ProPetro Holding Corp (NYSE: PUMP) reported earnings. ProPetro This fall 2025 earnings beat market expectations. Income was $289.7 million. Adjusted EBITDA was $51.0 million. Gross margin hit 25.9%. Thus the corporate exhibits operational resilience. Vitality demand continues to drive outcomes.

Click on Right here to go to the ProPetro Holding Corp’s Investor Relations.

ProPetro This fall 2025 Earnings: Monetary Overview

The vitality sector gained momentum. So corporations like ProPetro benefited. ProPetro’s This fall 2025 earnings replicate this pattern. Administration maintained pricing self-discipline. Additionally, fleet utilization remained optimized. In truth, margins improved quarter-over-quarter. Outcomes exhibit operational excellence.

Enterprise Segments

ProPetro This fall 2025 earnings got here from a number of areas. Hydraulic Fracturing generated $203.9M. That was 70.4% of complete income. So this section is essential. Additionally, Wireline companies added $55.4M income. Cementing contributed $29.6M. In the meantime, PROPWR energy technology added $1.4M.

Income Developments

ProPetro This fall 2025 earnings seem under. The chart exhibits eight quarters.

Determine 1: ProPetro This fall 2025 earnings income pattern over eight quarters

Profitability

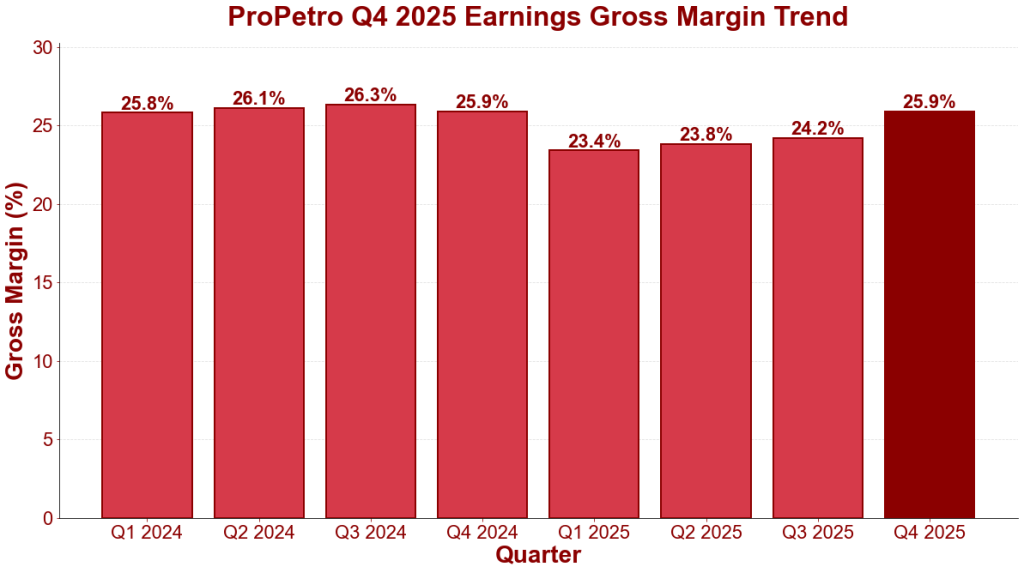

Gross margins improved. So profitability elevated. Margins hit 25.9% in This fall. This displays effectivity features. Additionally the combination improved. In truth, fleet prices decreased. Plus administration managed bills. In the meantime, pricing remained agency.

Margin Efficiency

Margins confirmed resilience. So administration executed properly. Thus the chart exhibits enchancment.

Determine 2: ProPetro This fall 2025 earnings gross margin development

Full 12 months 2025

Full-year income was $1,269.2M. Final yr it was $1,444.3M. So income declined 12.1% YoY. However money movement improved. Additionally, working money hit $81.0M in This fall. Plus free money movement was $98.1M. In truth, EBITDA totaled $208.4M. Thus, the mannequin proved resilient.

Development: PROPWR

PROPWR is an influence enterprise. So ProPetro is diversifying. In truth, PROPWR generates electrical energy. The corporate has 240 MW dedicated. Plus 550 MW is on order. Thus PROPWR is ramping up quick. Administration targets 1,000+ MW by 2030.

2026 Outlook

Capital spending: $390M-$435M. So funding will enhance. Completions: $140M-$160M. PROPWR: $250M-$275M. Thus the corporate balances development. Additionally, it maintains money technology. In truth, each get equal focus.

Stability Sheet

Money: $236.0M. Debt: $132.0M. So liquidity is $325.0M. This provides flexibility. Additionally latest fairness funding: $163M. Plus Caterpillar facility: $157M. Thus, ProPetro has capital to take a position.

Market Place

ProPetro is a Permian pure play. So it advantages from one area. In truth, Permian is advantaged. Additionally buyer relationships are deep. Thus, ProPetro has pricing energy. Plus PROPWR is a brand new alternative. So vitality prospects want energy.

ProPetro This fall 2025 Earnings: Key Takeaways

- Income of $289.7M exhibits ongoing sector demand.

- Gross margins at 25.9% show operational excellence.

- Free money movement of $98.1M funds development.

- PROPWR targets 1,000+ MW by 2030.

- Capital steering of $390M-$435M alerts enlargement.

- Liquidity of $325M allows debt discount.