In November 2025, the Tether Dominance index (USDT.D) — the share of USDT’s market cap relative to the whole crypto market cap — formally surpassed 6%. It additionally broke above a descending trendline that had remained intact since 2022.

Analysts have expressed concern as USDT.D breaks a long-term resistance degree. The transfer usually alerts the start of a significant correction and even an prolonged bear marketplace for your entire crypto market.

How Important Is the Rise of USDT.D within the Market Context of November?

TradingView information exhibits that USDT.D reached 6.1% on November 18 earlier than pulling again to five.9%.

Sponsored

Sponsored

Earlier within the month, this metric sat under 5%. The rise displays heightened warning amongst buyers. Many have rotated capital into essentially the most liquid stablecoin as an alternative of deploying funds to purchase deeply discounted altcoins.

USDT.D vs. Complete Market Cap. Supply: TradingView

Historic information point out a powerful inverse correlation between USDT.D and complete market capitalization. Subsequently, USDT.D breaking above a trendline that has held for practically 4 years could sign deeper market-wide declines forward.

A number of analysts anticipate USDT.D to climb towards 8% by the tip of the 12 months, implicitly suggesting {that a} bear market could also be forming in November. This projection has advantage as a result of worry continues to develop and exhibits no indicators of easing.

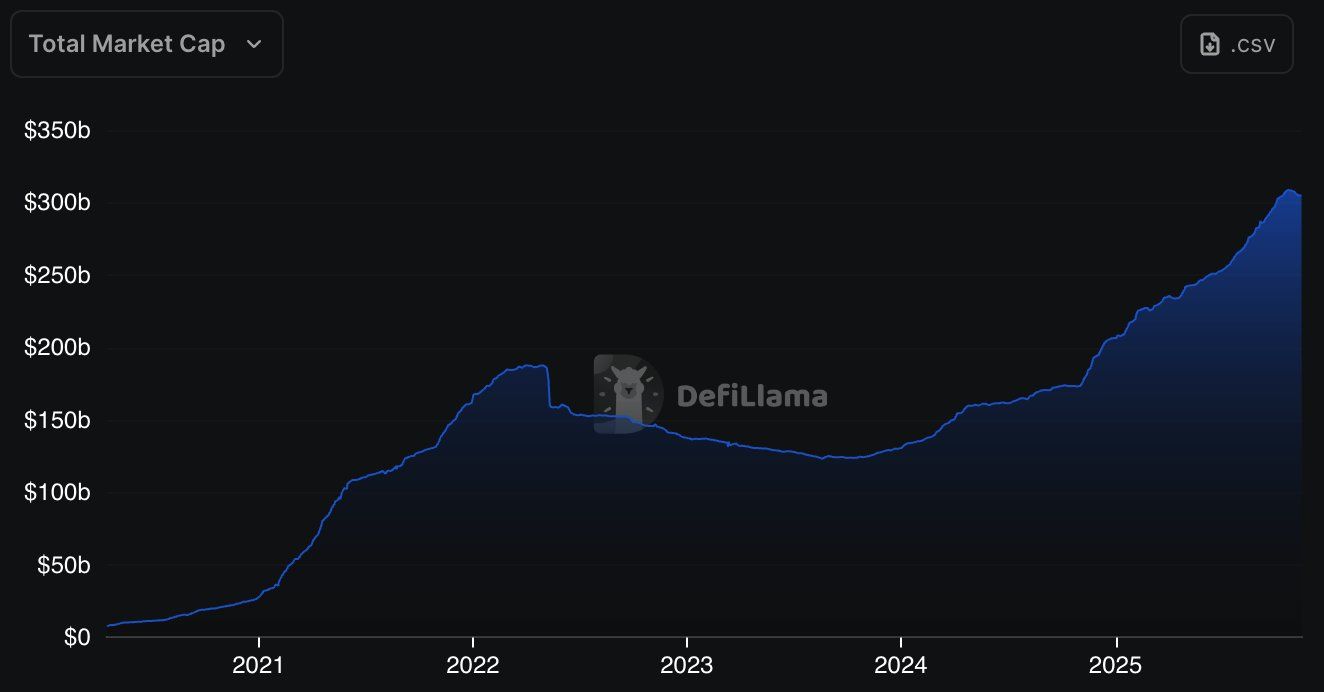

As well as, the well-known analyst Milk Street highlights a notable shift within the stablecoin market. DefiLlama information exhibits that the whole stablecoin market cap fell from $309 billion on the finish of October to $303.5 billion in November.

The stablecoin market has shed roughly $5.5 billion in lower than a month. This marks the primary important decline for the reason that 2022 bear market. The DefiLlama chart reveals that, after 4 years of steady progress, the curve has flattened and is beginning to flip downward.

The mixture of a shrinking stablecoin market cap and a rising USDT.D suggests a broader development. Buyers seem not solely to be promoting altcoins into stablecoins but additionally withdrawing stablecoins from the market fully.

“Expanding supply means fresh liquidity entering the system. When it flattens or reverses, it signals that the inflows powering the rally have cooled,” Milk Street stated.

Nonetheless, Milk Street nonetheless sees a glimmer of optimism within the present panorama. He argues that the scenario doesn’t essentially point out a disaster. As a substitute, the market is working with much less “fuel” for the primary time in years, and such shifts usually precede worth adjustments.

Moreover, a current BeInCrypto report notes a contrasting development. Regardless of the declining market cap, the quantity of stablecoins held on exchanges has elevated in November. This means that some buyers view the downturn as a possibility to place themselves for the tip of the 12 months.