I have been analyzing knowledge to trace inventory market sector traits since I entered the enterprise in 1997. My first job was as a analysis assistant for an impartial analysis agency that supplied sector and trade cash circulation analysis to mutual and hedge fund managers. Ultimately, I turned a companion earlier than leaving and creating my very own proprietary shares and sector rating instrument in 2003.

For years, cash managers have used my analysis to establish new inventory concepts and inform their selections on whether or not to chubby or underweight sectors, industries, and shares. My mannequin, which continues to be out there at Limelight Alpha, continues to be laborious at work analyzing knowledge. This summer season, it highlighted a delicate shift towards healthcare within the early days of what is confirmed to be a sturdy rally.

Limelight Alpha Sector Rating (December 27 2025):

The rating displays the highest-scoring to the lowest-scoring sectors by rating as of 12/27/2025. Larger-scoring sectors have optimistic elementary, cash circulation, and momentum traits.

L

The efficiency of healthcare shares largely lagged till the summer season. Since showing close to the highest of the large-cap sector rating in June, it has not solely been one of many inventory market’s finest performers but additionally outperformed the expertise sector.

Except you are dwelling underneath a rock, you are properly conscious of the positive factors in expertise (and personal a whole lot of it). Since ChatGPT’s launch in 2022, buyers have poured into expertise shares, similar to Nvidia, thereby growing the expertise sector’s S&P 500 weighting, whereas shunning healthcare shares, which has led to a decline in its publicity within the index.

Consequently, buyers have probably discovered themselves proudly owning a big variety of expertise shares heading into 2026, however too few healthcare shares — one thing buyers might need to contemplate as they give thought to what’s subsequent for the inventory market now that we have entered the New 12 months.

Healthcare shares have been rallying since June 2025.

B

Diversification is not a nasty factor, and healthcare may very well be the sector to focus on in 2026

Expertise shares rally has lifted the sector to 34.4% of the S&P 500 index. Nevertheless, when you embrace communication companies, which embrace tech stalwarts like Meta and Alphabet, the determine surges to 45%. Toss in Amazon, which lives in shopper discretionary, and the determine climbs nearer to 50% — a degree excessive sufficient to be harking back to the peak of the Web increase, when expertise comprised a good portion of the benchmark index.

Associated: Shares wild trip in 2025 units the stage for 2026

No person is ringing a bell to promote expertise, and there are contrasts to the Web increase that recommend an AI bust is not looming, together with an absence of unused capability. Throughout the Web increase, firms put in huge fiber optic networks earlier than demand existed. This time round, all the information heart capability constructed up to now seems totally subscribed.

“While often compared to late-1990s fiber, today’s data center cycle is fundamentally different, underpinned by long-term contracts with the world’s most advanced technology companies, and capability, power, and land emerging as key constraints on growth,” wrote KKR in a current report. “Current absorption rates show no signs of overbuilding in the world’s most active market… in the longer term, we think demand should justify much of today’s data center build-out.”

Nonetheless, after three consecutive huge years for returns, buyers should not be stunned if expertise shares take a break to backfill some positive factors in some unspecified time in the future. If that’s the case, it might open the door for extra rotation into different sectors which have been largely ignored, together with healthcare.

Rating knowledge exhibits quiet shift towards healthcare

The sector mannequin I developed aggregates particular person scores on 1,600 shares by trade and sector, after which ranks sectors by common rating. The scores incorporate a spread of elementary and technical evaluation knowledge factors, with a hefty concentrate on earnings and quick and long-term momentum.

These elements have more and more been working in healthcare’s favor, regardless of what seems to be main headwinds from regulatory scrutiny over drug costs and medical health insurance premiums and protection.

Associated: Each main analyst’s S&P 500 value goal for 2026

Whereas these worries beforehand saved buyers at bay, Wall Avenue seems to be more and more warming as much as the concept that current large pharma offers with the White Home will enable the trade to sidestep a broader, profit-margin-busting reckoning. The efficiency of main drugmakers has been stable, and never simply the GLP-1 weight reduction Large Eli Lilly (LLY), which had already made a big transfer because of surging demand.

Amgen (AMGN), Johnson & Johnson (JNJ), Merck (MRK), and others, together with overseas stalwarts GlaxoSmithKline (GSK) and AstraZeneca (AZN), are all rallying since June.

Returns for choose healthcare shares since 6/30/2025:

Firm

Image

Return 6/30 – 12/31/2025

Illumina

ILMN

37.47%

Natera

NTRA

35.60%

Johnson & Johnson

JNJ

35.48%

Merck

MRK

32.97%

AstraZeneca

AZN

31.55%

GSK ADR

GSK

27.71%

Amgen

AMGN

17.23%

Bristol Myers Squibb

BMY

16.53%

It isn’t simply the large gamers with established blockbusters both.

