Picture supply: Getty Photographs

The FTSE 100 and FTSE 250 have loved wholesome positive factors thus far in 2025, rising 20% and seven% respectively. And so they might have a lot additional to run within the months and years forward. But, I consider there could possibly be higher UK shares to purchase exterior London’s primary two share indexes.

Guessing near-term inventory market actions is notoriously tough. However Metropolis analysts anticipate the next UK shares to blast off in the course of the subsequent 12 months. Right here is why I feel they demand consideration from short- and long-term buyers.

Going for gold

At 271.4p per share, Serabi Gold (LSE:SRB) has risen a whopping 143% in worth since 1 January. It’s been blown increased by a rocketing treasured metallic worth, which touched new peaks round $4,381 per ounce in October.

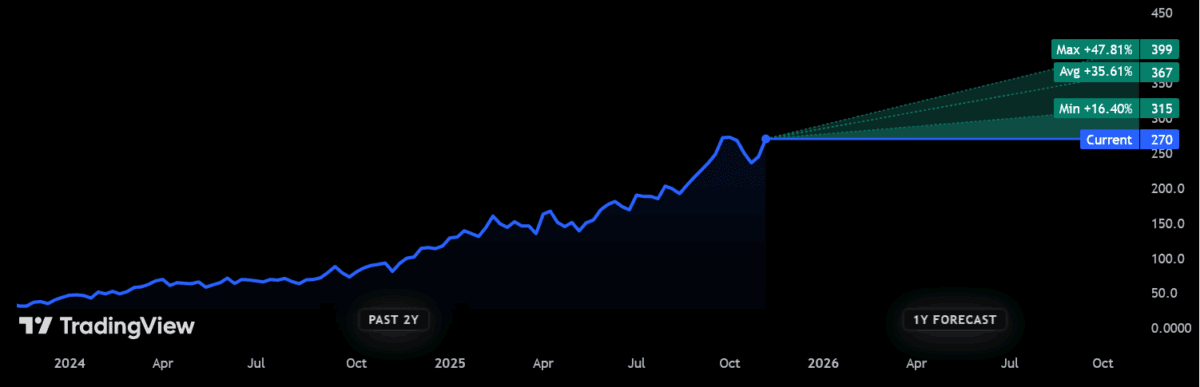

Supported by a sturdy outlook for gold costs, dealer consensus suggests Serabi’s shares will rise one other 36% over the subsequent 12 months:

Supply: TradingView

Supply: TradingView

Additional gold worth positive factors aren’t assured, in fact. Actually, indicators that the current rally has run out of steam might pull gold mining shares like this sharply decrease once more.

However on stability issues are wanting good for the safe-haven metallic, given ongoing macroeconomic challenges and large geopolitical uncertainty. Morgan Stanley analysts reckon gold will attain $4,500 per ounce by the center of 2026.

Serabi is making good progress in climbing manufacturing, too, to capitalise on this fertile surroundings and ship long-term earnings progress. Manufacturing rose to a document 12,090 ounces within the first half, up 27% 12 months on 12 months. It stays on observe to ship 100,000 ounces of the fabric per 12 months by 2028.

Serabi shares commerce on a ahead price-to-earnings (P/E) ratio of 5.3 instances. This makes it one of many least expensive gold shares on the market, and leaves scope for additional worth positive factors in my view.

A high penny inventory

At 52.5p, the Distribution Finance Capital (LSE:DFCH) share worth is up a formidable 45% within the 12 months to this point. If forecasts show appropriate, the penny inventory has a lot additional to climb over the subsequent 12 months.

Metropolis forecasts recommend the specialist finance supplier will rise by nearly two-thirds in worth, to 85p:

Supply: TradingView

Supply: TradingView

Be conscious that only one analyst presently has rankings on the corporate’s shares. This doesn’t give a broad vary of opinions. But, I feel there’s good motive to anticipate DF Capital to proceed its spectacular momentum.

Like different finance suppliers, earnings are extremely delicate to broader financial circumstances. A bleak outlook for the UK financial system due to this fact deserves consideration from buyers. However thus far the corporate has been in a position to hurdle troubles and document gorgeous outcomes.

Due to new product launches and market share positive factors, its mortgage e-book was a whopping £759m on the finish of Q3. That was up 26% 12 months on 12 months.

Right now, DF Capital shares commerce on a ahead P/E ratio of 9.1 instances. This seems to be actually low cost in my view, and gives room for extra worth positive factors for my part.