The worldwide style trade is bracing for 2026, navigating a market outlined by geopolitical instability, macroeconomic uncertainty, and, above all, unprecedented U.S. tariffs. As leaders pivot from specializing in “uncertainty” to acknowledging the surroundings is solely “challenging,” tariffs have emerged because the primary hurdle dealing with executives.

The severity of the commerce panorama can’t be overstated, executives advised McKinsey and the Enterprise of Trend for the 2026 version of The State of Trend report. U.S. tariffs on attire and footwear imports, which had been round 13% earlier in 2025, dramatically spiked to 54% following preliminary authorities bulletins in April. Though charges later eased, the weighted common tariff fee for attire and footwear from the highest 10 importers stood at 36% as of mid-October, nicely above historic norms. This sudden surge locations the attire and footwear trade amongst these most uncovered to the tariffs’ profound impacts. Reflecting this crucial state of affairs, 76% of style executives surveyed consider responses to commerce disruptions and tariffs would be the single most necessary issue shaping the trade in 2026.

For the tenth anniversary of the report, which started in 2016, McKinsey and Enterprise of Trend charted the numerous modifications for the trade since 2016, from a generalized “age of volatility” to Asia’s plain rise to disruptions in how consumers store. For 2026, they chart main points, together with “tariff turbulence” and three emergent shopper appetites: a give attention to resale, a way of “well-being” of their purchases, and a future marked by synthetic intelligence (AI).

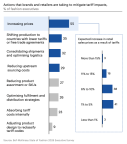

The report finds manufacturers making worth modifications, shifting sourcing, and bettering effectivity in a bid to counteract the influence of tariffs. Bigger suppliers are responding by optimizing their footprints whereas chasing digitization and automation, and smaller gamers, in the meantime, are beneath mounting stress. “Agility will be the defining factor enabling brands and suppliers to maintain their competitive edge.” Amid this financial disruption, Levi Strauss CEO Michelle Gass spoke to Joan Kennedy of Enterprise of Trend about how she’s adopted an aggressive and methodical tariff playbook, positioning the 170-year-old denim large as a standout in managing the chaos.

Levi’s benefit, and painful fact

Crucially, Levi’s entered this era with a structural benefit: Roughly 60% of its enterprise is worldwide, lowering the tariff burden in comparison with many home rivals who’re extra closely penetrated within the U.S. But, even with this benefit, the tariff will increase demanded strategic motion. Gass described the general surroundings as “very complex,” encompassing macroeconomic forces, geopolitical points, and big disruption in expertise and AI, and she or he articulated the required, unavoidable actuality of spending some prices on to the patron, stating plainly: “There’s only so much you can absorb from the tariffs, because they’re just very high.”

Levi’s method to pricing is multifaceted: First, focused and surgical pricing will increase are being applied, a measure additionally being taken by most attire retailers (55% of executives anticipate additional worth will increase in 2026 in response to tariffs). Second, the corporate is using promotional levers, particularly pulling again on reductions equivalent to “20% off” occasions, which helps elevate the model and mitigate tariff influence by bettering margins. Third, the corporate is pricing for innovation, leveraging new merchandise the place customers are “likely willing to pay more.”

Levi’s didn’t reply to Fortune’s request for touch upon extra specifics about pricing will increase to return.

Past pricing, Levi’s has prioritized inside operational prowess. Gass, who took over as CEO in 2024, has been driving a course correction centered on transformation, streamlining the enterprise and lowering unwieldy stock. Tactical strikes included slicing slower-selling SKUs. Extra considerably, the corporate is present process a elementary “rewiring” to cut back complexity throughout its community of 120 nations. By growing the commonality of product throughout all international shops from lower than 10% to about 40%, Levi’s is producing efficiencies throughout design, sourcing, and merchandising. As Gass summarizes this technique: “We’re operating in a complex environment, but we ourselves are becoming less complex.”

This disciplined method has delivered outcomes. Levi’s reported a 7% year-on-year enhance in quarterly gross sales in October 2025, posting its fourth consecutive quarter of high-single-digit progress. The corporate additionally raised its full-year income outlook, even because it cautioned that tariffs would influence margins within the fourth quarter.

The trade general is adapting to the brand new commerce map, with 35% of executives planning to shift sourcing to markets with extra favorable commerce agreements. Nonetheless, Levi’s emphasizes that in a risky commerce surroundings, agility relies upon closely on strategic provider partnerships constructed on collaboration. Gass famous that Levi’s groups speak to distributors 24/7, treating it as a “relationship business” the place sourcing from a number of nations affords essential flexibility in opposition to tariffs and supply-chain disruptions.