Tariff revenues are dramatically falling wanting preliminary White Home expectations, producing roughly $100 billion lower than projected, in line with a current evaluation from Pantheon Macroeconomics. Treasury Secretary Scott Bessent predicted in August that tariffs would increase “well over half a trillion, maybe towards a trillion-dollar number,” however information compiled by means of November 25 implies that customs and excise taxes annualize to solely $400 billion.

This shortfall stems from an Common Efficient Tariff Charge (AETR) that’s far decrease than anticipated. The AETR is presently estimated at simply 12%, falling considerably wanting the near-20% extensively anticipated earlier this spring. Even the Congressional Price range Workplace (CBO) was stunned, decreasing its estimate of the pre-substitution tariff price to 16.5% from 20.5% final month. Pantheon Macro Chief U.S. Economist Samuel Tombs and Senior U.S. Economist Oliver Allen recognized three main elements driving the lower-than-expected AETR, beginning with the U.S.’s relationship with China. Briefly, the plunge in buying and selling exercise with China isn’t being made up for with recent tariff income.

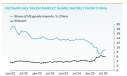

1. China imports plunge and rerouting

The primary main issue is the sharp decline in imports from China, which have plunged by 30%. China’s share of complete U.S. imports has dropped to only 9%, down from 13% in 2024. Corporations are fairly clearly rerouting commerce by means of Vietnam, Pantheon discovered. Imports from Vietnam have surged to account for six% of all imports, up from 4% final yr, pushed by “huge increases in imports of game consoles, TVs and clothes.” All of those bear a 20% tariff, beneath the near-50% price utilized to Chinese language imports.

2. USMCA compliance exceeds expectations

Second is the results of a Trump coverage from his first time period in workplace: the long-heralded renegotiation of NAFTA generally known as the United States-Mexico-Canada Settlement (USMCA). It seems the proportion of products getting into the U.S. tariff-free from Canada and Mexico below USMCA is far increased than preliminary estimates prompt.

The White Home estimated in March that 38% of Canadian imports and 50% of Mexican imports had been coated by the USMCA. After Trump’s shock tariff hikes on every nation this yr, topic to negotiation downward, items not compliant with USMCA guidelines are presently tariffed at 35% from Canada and 25% from Mexico, aside from a ten% tariff on power assets from Canada.

This implies the realized AETRs for these international locations ought to have been roughly 18% and 13%, respectively. Nonetheless, the information reveals realized AETRs in August had been simply 5% in each Canada and Mexico. This suggests a considerable enhance within the share of imports getting into below the USMCA deal.

Pantheon Macro says companies in Canada and Mexico have possible change into way more rigorous in offering data to U.S. customs to show the origin of elements of their merchandise, a apply that they had little incentive to observe below the earlier tariff construction. In different phrases, Canada and Mexico are ensuring they get the USMCA tariff exemption, and it’s throwing off the White Home calculations, which had been based mostly off earlier, much less compliant cross-border commerce.

3. Surge in tariff-exempt AI tools

The third issue diluting the general AETR is a surge in imports of products exempt from tariffs this yr. Particularly, imports of “automatic data processing machines”—which largely embrace private computer systems and superior chips used for synthetic intelligence—have soared. These imports now account for 9% of all complete imports, a major enhance from 4% in 2024. This surge in high-tech imports truly disguised a ten% year-over-year fall in imports of different merchandise in August.

This seems to be a one-off, or one-year sort of exception. “We we think U.S. firms are depleting inventory of imported goods for now,” Pantheon wrote, including the probability of the Supreme Court docket hanging down roughly 60% of the present tariff regime below the IEEPA regulation “is temporarily incentivizing businesses to postpone placing new orders for imports.”

If the present tariffs stay in place, the one-year nature of this stock depletion means tariff-applicable imports ought to get well subsequent yr, with Pantheon calculating them at $36 billion monthly, with the AETR ticking as much as 13%. “Even so, tariff revenues still would be much lower than the White House envisaged when it announced the rates.”

That stated, the $400 billion annualized quantity is even bigger than another earlier calculations that had been deemed “very significant” by Torsten Sløk, chief economist of Apollo World Administration. A revered voice on Wall Road, Sløk wrote in September that even a $350 billion income determine from tariffs represented a major merchandise within the U.S. funds. However every discount in tariffs is wiping out increasingly more deficit discount, with the CBO slashing its estimates just lately to disclose one thing round $1 trillion in financial savings which have evaporated amid Trump decreasing his levies on different international locations’ items.

Within the meantime, the tariffs that stay are functioning increasingly more like a tax, since different international locations and worldwide corporations don’t pay for them—U.S. corporations and customers do. LendingTree calculated tariffs will value American consumers some $29 billion this vacation season, whereas funding financial institution UBS states it plainly: “the tariffs are a big tax increase.” Essentially the most fast affect of the commerce regime is felt in rising costs, that are “keeping things elevated.” Estimating a weighted-average tariff price of 13.6%, UBS calculated that tariffs will add 0.8 proportion factors to core PCE inflation in 2026, erasing roughly a yr’s value of disinflation progress.