Palantir (PLTR) might be the primary title that pops up when buyers consider defense-grade AI.

It’s the form of software program that generals and ministers depend on when seconds matter and a scarcity of readability isn’t an choice.

CEO Alex Karp has leaned all the best way in. “Palantir is on fire,” he advised Yahoo Finance earlier this 12 months, positioning the enterprise as one which’s leveraging AI in real-world missions.

The inventory market is clearly loving it. Shares have surged triple digits this 12 months, lifted by rising conviction in Palantir’s distinctive AI benefit and its rising position in public-sector workflows.

AI is vital within the world arms race and has change into central to the corporate’s pitch. Layer that onto Palantir’s large authorities e book of enterprise, and it feels extra like an infrastructure participant than a contractor.

That’s precisely why this newest transfer has caught the investor’s eye.

In a remarkably uncharacteristic transfer, Palantir simply walked away from a significant authorities id deal, leaving billions on the desk attributable to considerations a couple of democratic mandate and information management.

Palantir has declined to take part within the UK authorities’s new digital id program.

Picture supply: Reynolds/AFP through Getty Photographs

Palantir pushes again on the UK’s digital id plan

Palantir isn’t biting with its newest bombshell transfer.

In keeping with reporting from The Occasions, the AI large received’t be taking part within the UK authorities’s new digital id program. UK head Louis Mosley known as the proposal “undemocratic,” flagging safety considerations.

He questioned the need of the transfer and stated that current IDs in passports and tax IDs are already getting the job finished. Palantir says it’s not bidding on any associated contracts.

Associated: Jim Cramer has 5-word message on authorities shutdown, shares

The plan would make digital ID obligatory for employment checks, whereas storing private credentials in a smartphone-based pockets. Ministers need to push it rapidly, however public help has been eroding quick, as latest polls present it falling from 53% to 31%, whereas 45% now oppose the coverage outright.

Nonetheless, the numbers would have been large for Palantir if the deal had gone via.

Procurement estimates run between £1.2 billion and £2 billion throughout integration, verification, and cloud companies. The UK authorities has already introduced AI spending to be at an eye catching £14 billion yearly, attracting heavy hitters.

Extra Palantir:

- Palantir lands shock AI cope with 109-year-old titan

- Salesforce CEO sends message on Palantir after $950M deal

- Financial institution of America revamps Palantir inventory outlook after AIPCon

For buyers, although, the event is big.

It signifies that Palantir received’t chase each income alternative, particularly one which opens the door for large regulatory, authorized, and reputational blowback.

It’s price noting that the corporate is already established in much less controversial areas, such because the £330 million NHS Federated Knowledge Platform.

Fast takeaways

- Palantir received’t be bidding on the digital ID program, attributable to mandates and safety considerations.

- The coverage makes digital ID obligatory for right-to-work checks, and public help for the transfer has declined sharply.

- Contract alternatives are pegged at £1.2 billion to £2 billion, attracting main integrators.

- Palantir focuses on lower-risk UK tasks, such because the £330 million NHS information platform.

