Picture supply: Getty Photos

Grainger (LSE:GRI) is a UK-listed actual property funding belief (REIT). With its shares priced at £1.94, it gives traders a strategy to get a foot on the property ladder with lower than £2.

It’s no secret that the toughest a part of shopping for a home is usually getting the deposit collectively as costs simply hold going up. However I feel this could possibly be a sensible strategy to try to construct some wealth to assist the method.

Constructing a deposit

Making an attempt to place collectively a deposit to purchase a home could be a soul-destroying expertise and everyone knows why. Regardless of greater rates of interest in the previous couple of years, property costs simply hold going up.

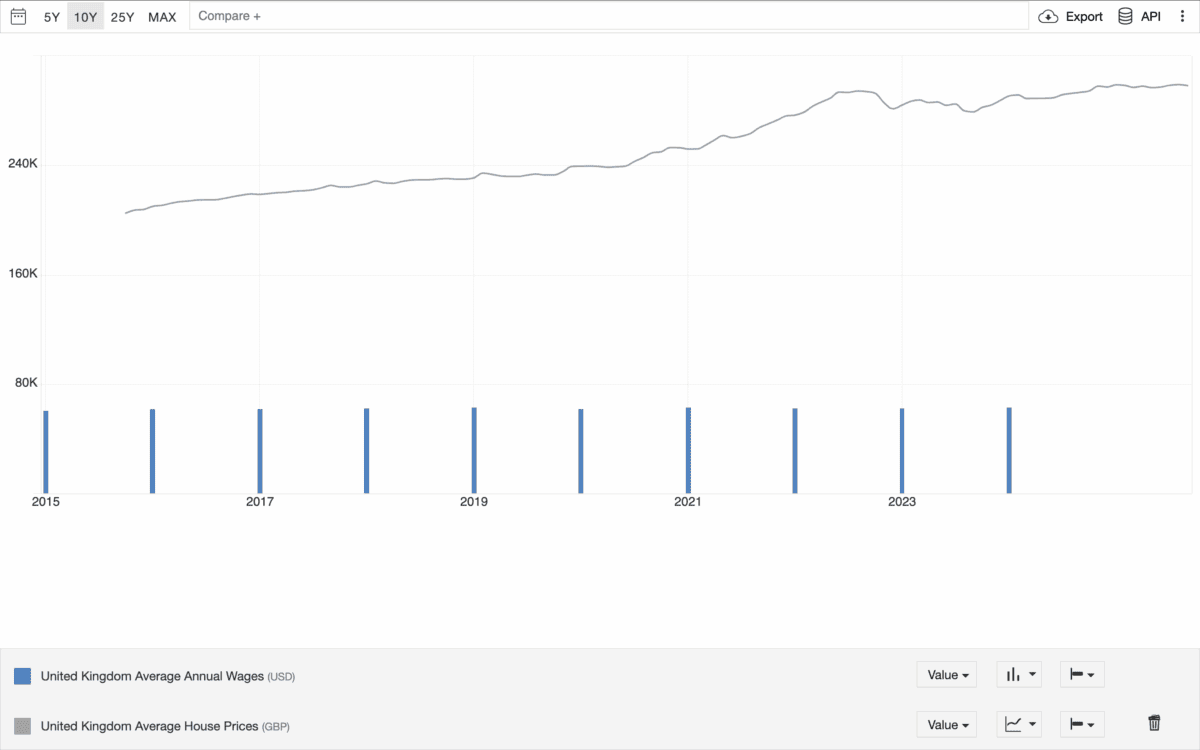

Within the final 10 years, the common home value within the UK is up by round 50% and the common wage has elevated by about 4%. Neglect Netflix, fitness center subscriptions, and no matter else — that equation simply doesn’t work.

Supply: Buying and selling Economics

There are many theories about why property costs hold going up – I actually have mine – however that’s a dialog for an additional day. What issues proper now could be what to do about it.

To keep away from being left behind, future first-time consumers want one thing that may hold tempo with rising home costs. And I feel Grainger is effectively value testing as a possible reply.

