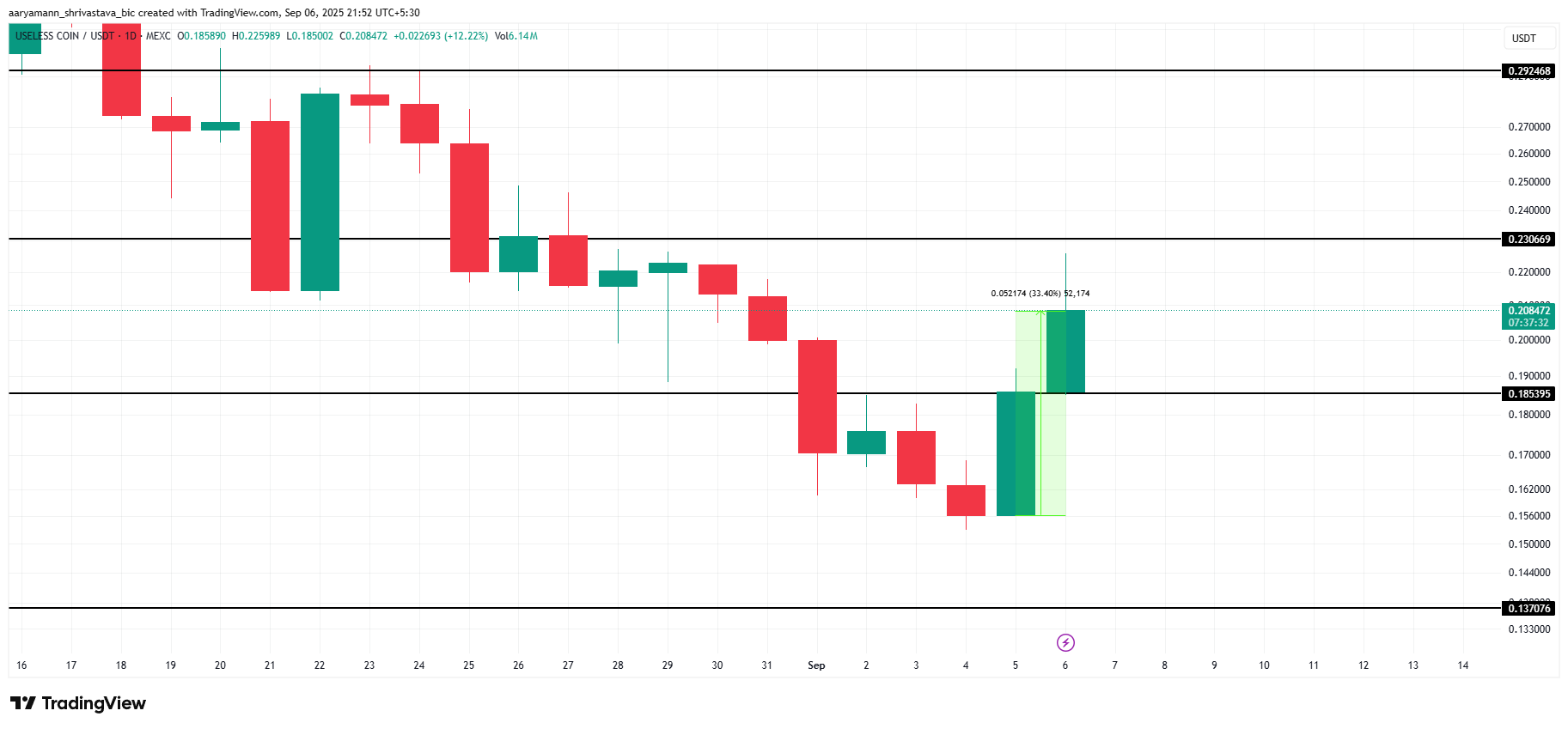

Ineffective Coin (USELESS) is staging an tried restoration, with the meme coin leaping 31% within the final 24 hours.

The worth motion highlights short-term optimism, although the broader outlook stays regarding. Weak inflows counsel that traders are nonetheless cautious regardless of the sudden rise in worth.

Ineffective Coin Fails To Acquire Help

The Shifting Common Convergence Divergence (MACD) indicator exhibits USELESS approaching a possible bullish crossover. If the MACD line crosses above the sign line, it will affirm a shift in momentum towards a optimistic pattern.

Sponsored

Sponsored

Such a crossover would point out that broader market cues are supporting the altcoin. This might assist USELESS maintain its present rally and probably entice new consumers. Elevated demand within the coming days could present further momentum, aiding the meme coin in testing increased resistance ranges.

