venezuelan oil renaissance, although.

Rating knowledge reveals vitality inventory winners

The sector mannequin I developed aggregates particular person scores on 1,600 shares by trade and sector, after which ranks sectors by common rating. The scores incorporate a variety of elementary and technical evaluation knowledge factors, with a hefty give attention to earnings and quick and long-term momentum.

These components have more and more been working in vitality’s favor, regardless of what seems to be main headwinds from falling oil costs amid manufacturing will increase in Saudi Arabia, the world’s second-largest producer, behind america, which has seen manufacturing soar alongside fracking in Texas’ Permian Basin.

Choose vitality shares owed cash from Venezuela

- ConocoPhilips: $10.5 billion ($793 paid).

- ExxonMobil: $1.6 billion.

- Halliburton: $754 million.

- Schlumberger: $469 million.

- Baker Hughes: $87 million.

Supply: Morgan Stanley. - Helmerich & Payne: ~$90 million, plus 11 rigs, in accordance with U.S. Courtroom of Appeals.

Particularly, over the previous month, shares in numerous vitality industries have been climbing in my rating, particularly amongst large-cap shares.

For instance, the top-scoring large-cap vitality trade on the finish of final week was gear & providers, a basket of shares that would see vital demand tailwinds if main producers (XOM, CVX, COP) return to Venezuela and plow billions into modernizing its infrastructure.

The best-scoring large-cap gear & providers shares embody Schlumberger (SLB) and Halliburton (HAL), two world giants which might be serving to E&P firms extract oil virtually all over the place on the planet. Schlumberger has previous expertise in Venezuela with reservoir mapping and effectively know-how, whereas Halliburton has expertise in repairing getting older and shut-in wells, and markets synthetic lifts helpful for extracting heavy oil from shallow sandy formations just like the Orinoco Belt.

One other high large-cap inventory buyers have been shopping for just lately is refiner Valero, which has vital refining operations alongside the U.S. Gulf coast geared towards the identical heavy crude that Venezuela has in reserve.

Mid and small-cap vitality shares have additionally been climbing greater in current weeks. Amongst mid-cap shares, high gear & providers shares embody Technip FMC(FTI) and Core Laboratories N.V. (CLB).

TechnipFMC markets reformers and know-how that removes sulfur and may crack heavy molecules into lighter fuels, which is especially essential given Venezuela’s heavy-crude reserves. Core Labs may see demand for its scientific evaluation surge as E&P firms look to find out the very best path ahead for upgrades, together with the place to drill, how a lot steam to make use of for extraction, and the quantity of diluents, corresponding to naphtha, so as to add.

Drillers are additionally seeing tailwinds, led by Transocean (RIG), which focuses on offshore rigs that would profit from elevated exercise off Venezuela’s coast. Venezuela has among the many most important offshore pure gasoline reserves, notably within the Mariscal Sucre and Plataforma Deltana areas.

Helmerich & Payne (HP) was one of many largest drilling contractors in Venezuela till 2010. It has over $100 million in unpaid invoices, plus 11 of its rigs have been seized by Hugo Chavez. It is FlexRigs may see sturdy demand if a serious push is made to ramp Venezuela manufacturing, assuming it is even prepared to danger working there once more.

In small-cap shares, Patterson Vitality (PTEN), Oil States Worldwide (OIS), and Oceaneering Worldwide (OII) are top-rated in my rating. Oceaneering may take part properly in any reboot of offshore manufacturing, given its subsea Remotely Operated Autos (ROVs) capability to guage and restore underwater infrastructure. Patterson is an HP rival with vital expertise in horizontal land rigs. On the similar time, Oil States Worldwide may see demand rise for its specialised connectors, together with the FlexJoint and high-pressure valves, like its Piper Valves.

Oil renaissance in Venezuela will not occur in a single day

After the weekend raid capturing and extraditing Maduro to the U.S. to face narco-terrorism prices, oil shares are rallying sharply greater once more on January 5.

Whereas the sector has been considerably neglected over the previous 12 months as crude costs have declined, buyers ought to be conscious that any tailwinds from Venezuela are prone to take a while to materialize.

Along with outdated manufacturing and refineries, the nation’s pipelines are previous and deteriorating, requiring modernization.

“PDVSA estimates that updating pipeline infrastructure alone would require around $8 billion in investment to return oil production to late 1990s levels. Although PDVSA no longer reports spills, the head of Venezuela’s Unitary Federation of Petroleum and Gas Workers estimates that oil spills occur almost daily in some states,” studies the EIA.

The systematic failure of your entire oil & gasoline trade in Venezuela may require $100 billion or extra of funding, and that funding will solely occur if exploration & manufacturing majors really feel assured that they will not be tossing good cash after unhealthy once more.

“Facilitating meaningful new investment probably takes more than just an easing of sanctions. US producers (CVX, COP, XOM, or others) would likely need to see a viable path to recouping any outstanding payments or arbitration awards, have confidence in the stability of the (new) government, and be comfortable with the fiscal terms before allocating any large amounts of capital to the country – something that might take time,” wrote Morgan Stanley.

What’s subsequent for oil costs

An enormous rise in Venezuela’s oil manufacturing would add extra strain to world oil costs. The worldwide oil market is already oversupplied with extra oil than it wants, following OPEC’s choices to extend manufacturing and regain market share towards U.S. shale producers, ostensibly a transfer designed to gradual U.S. manufacturing by chopping earnings within the Permian Basin. In response to the Dallas Federal Reserve, the break-even prices of the Permian Basin whole $61 per barrel. Direct manufacturing prices in Saudi Arabia are estimated beneath $25 per barrel.

The ‘flood the streets’ oil coverage employed by OPEC has at the moment taken per-barrel costs right down to about $60 from $115 in 2022.

Morgan Stanley strategist Martijn Rats expects the excess to worsen earlier than it improves, peaking in 1H26 at ~2.7 mb/d.

Given the drop and the truth that rebooting Venezuela’s manufacturing would additional add to the provision, crude oil costs could possibly be capped till there’s extra readability on a timeline for Venezuela.

Associated: Venezuela shock might rock oil, shares this week