Seize a espresso and settle in as a result of markets are transferring, and never in small methods. What began as one other busy week of earnings and financial information has shortly become one thing extra vital. Someplace between Nvidia’s eye-popping numbers and JPMorgan’s newest name, merchants are abruptly speaking about an “everything rally,” and even Bitcoin miners are waking as much as the thrill.

Crypto Information of the Day: JPMorgan Predicts ‘Everything Rally’ as Nvidia Posts $57 Billion Q3 Income

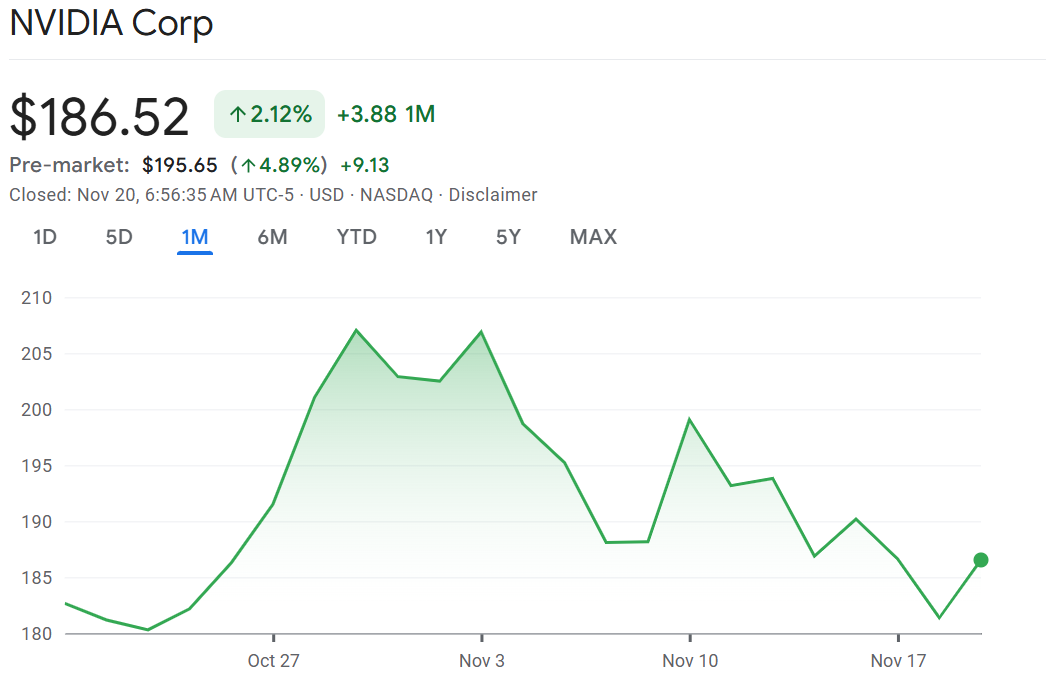

JPMorgan’s buying and selling desk forecasts an “everything rally” after Nvidia exceeded expectations with $57 billion in quarterly income and a $65 billion steering, triggering a 5% after-hours surge and including over $200 billion to the chipmaker’s market worth.

Sponsored

Sponsored

Nvidia’s spectacular earnings report bolstered perception within the AI funding cycle. Features unfold throughout chipmakers, and Bitcoin rose above $91,000, with danger urge for food returning to markets after a multi-day slide.

Bitcoin (BTC) Value Efficiency. Supply: BeInCrypto

Nvidia projected a good stronger fourth quarter, guiding income to $65 billion versus the $62 billion anticipated by analysts.

Nvidia’s upbeat report sparked positive factors in different chipmakers. AMD, Micron, Broadcom, and Intel all climbed in after-hours buying and selling, reflecting optimism for the semiconductor sector.

The outcomes strengthened investor confidence that AI infrastructure spending stays on monitor regardless of current volatility.

JPMorgan and Goldman Sachs See Shopping for Alternative

After the S&P 500 Index fell 3.4% over 4 days, JPMorgan’s buying and selling desk issued a bullish notice. Andrew Tyler reiterated a dip-buying stance, emphasizing secure fundamentals and stating the funding thesis shouldn’t be reliant on Federal Reserve coverage shifts.

The financial institution highlighted Nvidia earnings and the September nonfarm payrolls report as main catalysts for potential new market highs.

