Virtuals Protocol (VIRTUAL) value has cooled off after a robust run, slipping 8% within the final 24 hours. Nonetheless, the broader setup appears constructive.

The token stays up almost 79% over the previous seven days, and the present pullback could merely be a pause earlier than one other push greater, if it stays above a key assist stage.

Sponsored

Mega Whales Accumulate as Retail Curiosity Returns

Whilst smaller holders booked earnings, mega whale wallets, the highest 100 VIRTUAL addresses, quietly elevated their holdings throughout the newest dip. Their mixed stability rose 0.06% over the previous 24 hours to 966.01 million tokens, that means they added about 0.58 million VIRTUAL.

VIRTUAL Mega Whales Are Shopping for: Nansen

That type of regular accumulation usually indicators that huge holders view the correction as short-term.

In the meantime, trade balances have dropped 0.46%, with about 0.18 million tokens shifting off buying and selling platforms. This exhibits that whereas the mega whales have been loading up, retail and smaller whales is perhaps reserving earnings. But, web shopping for strain stays.

Sponsored

This quiet accumulation additionally strains up with enhancing chart indicators.

On the 4-hour chart, the 100-period Exponential Shifting Common (EMA) has simply crossed above the 200-period EMA, a bullish crossover that usually indicators rising energy within the short-term development. The EMA is a shifting common that offers extra significance to latest costs, serving to merchants spot early momentum shifts.

On the similar time, the Cash Move Index (MFI), which tracks how a lot cash is coming into or exiting the market based mostly on each value and quantity, has began curling upward from close to 40 towards 60.

That exhibits shopping for energy returning regularly, particularly from retail merchants who usually react to whale-led strikes. The latest VIRTUAL/USDT itemizing on OKX could possibly be a sentimental driver of this renewed retail pickup.

Sponsored

Collectively, these on-chain and chart indicators recommend that each giant and smaller buyers are positioning for a continuation of the broader uptrend. The VIRTUAL value pullback, for now, seems to be a pause and never the tip of the rally.

Flag Breakout And Bullish Divergence Maintain the VIRTUAL Value Rally Alive

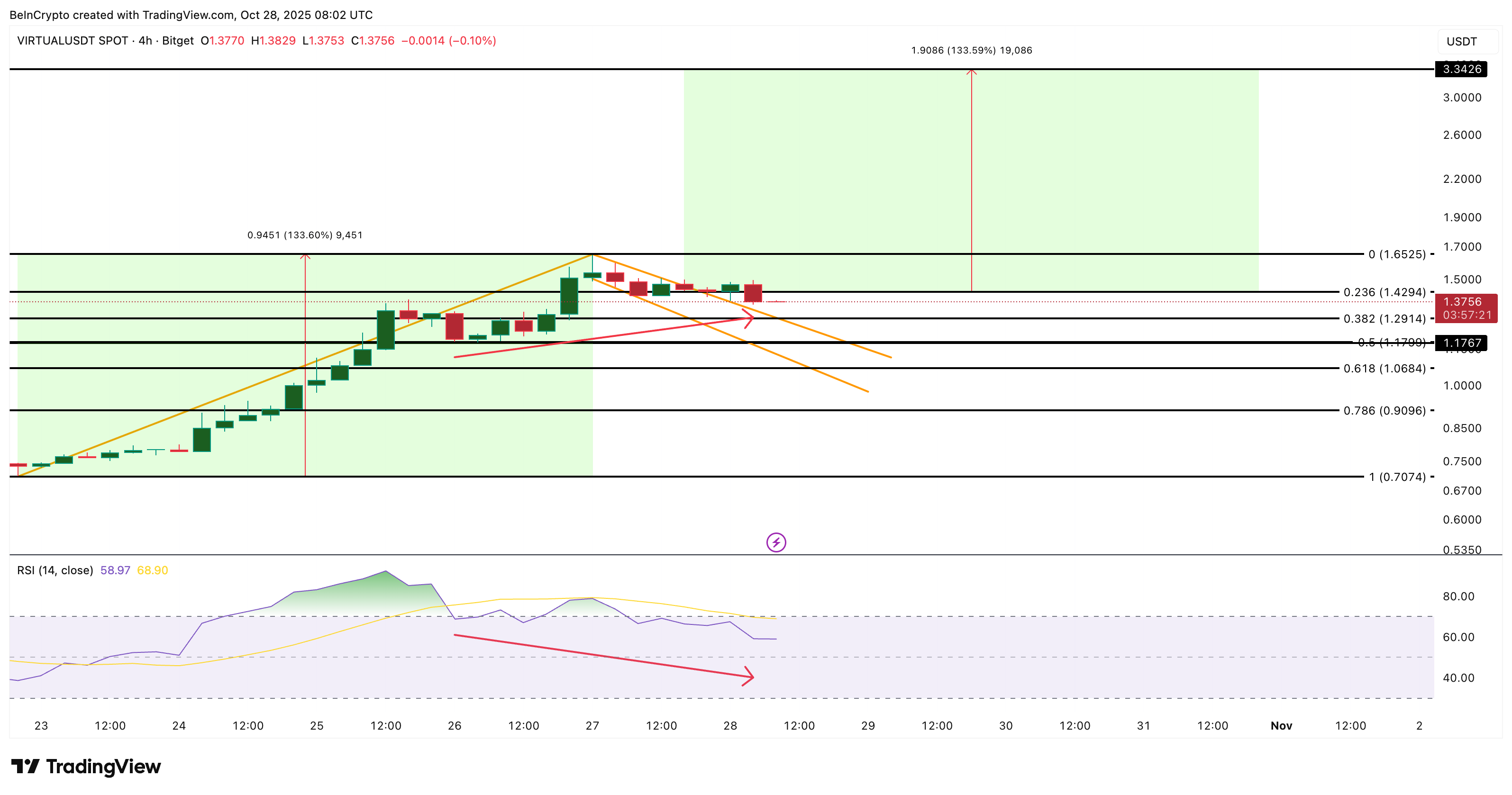

VIRTUAL just lately broke out of a flag-and-pole sample close to $1.42. It’s a setup that usually precedes continued upside after a pointy rally. From that breakout, the projected transfer factors towards $3.34, representing a possible 133% achieve from present ranges.

Nonetheless, the token should first shut a full 4-hour candle above $1.65 to verify renewed energy and try a push in direction of $3.34. Including conviction to this view, between October 26 and 28, the worth made a better low whereas the Relative Power Index (RSI) made a decrease low.

Sponsored

This sample, a hidden bullish divergence, usually exhibits that an uptrend stays intact whilst costs cool.

It additionally hints that the continuing pullback may finish quickly if consumers proceed to defend the decrease ranges.

For draw back validation, the bullish setup stays legitimate so long as VIRTUAL holds above $1.17. A 4-hour shut under that will open the way in which towards $1.06. That might invalidate a lot of the bullish pole-and-flag breakout momentum.

Even when the rally reaches $3.34, VIRTUAL would nonetheless be about 35% under its all-time excessive of $5.07, leaving ample room for restoration. If the broader development continues, this pullback may drive the subsequent main rebound section fairly than its finish.