Solana worth has climbed about 5.5% over the previous seven days, holding close to the $85 stage. This rebound adopted a pointy decline earlier this month.

However beneath this restoration, a serious provide shift is underway. Practically $870 million price of SOL has quietly moved out of liquid staking. On the similar time, the Solana worth continues to commerce inside a bearish continuation sample. Collectively, these alerts present why the approaching days may determine Solana’s subsequent main transfer.

Sponsored

Sponsored

$870 Million Provide Unlock Provides New Danger as Solana Worth Weakens

The most important structural change comes from liquid staking exercise. Liquid staking permits buyers to lock SOL whereas nonetheless receiving a tradable token representing their deposit. This retains the unique SOL locked and unavailable for promoting whereas the liquid staking token trades individually.

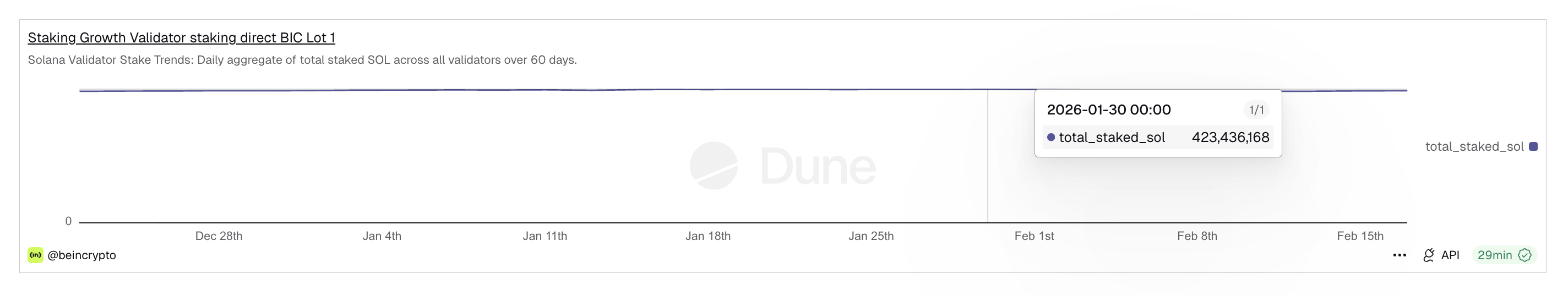

Since June 2025, the entire quantity of SOL locked in liquid staking protocols has dropped from 45.66 million SOL to 35.48 million SOL. This implies 10.18 million SOL has exited liquid staking, over 22%. On the present Solana worth, this equals roughly $870 million price of SOL changing into liquid once more.

SOL LSTs: Dune

This doesn’t assure speedy promoting, but it surely will increase the quantity of SOL that may now be offered. In easy phrases, beforehand locked provide has change into out there provide. This will increase potential promoting strain if market situations weaken.

Validator staking tendencies verify the identical course. Direct validator-staked SOL has additionally declined from 423.43 million SOL to 419.07 million SOL in current weeks. This confirms the shift is not only inner rotation between staking varieties. Some SOL is leaving locked environments completely, including to liquid provide threat.

This provide shift is occurring whereas the Solana worth is already fragile. After falling by over 50%, Solana rebounded. However the restoration stalled shortly, and Solana’s worth now trades near the decrease boundary of a bear flag sample.

Sponsored

Sponsored

Breaking under the decrease boundary can set off a SOL worth crash. Whether or not this occurs relies upon closely on investor conduct.

Brief-Time period Holders Improve Provide Whereas Lengthy-Time period Holders Step Again

