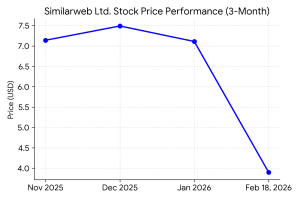

Similarweb Ltd. (NYSE: SMWB) shares moved -2.15% in Wednesday buying and selling following the disclosure of monetary outcomes for the fourth quarter and full yr 2025. Administration initiatives fiscal yr 2026 income between $305 million and $315 million, representing roughly 10% progress on the midpoint. First quarter 2026 income is estimated to be between $72 million and $74 million. The market capitalization for Similarweb Ltd. is $336.5 million as of February 18, 2026.

Fourth Quarter Outcomes

Consolidated income for the fourth quarter was $72.8 million, a rise of 11% in comparison with the prior-year interval. Internet loss was a GAAP lack of $7.5 million.

Phase Highlights:

- Multi-year subscriptions reached 60% of annual recurring income (ARR), up from 49% a yr in the past.

- The variety of prospects with an ARR of $100,000 or extra grew to 454, a rise of 12% year-over-year.

- Remaining efficiency obligations (RPO) elevated 17% to $288.8 million.

- Total internet retention charge was 98%, whereas retention for purchasers with over $100,000 in ARR was 103%.

Monetary Developments

Full 12 months Outcomes Context

For the complete yr 2025, income was $282.6 million, in comparison with $249.9 million in 2024. Internet revenue was a non-GAAP working revenue of $9.1 million. Monetary outcomes point out a pattern of income growth and narrowing working losses.

Enterprise & Operations Replace

Similarweb launched AI Studio on February 10, 2026, a platform offering AI brokers entry to digital datasets for enterprise intelligence. The corporate additionally expanded its knowledge availability on the Bloomberg Terminal, integrating distinctive guests and bounce charge metrics into Bloomberg’s analytics workflow.

M&A or Strategic Strikes

Phoenix Monetary disclosed a 5.04% holding in Similarweb in late 2025. The corporate additionally introduced a collaboration with Manus to combine digital advertising and marketing insights into AI brokers.

Fairness Analyst Commentary

Needham & Firm reissued a purchase score on Similarweb, citing improved income visibility from multi-year contracts. Oppenheimer lowered its value goal to $7.00 following the fourth quarter income miss, whereas Goldman Sachs maintained a impartial score. Market analysis signifies institutional possession of roughly 57%.

Efficiency Abstract

- Similarweb shares traded decrease following the fourth quarter income outcomes.

- Consolidated income elevated 11% to $72.8 million.

- The corporate achieved its ninth consecutive quarter of optimistic free money move.