TPG RE Finance Belief, Inc. (NYSE: TRTX) This fall 2025 earnings introduced strong outcomes. The mortgage portfolio reached $4.3 billion, marking important portfolio enlargement. The corporate maintained 100% performing standing whereas originating $927 million in new loans. These outcomes exhibit constant execution in industrial actual property finance.

- Monetary Highlights for This fall 2025

- Quarterly Mortgage Portfolio Progress

- TPG RE Finance Belief, Inc. This fall 2025 Earnings: Mortgage Exercise Acceleration

- Full Yr 2025 Efficiency Overview

- Portfolio High quality and Danger Administration

- Key Enterprise Drivers

- TPG RE Finance Belief, Inc. This fall 2025 Earnings: Progress Trajectory

- Key Takeaways

- About TPG RE Finance Belief, Inc.

Monetary Highlights for This fall 2025

- The mortgage portfolio grew to $4.3 billion in complete commitments.

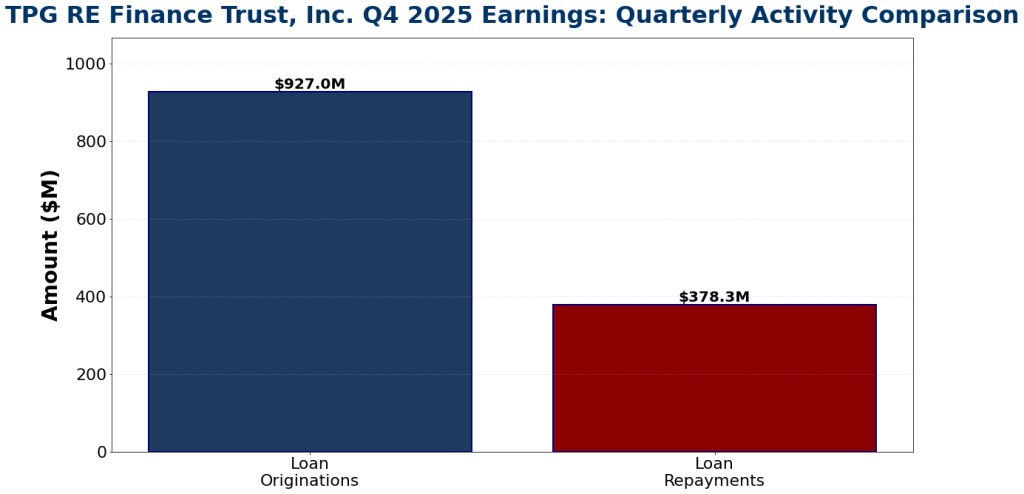

- Originated $927 million in new first mortgage loans.

- Acquired $378.3 million in mortgage repayments.

- Maintained a 100% performing mortgage portfolio.

- Weighted common loan-to-value ratio of 65.7%.

- Weighted common rate of interest flooring of two.66%.

Quarterly Mortgage Portfolio Progress

TPG RE Finance Belief, Inc. This fall 2025 earnings confirmed quarterly mortgage portfolio enlargement, with commitments reaching $4.3 billion at year-end.

TPG RE Finance Belief, Inc. This fall 2025 Earnings: Mortgage Exercise Acceleration

The fourth quarter demonstrated strong exercise in each mortgage originations and repayments. Complete new mortgage commitments of $927 million exhibit the corporate’s means to deploy capital. Mortgage repayments of $378.3 million generated wholesome money move from portfolio maturation. This stability between originations and repayments displays profitable portfolio administration.

Mortgage originations outpaced repayments in This fall 2025, exhibiting internet portfolio development.

Full Yr 2025 Efficiency Overview

For the total 12 months 2025, TRTX This fall 2025 earnings mirrored constant annual efficiency. Complete mortgage commitments originated reached $1.9 billion with repayments of $987.9 million. Distributable earnings reached $76.8 million, supporting $77.9 million in shareholder dividends.

Portfolio High quality and Danger Administration

The corporate maintained strong credit score high quality all through 2025 with 100% performing loans and 0 delinquencies. The weighted common danger ranking remained secure at 3.0. Credit score loss reserves totaled $77.4 million, equal to 180 foundation factors. The portfolio demonstrated resilience throughout all industrial actual property property sorts.

Key Enterprise Drivers

- Constant mortgage origination velocity with $927 million in This fall.

- Diversified portfolio throughout main metro areas.

- Give attention to first mortgage loans with strong collateral backing.

- Energetic portfolio administration with balanced repayments.

- Disciplined leverage administration with a debt-to-equity ratio of three.02x.

- Entry to numerous financing sources, together with CLO issuances.

TPG RE Finance Belief, Inc. This fall 2025 Earnings: Progress Trajectory

The corporate ended 2025 with $143 million of accessible liquidity and an prolonged credit score facility by way of February 2028. Administration elevated the secured revolving credit score facility by $85 million to $375 million complete capability. This positions the corporate to proceed sourcing compelling mortgage alternatives. The strong stability sheet and numerous funding sources help future mortgage portfolio development alternatives. Administration expects continued momentum in industrial actual property lending exercise.

Key Takeaways

- The mortgage portfolio expanded to $4.3 billion in complete commitments.

- This fall 2025 originations of $927 million exhibit constant deal exercise.

- The portfolio remained 100% performing all year long.

- Distributable earnings of $76.8M supported secure dividends.

- Improved liquidity and prolonged credit score amenities help development plans.

About TPG RE Finance Belief, Inc.

TPG RE Finance Belief, Inc. is a industrial actual property finance firm that originates, acquires, and manages primarily first mortgage loans secured by institutional properties in main and secondary markets. The corporate is externally managed by TPG RE Finance Belief Administration, a part of TPG Actual Property. For extra info, go to https://www.tpgrefinance.com/

Click on Right here to go to the AlphaStreet web site.