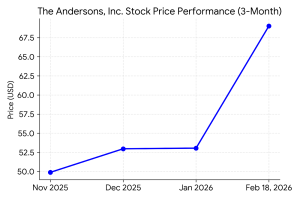

The Andersons, Inc. (Nasdaq: ANDE) reported full yr 2025 web revenue of $95.7 million. The corporate’s shares moved +4.32% in Wednesday buying and selling following the disclosure of economic outcomes for the fourth quarter and full yr 2025. The market capitalization for The Andersons, Inc. is $2.34 billion as of February 18, 2026.

Fourth Quarter Outcomes

Consolidated income for the fourth quarter was $3,282 million, a rise of 5.1% in comparison with the prior yr interval. Web revenue was a web revenue of $67.4 million.

Phase Highlights:

- Renewables pretax revenue reached $54.3 million on report manufacturing and merchandising.

- Agribusiness pretax revenue was $45.0 million following a report corn harvest.

- Adjusted EBITDA for the fourth quarter reached $136.5 million, a report on an adjusted foundation.

- The Vitamins phase stabilized with a concentrate on stock administration.

Monetary Tendencies

Full Yr Outcomes Context

For the complete yr 2025, income was $11,600 million, in comparison with TTM million in 2024. Web revenue was $95.7 million. Monetary outcomes point out a development of report adjusted profitability and operational development.

Enterprise & Operations Replace

The Andersons started operations at a mineral processing facility in Carlsbad, New Mexico. The corporate introduced a $60 million funding to extend ethanol capability at its Clymers, Indiana, facility and is progressing on a multi-year enlargement on the Port of Houston.

M&A or Strategic Strikes

The corporate acquired 100% possession of its ethanol crops in late 2024. Strategic capital investments are at present at varied phases of completion throughout the asset footprint.

Fairness Analyst Commentary

Benchmark initiated protection on The Andersons with a purchase advice on February 5, 2026. BMO Capital Markets and Lake Road additionally keep lively protection on the inventory. Analysis highlights concentrate on the corporate’s full possession of ethanol crops and export capability enlargement.

Steering & Outlook

Administration intends to pursue further development initiatives centered on decreasing carbon depth at ethanol crops. The corporate expects to start working a bio-based diesel feedstock storage and mixing facility within the first quarter of 2026.

Efficiency Abstract

- The Andersons’ shares rose following report adjusted quarterly web revenue.

- Renewables and Agribusiness segments reported stable operational execution.

- Adjusted EBITDA reached $136.5 million for the quarter.