SETUP POISED FOR AN “EVERYTHING RALLY”

JPMORGAN TRADING DESK:

“Given that there have not been any changes to the fundamental story, nor does our investment hypothesis rely on the Fed easing, we are dip-buyers. As we look at the two key events this week, (i) Sept’s NFP and (ii)…

— *Walter Bloomberg (@DeItaone) November 19, 2025

Sponsored

Sponsored

Goldman Sachs mirrored JPMorgan’s optimism. Associate John Flood described the current market drop as a “real buying opportunity” forward of Nvidia’s earnings, anticipating a year-end rally.

The funding financial institution acknowledged that hedge funds have de-risked, whereas discretionary traders stay underweight and are poised to deploy capital.

November has been the S&P 500’s weakest month since 2008, with a 3% decline month-to-date.

Bitcoin Mining Shares Surge on AI Optimism

Bitcoin mining shares like Cipher Mining, IREN, and Hut 8 leapt in pre-market buying and selling after Nvidia’s sturdy steering. The surge mirrored rising acknowledgment of miners’ increasing function in AI infrastructure and high-performance computing.

FirmOn the Shut of November 19Pre-Market OverviewIREN Restricted (IREN)$45.83$49.27 (+7.51%)Cipher Mining Inc. (CIFR)$4.67$6.35 (+35.97%)Hut 8 Corp (HUT)$37.54$39.60 (+5.49%)Bitcoin Mining Shares Pre-Market Overview

Nonetheless, institutional traders, together with Peter Thiel and SoftBank, have lately trimmed their holdings in Nvidia and main AI corporations, signaling wariness over excessive valuations.

Sponsored

Sponsored

Peter Thiel reportedly offered his whole place of 537,742 shares in Nivdia.

Why? It’s a bubble, all of them realize it & are cashing out.

– Nvidia ALONE = 15% of US GDP.

-OpenAi desires a govt bailout.

– US Development is .01% whenever you take away AI sector. pic.twitter.com/mk3Nc6yBpk

— Maine (@TheMaineWonk) November 17, 2025

A Financial institution of America survey revealed that 45% of fund managers see an AI bubble as the first risk to markets. World regulators, together with the Financial institution of England and the IMF, warn of dangers from potential AI and crypto bubbles.

Skeptics Query Nvidia’s Shareholder Worth Creation

Amidst sturdy market enthusiasm, investor Michael Burry raised considerations concerning Nvidia’s stock-based compensation. Burry examined monetary information since 2018, highlighting a spot between reported earnings and true worth creation for shareholders.

For the reason that starting of 2018, NVDA earned about $205B web revenue and $188B free money stream, assuming all cap ex was progress cap ex.

SBC amounted to $20.5B.

However it purchased again $112.5B price of inventory and there are 47 million MORE shares excellent.

The true price of that SBC dilution… pic.twitter.com/u8VhZyokrB

— Cassandra Unchained (@michaeljburry) November 20, 2025

Burry’s evaluation suggests stock-based compensation has masked Nvidia’s actual earnings energy. The corporate posted $205 billion in web revenue and $188 billion in free money stream since 2018.

Regardless of this, its share rely rose by 47 million, even after $112.5 billion in repurchases. The dynamic raises questions on whether or not headline numbers absolutely mirror worth for shareholders.

Sponsored

Sponsored

This debate captures ongoing tensions in market sentiment. Whereas JPMorgan and Goldman Sachs spotlight sturdy fundamentals and structural AI demand, skeptics level to valuation dangers and attainable headwinds.

As traders digest Nvidia’s outcomes and altering financial information, the approaching weeks will reveal whether or not the “everything rally” expectation comes true or volatility persists.

Chart of the Day

Byte-Sized Alpha

Crypto Equities Pre-Market Overview

FirmOn the Shut of November 19Pre-Market OverviewTechnique (MSTR)$186.50$191.88 (+2.88%)Coinbase (COIN)$257.29$263.38 (+2.37%)Galaxy Digital Holdings (GLXY)$25.76$26.75 (+3.84%)MARA Holdings (MARA)$11.10$11.48 (+3.42%)Riot Platforms (RIOT)$13.35$13.76 (+3.07%)Core Scientific (CORZ)$15.39$16.36 (+6.30%)Crypto equities market open race: Google Finance