Pearl Diver Credit score Firm Inc. (NYSE: PDCC) launched This fall 2025 earnings right now. Pearl Diver This fall 2025 reported combined outcomes however confirmed rising money circulate momentum. In actual fact, recurring money flows surged to $9.8 million within the quarter.

Pearl Diver This fall 2025 Earnings: Quarterly Efficiency

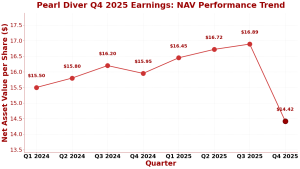

This fall 2025 delivered key insights into Pearl Diver’s CLO fairness technique. Web asset worth declined to $14.42 as of December 31, 2025. Specifically, this compares to $16.89 within the prior quarter. So the NAV fell 14.6% sequentially. Because of this, market situations and mortgage unfold tightening drove the decline.

The corporate reported a internet lack of $12.4 million for the quarter. Funding earnings reached $5.7 million, up from $5.4 million beforehand. But bills of $2.5 million rose barely. General, internet funding earnings improved to $3.4 million. Due to this fact, this marks a 13.3% improve from the prior quarter’s $3.0 million.

Click on right here to learn the press launch.

Pearl Diver This fall 2025 Earnings: Money Stream Efficiency

Money circulate efficiency improved within the quarter. Recurring money flows from CLO investments surged to $9.8 million. Additionally, this rose 12.6% from $8.7 million in Q3. On a per-unit foundation, money flows hit $1.44. Due to this fact, this exceeded the prior quarter’s $1.28 per unit.

Money flows exceeded distributions and bills once more. Additionally, administration famous this as a key achievement. In actual fact, quarterly distributions totaled $0.22 per unit. Protection improved because of rising money technology. So this sustainability helps Pearl Diver’s dividend technique.

Determine 1: Pearl Diver This fall 2025 earnings present rising recurring money flows. In the meantime, momentum constructed via 2024 and 2025, with This fall hitting $9.8M.

Pearl Diver This fall 2025 Earnings: CLO Portfolio Metrics

The corporate manages a diversified CLO fairness portfolio. As of December 31, Pearl Diver held about 1,279 distinctive company obligors. Additionally, these corporations signify over 1,600 underlying loans. Plus, the overall mortgage portfolio worth reached $27.3 billion. Due to this fact, diversification reduces danger from any single obligor.

The most important obligor represented simply 0.7% of loans. Additionally, the highest 10 obligors accounted for 4.5% mixed. This exhibits strong portfolio self-discipline. In the meantime, the weighted common CLO yield was 12.99%. This in comparison with 13.07% within the prior quarter.

Capital Construction

Leverage rose modestly through the quarter. Complete debt was $40.5 million. This represented 28.7% of whole property. Now, within the prior quarter, leverage was 25.7%. Plus, leverage elevated 300 foundation factors.

Pearl Diver offered shares through its at-the-market providing. The corporate issued 30,680 shares in This fall 2025. Web proceeds had been roughly $0.5 million. In the meantime, in early Q1 2026, the corporate continued promoting shares. Additionally, via February 13, 2026, it raised $0.4 million from 31,655 shares.

Determine 2: Pearl Diver This fall 2025 earnings present NAV strain. In the meantime, the December decline to $14.42 displays market tightening and mortgage unfold compression.

Ahead Technique

CEO Indranil Basu famous challenges within the macro surroundings. Mortgage spreads tightened, pressuring NAV. But administration remained optimistic about CLO alternatives. Additionally, the corporate used its machine studying method to seek out worth. So administration added positions providing strong risk-adjusted returns.

Pearl Diver’s reinvestment calendar extends into 2030. 99.9% of CLOs have reinvestment dates from 2026-2030. This creates alternatives to reinvest at favorable costs. Due to this fact, administration plans to proceed its CLO fairness technique. Now, the purpose is to create shareholder worth over time.

Key Takeaways

Pearl Diver This fall 2025 earnings present a combined however constructive image. Additionally, money circulate momentum continues to construct. Recurring money flows surged 12.6% to $9.8 million. Plus, internet funding earnings improved 13.3%. But NAV fell as a consequence of market tightening and unfold compression. In the meantime, the portfolio stays well-diversified throughout 1,279 obligors. So administration maintains a strategic concentrate on worth creation. For traders, the rising money flows assist the present dividend. Briefly, the lengthy reinvestment calendar provides future upside potential.

Click on Right here to go to the AlphaStreet web site.