Conventional dividend ETFs are designed to supply stability, common revenue and long-term capital development. Even those that push the boundaries of excellent religion in what it means to be a dividend ETF at the very least bear some resemblance to 1.

However one ETF is the worst illustration of a dividend ETF that I’ve seen.

Whereas the fund’s goal says that it “aims to maximize yield per unit of active risk,” there’s no means that this ETF in follow may even charitably be described as a dividend technique. It has so few guardrails on what it’s allowed to do and is clearly making the most of it.

On the floor, returns look good, the Morningstar score is stable and it has a razor-thin expense ratio. All hallmarks of what you’d search for in a very good fund.

Look beneath the hood, nonetheless, at how the sausage is made and also you’ll discover one thing ugly.

The Franklin U.S. Core Dividend Tilt Index ETF (UDIV) tracks the Morningstar U.S. Dividend Enhanced Choose Index.

Shutterstock

What UDIV is meant to do

The fund I’m speaking about is the Franklin U.S. Core Dividend Tilt Index ETF (UDIV). It tracks the Morningstar U.S. Dividend Enhanced Choose Index, which is designed to ship a portfolio of shares with a better dividend yield than the broader market.

In accordance with Morningstar, the index is constructed utilizing an optimization framework that goals to maximise dividend yield, enhance diversification, mitigate lively danger, and simplify replication.

Associated: 3 Excessive-Yield Vanguard Dividend ETFs for Retirement

That each one sounds effectively and good. In follow, nonetheless, it’s not.

The methodology utilized by UDIV basically boils right down to this: so long as the ultimate portfolio produces an above common yield, something goes. There’s no high quality test. No emphasis on fundamentals. No yield requirement. No baseline dividend historical past. The constituents of the portfolio don’t even have to pay a dividend.

The tip result’s a portfolio that appears something however like a dividend ETF.

Why UDIV is likely one of the worst dividend ETFs

One must look no additional than the composition of UDIV to see how absurd it’s.

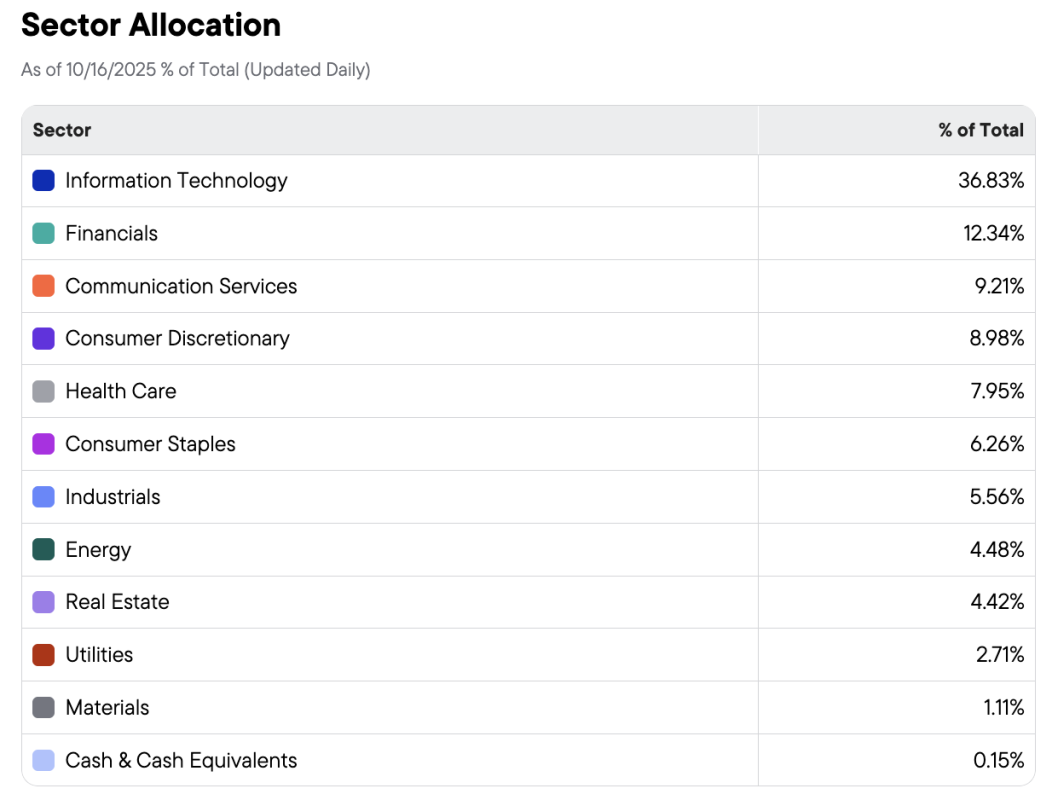

UDIV prime sector holdings (supply: Franklin)

The almost 37% allocation to tech shares is increased than even that of the S&P 500, which is as concentrated because it’s ever been in tech shares. The remainder of the sector holdings are principally inside about 2% by some means of the S&P 500.

Extra ETFs

- Overlook VOO, SPY, VTI: Greatest inventory investing decide is that this Constancy fund

- Greatest Bitcoin ETFs 2025: Constancy and Grayscale Problem IBIT

- Why the Schwab Dividend ETF (SCHD) Is shedding its edge to Vanguard

However even that’s not essentially the most egregious factor about UDIV. Take a look at the fund’s prime 10 holdings.

