Solana value traded close to $203 at press time, recovering barely after dipping under $200 earlier within the day. That small rebound stored every day losses to about 1%, however the broader construction stays shaky.

Bulls have managed to reclaim the $200 mark, but on-chain charts recommend that the momentum could not final for lengthy.

Lengthy-Time period Holders Sit on Elevated Positive aspects

The primary warning signal comes from the Web Unrealized Revenue/Loss (NUPL) of long-term holders. This metric tracks whether or not buyers are sitting on paper income or losses. When NUPL is excessive, it suggests holders could also be tempted to lock in good points.

Solana Flashes Revenue-Taking Danger: Glassnode

On August 28, Solana’s long-term holder NUPL touched 0.44, its highest in six months and near the March 2 peak of 0.4457. That earlier spike was adopted by a pointy drop when Solana value fell from $179 to $105 in lower than two weeks, a 41% correction. A more moderen instance got here on July 22, when a 23% slide adopted a NUPL excessive.

The most recent NUPL studying has eased barely to 0.40, however it’s nonetheless elevated in comparison with current months.

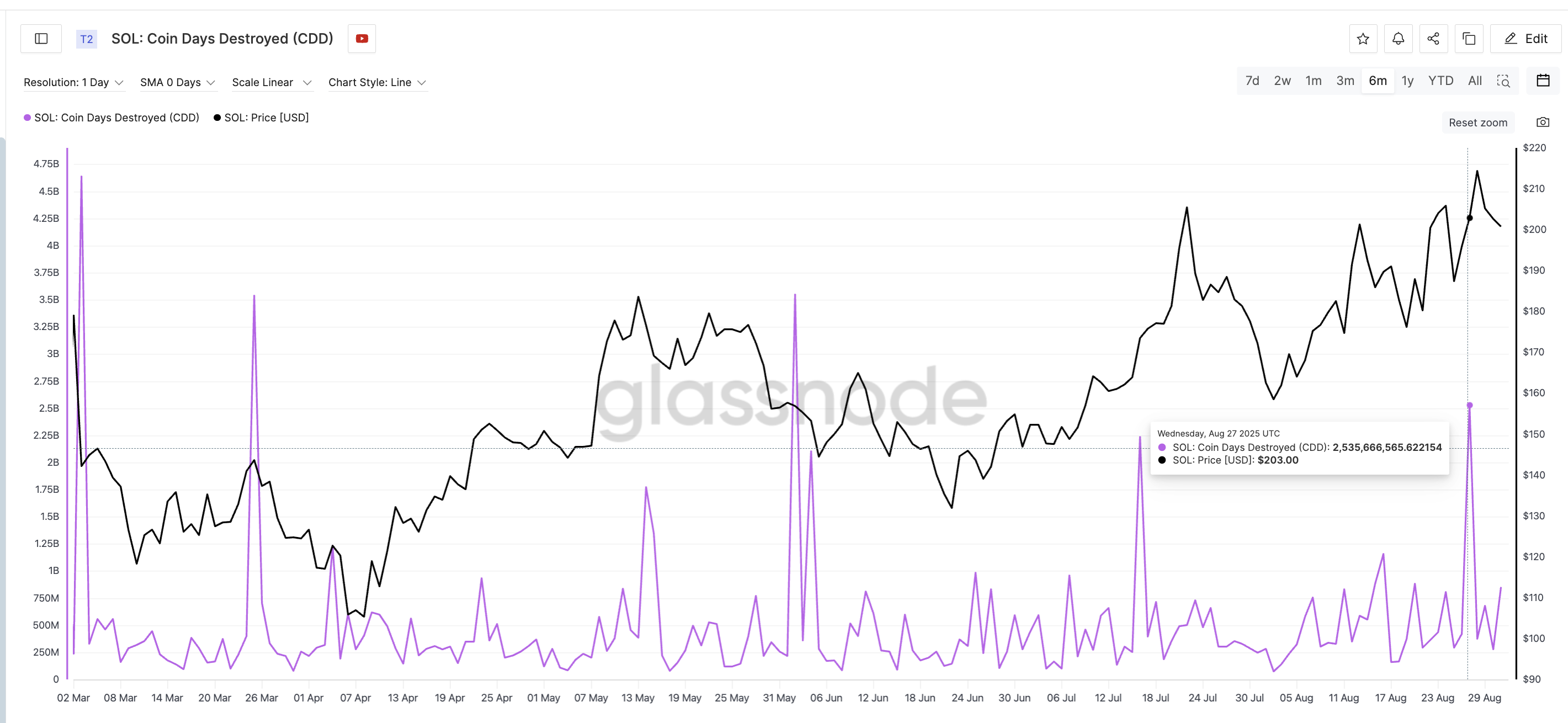

Coin Days Destroyed Validates Revenue-Taking

This concern can be seen within the Coin Days Destroyed (CDD) metric, which tracks what number of older cash are transferring on-chain, presumably hinting at profit-taking. Every time CDD spiked over the previous six months, Solana’s value corrected sharply quickly after.

Older SOL Cash Are Shifting: Glassnode

Older SOL Cash Are Shifting: Glassnode

For instance, on March 3, the Solana value fell from $142 to $118, a 17% drop. One other spike on March 25 noticed the value slip from $143 to $105. Even when the transfer was delayed, like after July 16, the eventual correction from $205 to $158 confirmed how sturdy the sign might be.

The most recent spike got here on August 27, when Solana traded close to $203. Whereas the correction has solely simply began, the sample suggests long-term holders could already be promoting into energy, validating what the NUPL knowledge hinted at.

Key Solana Worth Ranges Affirm the Danger

The technical chart completes the image. Solana is buying and selling close to $203, flipping the $201 resistance into momentary help. However the bullish case will solely maintain if a every day shut stays above that degree.

A dip under $196 or $191 would tilt momentum bearish, and breaking $175 would verify a deeper correction.

Solana Worth Evaluation: TradingView

Solana Worth Evaluation: TradingView

On the upside, bulls must reclaim larger floor rapidly, however with long-term holders sitting on good points and CDD exhibiting cash transferring, the danger of additional draw back stays in play.

Nevertheless, the bearish pattern would fizzle out if the Solana value manages to reclaim 207 cleanly, with an entire candle forming above that degree. For now, the metrics recommend that the Solana value rebound above $200 could not maintain with out stronger help.