USELESS MACD. Supply: TradingView

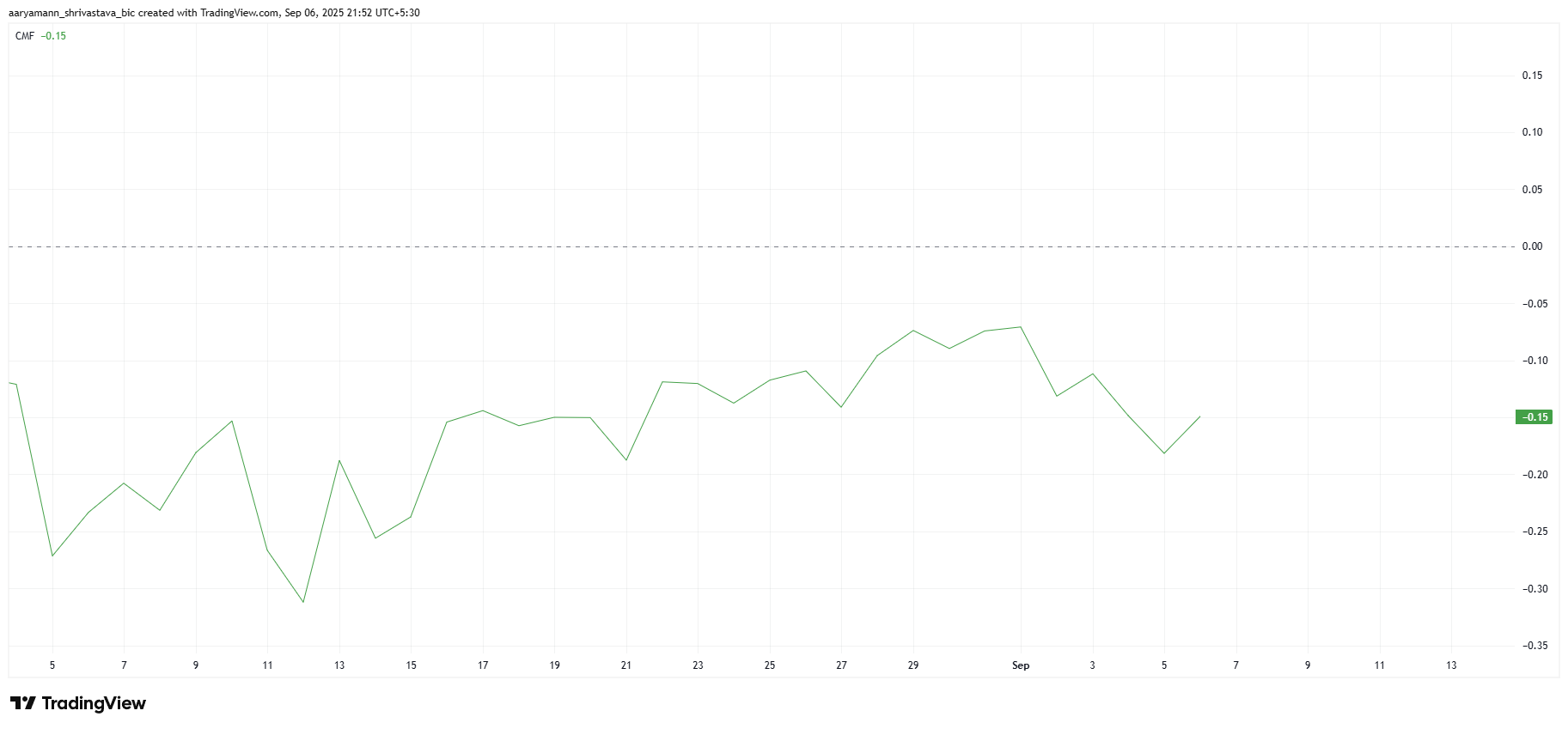

Regardless of the latest bounce, the Chaikin Cash Move (CMF) indicator alerts underlying weak point. At present sitting beneath the zero line in unfavorable territory, it highlights restricted investor participation and weak inflows.

Lack of contemporary capital inflows stays detrimental to long-term development. With out constant shopping for strain, the altcoin dangers stagnation. The weak sentiment means that USELESS could battle to maintain momentum until broader market circumstances enhance considerably within the close to time period.

USELESS CMF. Supply: TradingView

USELESS CMF. Supply: TradingView

USELESS Value Wants A Push

On the time of writing, USELESS is buying and selling at $0.208, having flipped $0.185 into assist following its 31% surge. The subsequent resistance lies at $0.230, a key barrier that the meme coin should overcome.

Given present technical alerts, USELESS could discover it tough to breach $0.230. If investor sentiment doesn’t enhance, consolidation beneath this resistance degree seems possible.

USELESS Value Evaluation. Supply: TradingView

USELESS Value Evaluation. Supply: TradingView

Then again, if market circumstances flip favorable, USELESS might push previous $0.230 and safe it as assist. This breakout would pave the best way for an increase to $0.292, invalidating the bearish thesis and reinforcing bullish momentum.