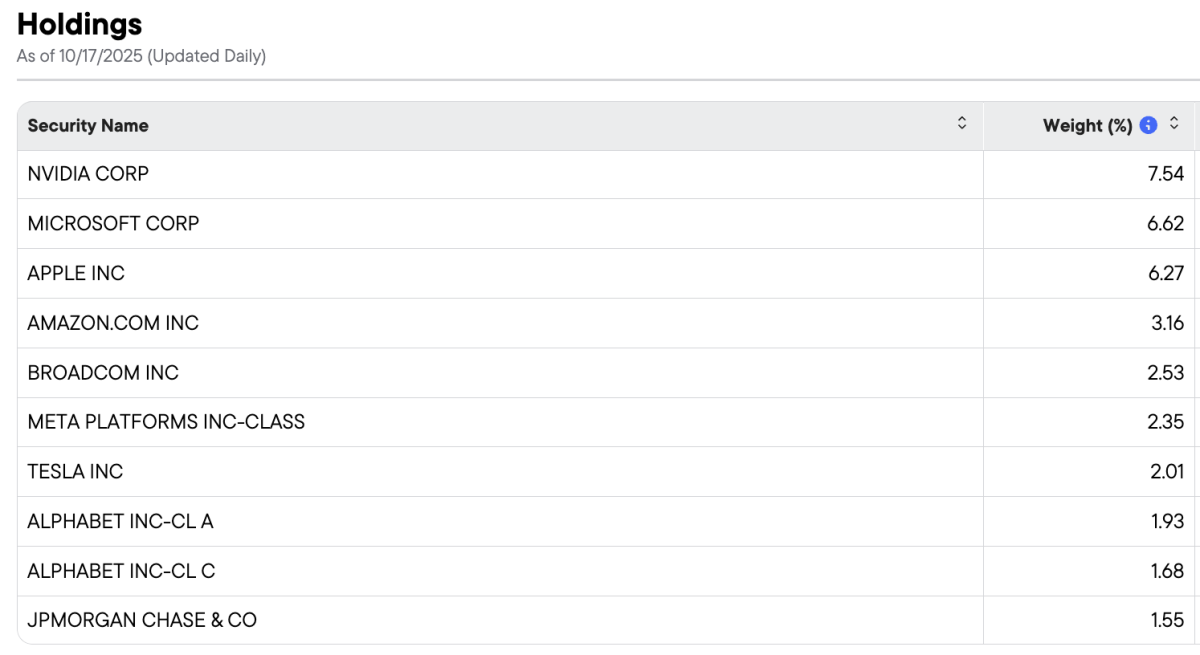

UDIV prime holdings (supply: Franklin)

Let’s rely all the ways in which UDIV’s declare of being a dividend ETF is a joke.

- 9 of the highest 10 holdings are the magnificent 7 shares plus Broadcom.

- Of these 9 shares, the very best dividend yield being supplied by any of them is Broadcom’s 0.68%.

- Amazon and Tesla don’t pay a dividend in any respect.

- UDIV’s prime holding, NVIDIA, has a dividend yield of 0.02%.

- Meta and Alphabet solely began paying dividends up to now two years.

Does that sound like every sort of a dividend ETF to you?

Sure, UDIV’s general yield of 1.6% is increased than the S&P 500’s 1.1% yield. Technically, it’s reaching its goal, however that is about so far as you will get from a conventional dividend inventory portfolio.

Higher dividend ETF variouss

Virtually something qualifies as a “better” dividend ETF various to UDIV, however listed below are just a few that I really feel are constructed the fitting means.

Schwab U.S. Dividend Fairness ETF (SCHD)

Setting apart its depressing latest efficiency, this is likely one of the finest constructed portfolios by way of pure dividend inventory publicity.

It incorporates screens for dividend high quality, dividend development and excessive yield. It additionally focuses on fundamentals and optimizes the portfolio to solely embrace these shares with the most effective mixture of all standards. Its 4% yield may even please revenue seekers.

WisdomTree U.S. High quality Dividend Development ETF (DGRW)

DGRW appears to be like for corporations with forward-looking dividend development potential, not simply dividend historical past. It considers stability sheet fundamentals, together with return on fairness (ROE) and return on property (ROA) as a part of its choice course of.

It additionally weights the portfolio by mixture dividends paid. Which means these corporations paying out essentially the most get larger weights within the portfolio.

SPDR S&P Dividend ETF (SDY)

SDY is maybe the most effective mixture of excessive yield and long-term dividend development. The fund consists of solely these corporations with a 20+ yr monitor report of dividend development, however then weighs qualifying parts by their dividend yield.

The result’s a fund that pays a modestly excessive yield however has a composition far totally different than that of the S&P 500.

UDIV is a mega-cap development fund with a heavy tech tilt above all else. The dividend part is simply a minor consideration.

In order for you tech publicity like this, simply spend money on a tech ETF. In order for you a dividend ETF, go together with one that really considers dividend development or high quality as a part of its choice standards.

Key takeaways

- UDIV is maybe the worst illustration of a dividend ETF on this planet.

- Its solely objective is to supply an general yield increased than that of the broader market.

- Outdoors of that, nearly something goes.

- Its drawbacks embrace a heavy tech chubby, the inclusion of many non-dividend payers and no consideration of dividend high quality.

Associated: The Constancy Dividend ETF beating Vanguard and Schwab in 2025