Sabre Company (NASDAQ: SABR) reported Sabre This fall 2025 earnings. Outcomes beat expectations. Income hit $667 million. It was up 3% year-over-year. Additionally, the corporate confirmed strong outcomes. Momentum is constructing.

Sabre Investor Relations

Sabre This fall 2025 Earnings: Market Efficiency

Sabre This fall 2025 Earnings: Quarterly Outcomes

This fall income was $667 million. Final yr it was $645 million. That is 3% progress. Working earnings hit $21 million. The margin was 3.2%. Additionally, bookings reached 83 million. Development was 3%. Air bookings rose 4%. Plus, passengers grew 4%. The full was 176 million. In actual fact, reserving charges rose. They went from $6.17 to $6.31

Full Yr 2025 Efficiency

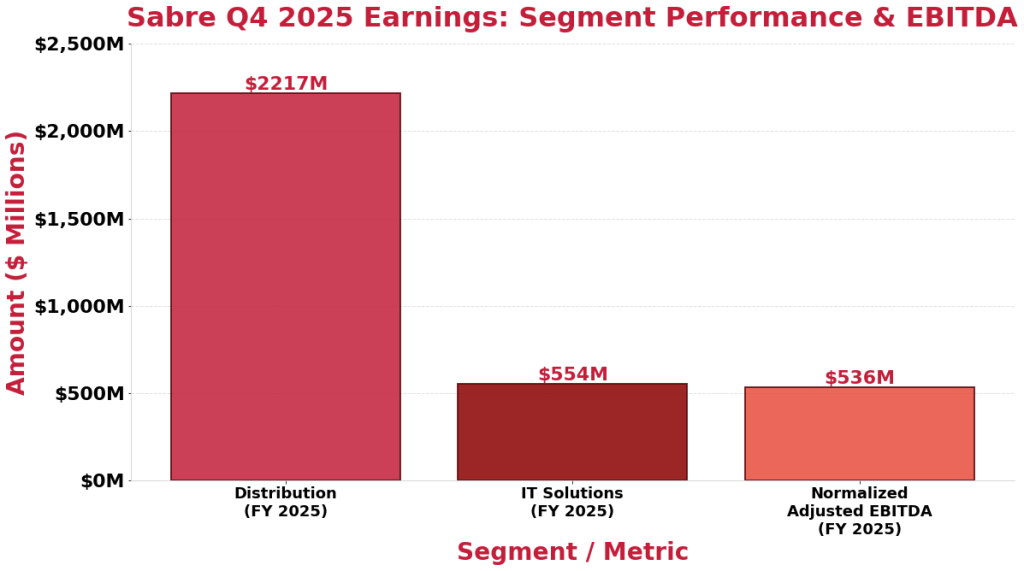

Full-year income was $2,771 million. It went up 1% from $2,745 million. Working earnings rose 22%. It hit $295 million. The margin went to 10.7%. It was up 190 foundation factors. So, bottom-line progress was good. Additionally, EBITDA went up 10%. It hit $536 million. In the meantime, margins moved to 19.3%. Plus, bookings hit 365 million. Development was 1%. In actual fact, the yr was strong for the agency.

Sabre This fall 2025 Earnings: Phase Breakdown

The Distribution unit hit $2,217 million. It went up 2%. Bookings hit 365 million. Development was 1%. However air bookings had been flat. Development was 0%. But, December was good. Air bookings rose 7% that month. So, this can be a good signal for 2026. Additionally, resort bookings jumped 5%. They hit 42 million. Plus, resort charges went up 130 foundation factors. In the meantime, momentum is obvious.

The IT Options unit had a tough yr. Income fell 3%. It went from $571 million to $554 million. The drop got here from misplaced shoppers and low volumes. But, administration sees hope. New platforms ought to assist quickly. General, the agency expects higher instances forward.

Sabre This fall 2025 Earnings Income Pattern

Sabre This fall 2025 earnings quarterly income development demonstrates constant efficiency throughout 8 quarters. Chart exhibits quarterly income monitoring from Q1 2024 by way of This fall 2025.

Sabre Phase Efficiency & EBITDA Development

Sabre This fall 2025 earnings chart shows phase income efficiency and normalized adjusted EBITDA for the total yr 2025. Distribution dominates income, whereas EBITDA exhibits a wholesome margin profile.

2026 Steering & Outlook

The agency backed mid-single-digit income progress for 2026. EBITDA is seen at $585 million. That is 9% above 2025. So, the agency sees pickup forward. Quantity ought to develop extra. Additionally, air bookings ought to rise mid-single digits. In the meantime, money circulate is seen as damaging at $70 million. Debt funds trigger this. But, the long run appears to be like good. Margins ought to develop extra. In actual fact, the trail is obvious for 2026.

Key Takeaways

Sabre This fall 2025 earnings present a very good run. Income hit $667 million. That’s 3% progress. Margins went up. EBITDA hit $536 for the yr. Additionally, December confirmed warmth. Air bookings rose 7% that month! The agency appears to be like to 2026 with cheer. Mid-single-digit progress is deliberate. Plus, AI tech will assist push gross sales. Furthermore, the restoration is obvious. Briefly, the journey tech agency is on the precise path.

Click on Right here to go to the AlphaStreet web site.