Biotech, which has been principally miss relatively than hit over the previous decade, has additionally placed on a present. We have seen biotech M&A exercise improve, and cash managers and buyers appear to be more and more recognizing that if regulatory fears are overpriced into shares, there may very well be bargains, particularly as funding prices drop, provided that rates of interest are retreating and robust markets supply entry to capital.

Since June, the iShares Biotech ETF (IBB) is up 33.4% and the SPDR S&P 500 Biotech ETF (XBI) is up 35.4%. For perspective, the SPDR Expertise ETF (XLK) is up 13.7% and the SPDR Healthcare ETF (XLV) is up 14.9% over the identical interval.

Is it too late to purchase healthcare shares?

I’ve spent greater than my justifiable share of time monitoring healthcare and have written 1000’s of tales on healthcare shares. I used to be additionally the host of Motley Idiot’s well-liked Trade Focus Healthcare podcast for years earlier than becoming a member of TheStreet.

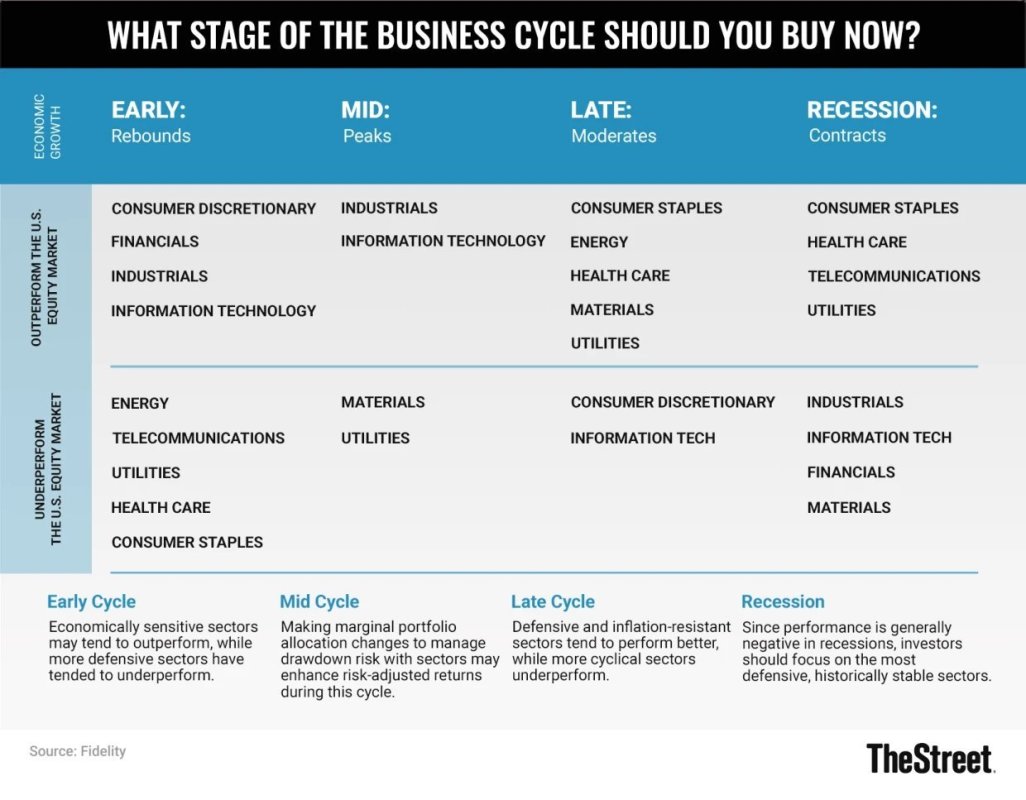

Whereas something can occur, traditionally, healthcare performs finest when the economic system is within the late stage of the enterprise cycle, and when it turns into rocky, buyers search relative security.

Constancy&interval;

The economic system is doing high-quality, provided that GDP is monitoring 3% for This autumn, in response to the Atlanta Fed’s GDPNow instrument. However Wall Avenue expects GDP progress to gradual as soon as a flood of tax refunds recedes, suggesting that as we push extra deeply into the 12 months, worries might emerge, notably forward of mid-term elections, offering a tailwind for a flight to security commerce.

For now, curiosity in healthcare shares is due primarily to:

- Portfolio rebalancing to normalize weights.

- Diversification to play some protection after a giant multiyear rally.

- Rising optimism that regulatory dangers are overblown.

- Rising merger & acquisition alternative.

- Falling rates of interest enhance earnings statements by reducing curiosity expense.

Whereas healthcare’s rally might stall at any level, the sector is getting into 2026 with momentum that, in my opinion, is powerful sufficient to warrant publicity in my portfolio. The relative energy index for the XLV is 54.3. Overbought is usually thought-about to be a studying above 70, suggesting the basket is not at present overbought. The RSI for the XBI ETF is 52.4.

Todd Campbell owns Illumina, Johnson & Johnson, and Amgen shares.

Associated: Goldman Sachs resets bets on US economic system in 2026