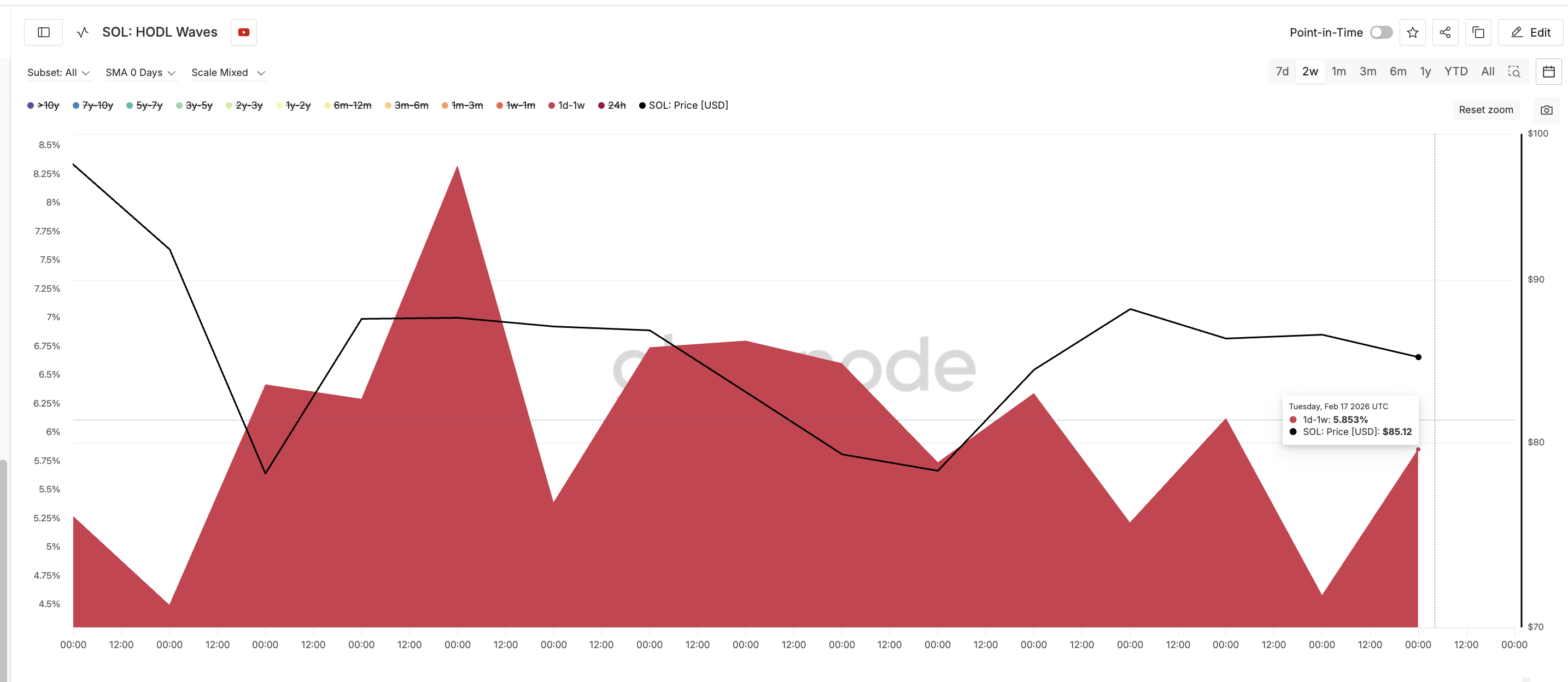

On-chain information now exhibits weakening conviction amongst stronger buyers and rising affect from short-term merchants. One key indicator confirming that is HODL Waves. This metric tracks how lengthy cash stay in wallets earlier than shifting and separates provide into short-term and long-term holder teams.

Brief-term Solana holders sometimes maintain cash between someday and one week. These buyers usually tend to promote throughout worth volatility fairly than maintain long-term.

Sponsored

Sponsored

Since Feb. 16, the availability held by these short-term holders has elevated sharply from 4.58% to five.85%. This sudden enhance means extra provide is now managed by merchants who traditionally promote quicker. This raises the chance of sudden promoting strain throughout worth weak spot.