A ready-made portfolio

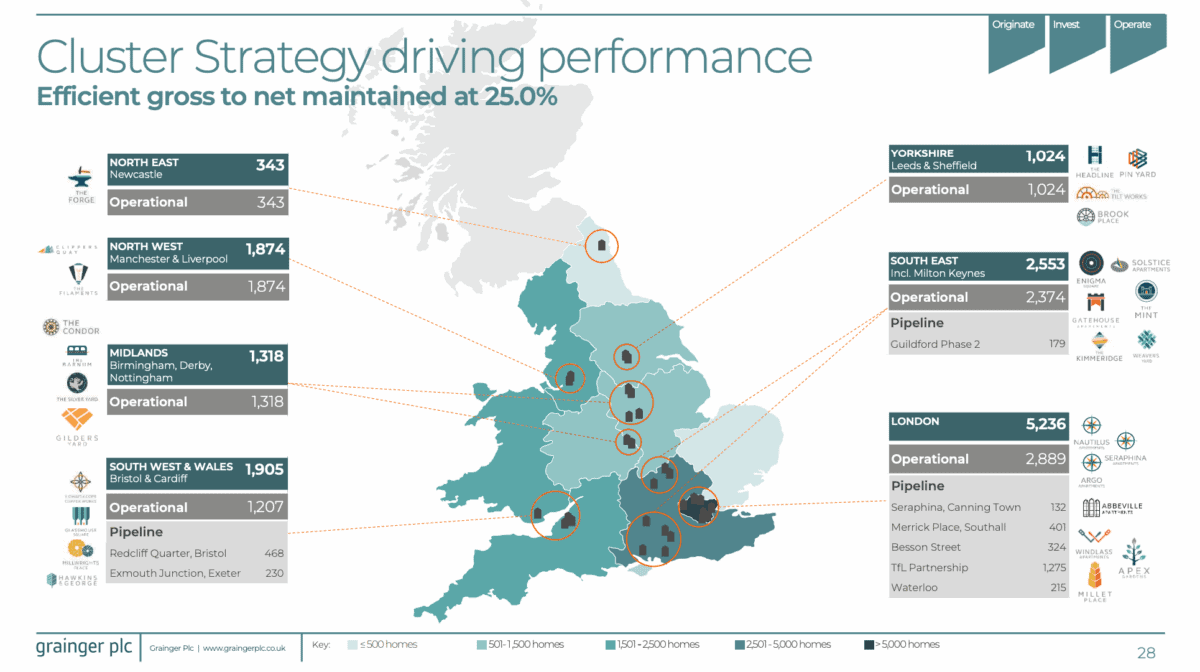

Grainger owns and leases a portfolio of over 11,000 homes throughout the UK. And round half of those are situated in London, the place demand at all times appears to be exceptionally robust.

Supply: Grainger Investor Relations

Put merely, this can be a approach of investing in property. So except one thing unusual occurs, an funding within the firm ought to develop as the worth of its portfolio will increase with rising home costs.

There are a number of explanation why it may not. One is the potential of altering rental laws producing loads of unexpected prices if Grainger has to maintain modifying its buildings.

Different issues being equal although, an funding within the agency ought to be capable to hold tempo with a rising property market. And we haven’t even bought to what I feel is the perfect bit.

Rental revenue

As a REIT, Grainger is required to return 90% of its taxable revenue to shareholders. So traders don’t simply take part in rising property costs, in addition they get money dividends from the enterprise.

Please word that tax therapy relies on the person circumstances of every shopper and could also be topic to vary in future. The content material on this article is supplied for data functions solely. It’s not supposed to be, neither does it represent, any type of tax recommendation.

Dividends are by no means assured, however have been rising steadily during the last decade. And the corporate reviews that loads of its tenants have a tendency to remain in its properties for the long run.

Grainger additionally has massive plans for future enlargement. A future pipeline value round £1.3bn means it’s wanting so as to add one other 37% to the worth of its current portfolio.

In a market the place costs solely appear to go greater, that could possibly be value lots. And traders can take part on this development by shopping for shares within the firm while not having an enormous deposit.

If you happen to can’t beat ’em…

It looks like first-time consumers within the UK are at a structural drawback – and so they have been lately. However investing in property by way of REITs is an concept that’s effectively value serious about.

Proudly owning shares in Grainger might assist future consumers keep away from being left behind by rising home costs whereas incomes passive revenue on the facet. And it’s not the one alternative value contemplating.