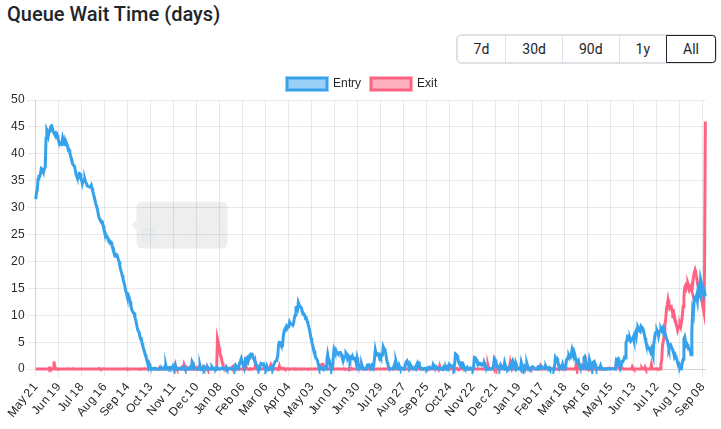

A rising variety of validators transferring to withdraw funds has induced a pronounced spike within the staked ether (ETH) exit queue.

Stakers should now await as much as 45 days till their ETH turns into obtainable, the longest delay in over two years.

The variety of staked ETH within the exit queue jumped 60% yesterday, rising from simply over a million ($5.7 billion) to over two and a half million ($11.7 billion). That is based on information from the Ethereum Validator Queue dashboard.

The quantity of staked ETH within the exit queue is now value over $11.7 billion.

Rush (to queue) for the exit

The sudden spike in queued ETH is right down to Kiln’s “orderly exit of all of its Ethereum (ETH) validators.”

Introduced yesterday, the “precautionary measure” follows the theft of $41 million value of staked solana from a pockets operated by Kiln.

The funds belonged to SwissBorg, for whom Kiln acted as “staking partner.”

The amount of ETH ready to be unstaked has been rising for the final two months. The expansion in pending withdrawals coincides with ETH’s mid-July pump from round $2,500 to nearly $5,000 by late August.

Regardless of the large amount of ETH within the exit queue, the determine represents simply 7% of the overall staked. 35 million ETH, valued at $155 billion, at the moment secures the most important proof-of-stake (PoS) blockchain.

Validator humorous enterprise

Yesterday, in addition to the spike in queued ETH, a “mass slashing event” of Ethereum validators came about.

Slashing is a safety mechanism within the community’s PoS mannequin whereby validators working incorrectly are topic to lose a portion of their staked ETH.

In keeping with the write-up from the EthStaker web page to help dwelling stakers, the slashings “were caused by operator error.” The slashing seems to be as a consequence of “conflicting attestations” on Ankr nodes.

Validators had been additionally accused of enjoying video games on Solana. The blockchain’s co-founder Anatoly “Toly” Yakovenko referred to as for punishment for validators who delay slots, steal rewards, and decelerate the community.