Picture supply: Getty Photos

After the primary jiffy of buying and selling at the moment (24 September), the JD Sports activities Trend (LSE:JD.) share value was largely unchanged following publication of the group’s outcomes for the 26 weeks to 2 August (H1 26).

This isn’t a shock to me provided that in the direction of the tip of July, the leisure retailer advised buyers that like-for-like gross sales have been 2.5% decrease in H1 26 in comparison with a yr earlier. And natural gross sales have been up 2.6%.

Had been the outcomes any good?

The precise figures turned out to be a tiny bit higher however by not sufficient to make a big distinction.

Nevertheless, over the previous 12 months, the corporate has purchased two retailers, one within the US (Hibbett) and one other in Europe (Courir). This implies reported income for the interval is eighteen% increased.

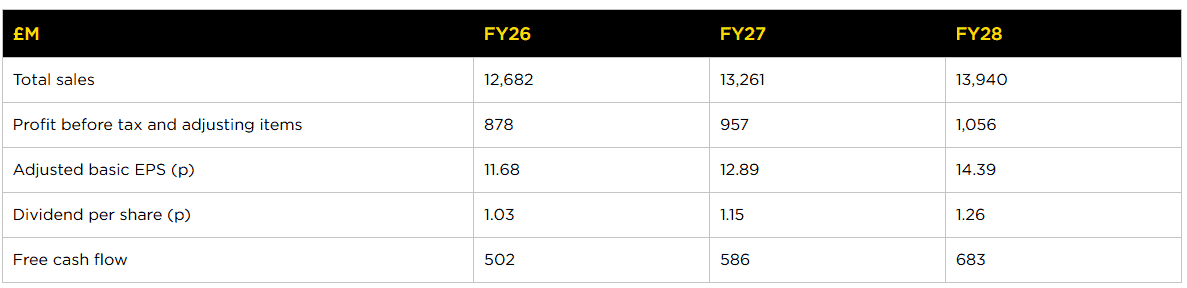

Crucially, the group is predicting a 12-month revenue earlier than tax and adjusting objects in step with analysts’ forecasts. Since its final announcement, the consensus has fallen by £10m to £878m. However the vary of estimates is essentially unchanged (£853m-£914m). Thanks, partly, to some stockpiling the group now expects “limited impact” from the US tariffs on this monetary yr.

Supply: firm web site

Supply: firm web site

JD Sports activities has determined to maintain its interim dividend unchanged though followers of share buybacks will welcome the announcement that it intends to buy one other £100m of its personal shares.

One space I’m keeping track of is the group’s money place. At 2 August, it reported web debt (earlier than lease liabilities) of £125m. A yr earlier, it disclosed web money of £41m. Nevertheless, it expects to return to the black on the finish of the monetary yr.

My verdict

On the face of it, JD Sports activities seems to be going within the fallacious path. It now owns extra shops than ever earlier than but it surely’s much less worthwhile. However I feel this displays market circumstances (the corporate blames “strained consumer finances”) somewhat than something to do with the group.

A few of this downturn has been attributed to errors made by Nike. It’s estimated that round half of what JD Sports activities sells is made by the American sportswear large. This most likely explains why their share costs have a tendency to maneuver in tandem. Nike is because of present a buying and selling replace on the final day of September.

However JD Sports activities isn’t a one-trick pony. Through the years, it’s demonstrated that it’s capable of transfer with the instances and adapt to altering client tastes. If its prospects proceed to show their backs on Nike, there are many different manufacturers that may be bought.

Don’t get me fallacious, the group isn’t going gangbusters in the meanwhile. However I feel it’s doing okay in a tough atmosphere. A bit like the corporate itself, I’m cautious about its rapid prospects. However historical past tells us (no ensures, after all) that economies are cyclical and the present uncertainty, specific within the UK, is unlikely to final perpetually.

On account of its wholesome steadiness sheet and powerful model, I feel JD Sports activities is effectively positioned to bounce again ought to client sentiment choose up. And I feel the present financial gloom is mirrored in a traditionally low valuation for the group’s shares. The inventory’s at the moment buying and selling on 7.5 instances this yr’s forecast earnings. For these causes, I feel it’s a inventory worthy of consideration.