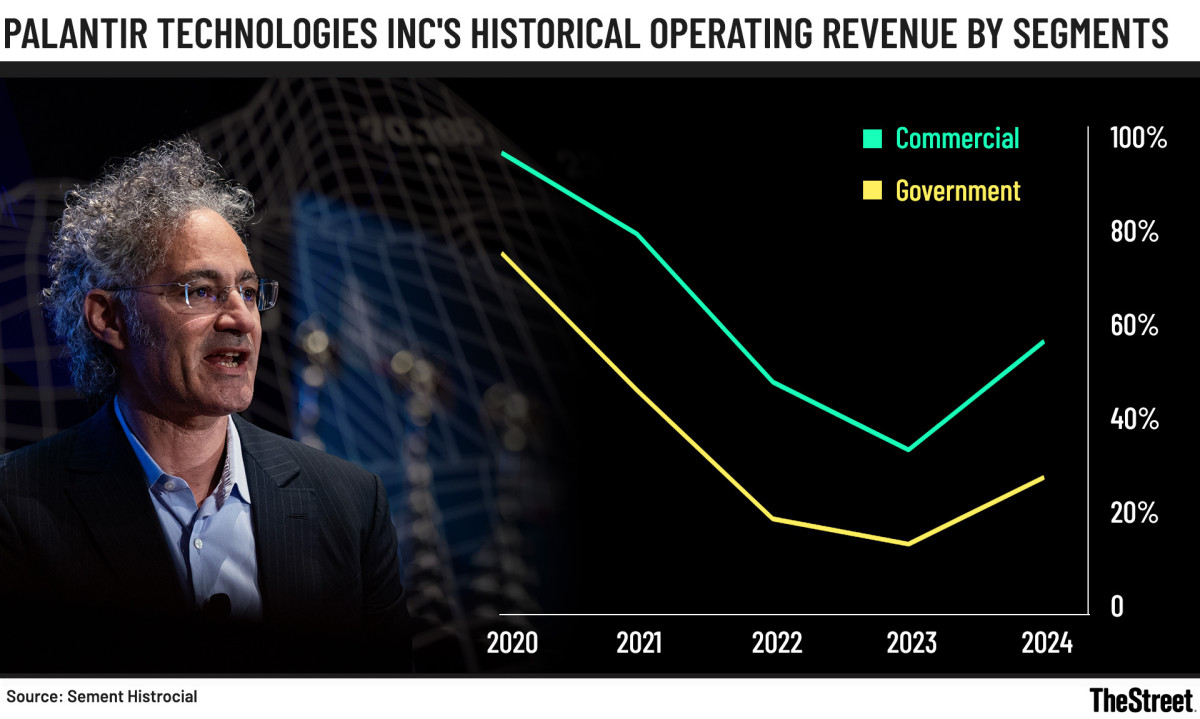

Palantir’s income combine 2020-2024 exhibiting business rebound and authorities slowdown.

Picture supply: TheStreet

Palantir’s authorities engine remains to be working sizzling

Palantir’s authorities e book is surging, regardless of the falling out within the UK digital ID saga.

As an example, in Q2 2025, complete gross sales skyrocketed to $1 billion, up 48% 12 months over 12 months, and authorities income shot up 49% to $553 million. U.S. authorities income particularly was up 53% to $426 million.

Zoom out, and the combo is extremely sturdy.

For full-year 2024, Palantir generated $2.87 billion in income, with 55% from authorities prospects. Furthermore, U.S. income grew 52% 12 months over 12 months in This fall 2024, which set the stage for its very good 2025 steerage at roughly $4.1 to $4.2 billion.

Associated: Legendary fund supervisor drops bombshell name on Nvidia inventory

Going again to 2019, Palantir’s business enterprise was gaining velocity, edging previous its authorities phase with an excellent $397 million in gross sales in comparison with $345.5 million.

By 2020, the tables had turned, with authorities gross sales surging to $610.2 million in contrast with $482.5 million on the business aspect. That hole solely grew via 2022, when the federal government phase reached $1.1 billion, in comparison with $834.4 million in business contracts.

Additional, it’s vital to notice that Palantir’s pipeline is anchored by multi-year protection and well being platforms.

The U.S. Military Enterprise Service Settlement is valued at as much as a whopping $10 billion over 10 years, which principally consolidated a number of software program buys into one automobile. Executives have additionally flagged momentum in nationwide safety work that’s now scaling extremely rapidly with AI.

Palantir’s greatest authorities offers within the final 24 months:

- U.S. Military ESA: As much as $10 billion over 10 years, enterprise software program and information platform.

- Maven Good System: $795 million contract ceiling following a 2025 modification; preliminary 2024 award was at $480 million.

- TITAN prototypes: $178.4 million for 10 next-gen deep-sensing floor stations.

- NHS Federated Knowledge Platform: £330 million over seven years for England-wide information platform.

Associated: CoreWeave lands mega deal from AI large