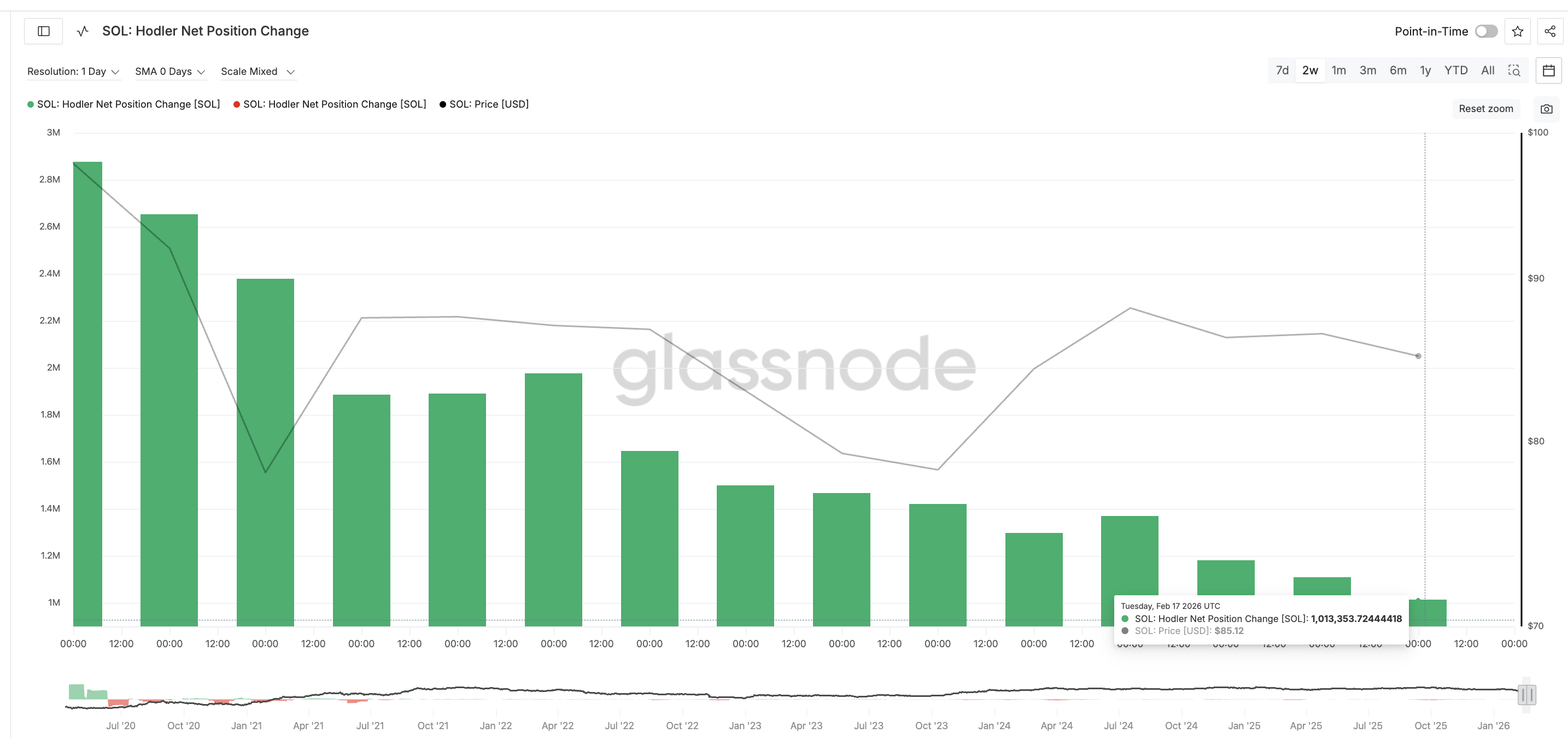

On the similar time, long-term holder conviction is weakening. This may be seen utilizing the Hodler Web Place Change metric. This indicator measures whether or not long-term holders are accumulating or lowering their holdings over time.

On Feb. 3, long-term holders added 2,877,297 SOL on a 30-day web foundation. That determine has now dropped to 1,013,353 SOL. This marks a decline of almost 65%.

This sharp drop exhibits long-term buyers are slowing their accumulation considerably. Lengthy-term holders usually present stability throughout corrections as a result of they maintain by volatility. When their accumulation slows, the worth turns into extra weak to deeper declines.

Sponsored

Sponsored

This creates a harmful mixture the place the liquid provide is rising, short-term merchants management extra cash, and long-term help is weakening. Collectively, these situations enhance draw back threat.

Solana Worth Ranges Present The place the Market Might Go Subsequent

Solana worth now sits close to a important technical stage that would determine its subsequent pattern. If SOL falls under the $82 help stage, the bear flag breakdown may start. The subsequent help ranges would seem close to $67 after which close to $50 as promoting strain will increase.

If the total bearish sample completes, Solana worth may fall towards $41. This might signify roughly a 50% decline from present ranges and totally verify the bearish continuation construction.

Nevertheless, restoration remains to be doable if consumers return strongly. If Solana worth breaks above $91, the speedy bearish strain would weaken and sign stronger demand returning.

A bigger restoration above $125 would invalidate the bearish sample. However such a transfer would require robust and sustained accumulation.