Picture supply: Getty Photographs

In search of the very best FTSE 250 all-rounders to purchase in September? Listed below are three UK mid-cap shares I feel buyers ought to take into account.

Defence hero

Pushed by hovering defence spending in Europe, QinetiQ (LSE:QQ.) is being tipped for sturdy and sustained development by Metropolis brokers.

An 18% bottom-line rise is tipped for this monetary yr (to March 2026). This leaves the corporate buying and selling on a ahead price-to-earnings (P/E) ratio of 15.7 instances, which is considerably beneath these of FTSE 100 defence gamers like BAE Methods and Rolls-Royce.

This additionally leaves QinetiQ shares on a rock-bottom P/E-to-growth (PEG) ratio of 0.9. It additionally means annual dividends are tipped to leap 8% yr on yr, leaving a 2% dividend yield.

Why is the corporate so low cost, you ask? A March revenue warning, wherein the agency suggested of extreme pressures within the US, spooked buyers as uncertainty stays over Washington defence budgets. This stays one thing buyers ought to control.

But, on steadiness, I consider this menace is greater than baked into the cheapness of QinetiQ’s share value. I additionally consider that, on steadiness, the outlook for the FTSE 250 defence star is massively encouraging as European defence budgets increase. Certainly, the corporate’s order consumption hit document ranges of £2bn final yr, helped by its sturdy relationships with the UK Ministry of Defence.

Rising market star

Lion Finance (LSE:BGEO) has been one of many FTSE 250’s strongest performers in 2025. But, it nonetheless gives wonderful all-round worth, with a ahead P/E ratio of 5.8 instances and a cumbersome 4.1% dividend yield.

The corporate’s cheapness in contrast with different UK banks displays its distinctive geographic footprint. In addition to providing vital publicity to Georgia, it has a considerable operation in Armenia and a smaller one in Belarus. These areas aren’t any strangers to political turbulence, which continues to this present day.

However the speedy tempo at which earnings are rising nonetheless makes Lion price a detailed look, in my opinion. Its working revenue grew 9.5% between January and June whereas revenue leapt 28%.

Metropolis analysts count on annual earnings per share to drop 18% in 2025. Nonetheless, this displays distinctive features the yr earlier than that distorted earnings. Certainly, the quantity crunchers predict the financial institution’s spectacular long-term development story to renew, pushed by sturdy financial development throughout its markets.

Financial institution on it

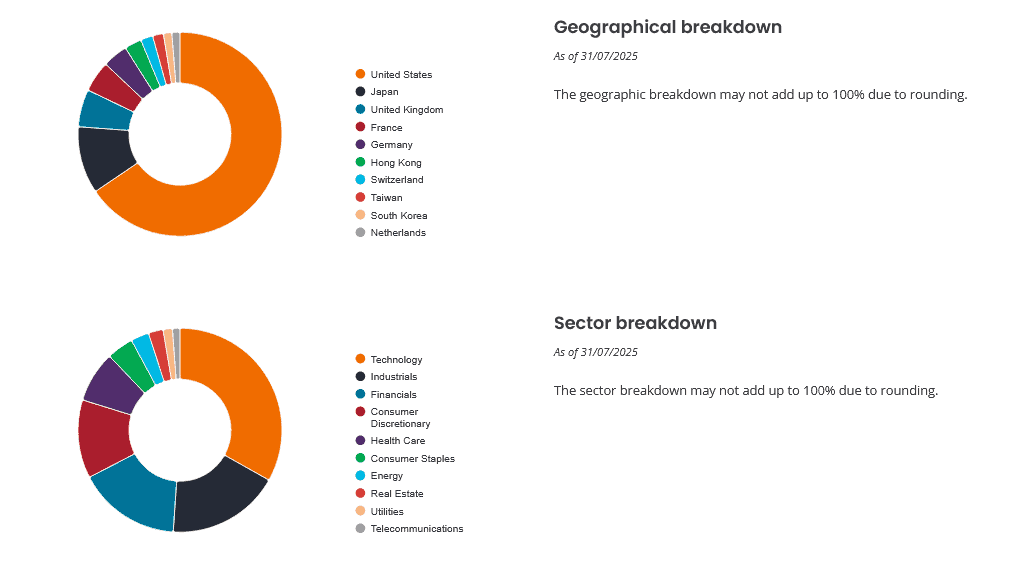

The Bankers Funding Belief (LSE:BNKR) gives a manner for buyers to focus on development and revenue at considerably decrease threat. You see, it holds shares in roughly 100 totally different firms from throughout the globe and totally different sectors:

Supply: Janus Henderson

Supply: Janus Henderson

This diversified strategy protects general returns from particular person firm, trade, or regional shocks. And pleasingly, this hasn’t come on the expense of returns — since 2015, it’s delivered a mean annual return of 11%.

That’s roughly double the return that the broader FTSE 250’s delivered in that point.

Bankers has achieved this by a mix of capital features and dividend revenue. Certainly, yearly dividends right here have risen yearly for greater than 50 years. That’s regardless of its excessive weighting of tech development shares, which may influence returns throughout financial downturns.

Right now, the belief trades at a 9% low cost to its internet asset worth (NAV) per share. This makes it price severe consideration, in my opinion.