Though nonetheless personal, the shadow of OpenAI and its still-unprofitable enterprise regardless of the blockbuster success of ChatGPT has rattled markets all through the again half of 2025. Speak of a bubble in synthetic intelligence (AI) was not quelled regardless of Nvidia delivering one more blockbuster quarter in November. The query stays about how OpenAI will steadiness ChatGPT’s seemingly limitless want, on the one hand, for “compute,” offered by information facilities sprouting all through the economic system, with a enterprise mannequin that takes it from the pink into the black. This is identical query that OpenAI CEO Sam Altman answered in a single exasperated phrase in a latest podcast look: “Enough.”

The funding financial institution HSBC, whereas clarifying that it nonetheless believes AI is a “megacycle” and that its forecasts “indicate a leading position for OpenAI from a revenue standpoint,” however calculates that the corporate faces a unprecedented monetary mountain whether it is to ship on its ambitions. HSBC World Funding Analysis tasks that OpenAI nonetheless gained’t be worthwhile by 2030, although its shopper base will develop by that time to comprise some 44% of the world’s grownup inhabitants (up from 10% in 2025). Past that, it’ll want at the least one other $207 billion of compute to maintain up with its progress plans. This stark evaluation displays hovering infrastructure prices, heightened competitors, and an AI market that’s surging in demand and cash-intensive to a level past any know-how development in historical past.

HSBC’s semiconductor analyst group, led by Nicholas Cote-Colisson, produced the determine by updating its OpenAI forecasts for the primary time since mid-October, factoring in latest multi-year commitments to cloud computing, together with a $250 billion settlement with Microsoft and $38 billion with Amazon. Importantly, HSBC notes, these offers got here with none new capital injection, and they’re the newest in a collection of capability expansions that now see OpenAI aiming for 36 gigawatts of AI compute energy by decade’s finish. Assuming that one gigawatt can energy roughly 750,000 properties, electrical energy on this scale would signify the wants of a state considerably smaller than Texas and just a little bigger than Florida. The Monetary Instances‘ AlphaVille blog, which previously reported on HSBC’s forecast, described OpenAI as “a money pit with a website on top.”

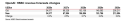

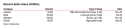

Nevertheless, the financial institution tasks that OpenAI’s cumulative free money stream by 2030 will nonetheless be unfavorable, leaving a $207 billion funding shortfall that should be crammed via further debt, fairness, or extra aggressive income technology. HSBC analysts mannequin OpenAI’s cloud and AI infrastructure prices at $792 billion between late 2025 and 2030, with whole compute commitments reaching $1.4 trillion by 2033 (HSBC notes that Altman has laid out a plan for $1.4 trillion in compute over the subsequent eight years). It can have a $620 billion data-center rental invoice alone.

Regardless of this, projected revenues—although rising quickly, to over $213 billion in 2030—would merely not be sufficient to bridge the divide. (The financial institution’s income projections are primarily based on an assumption of a better proportion of paid subscribers within the medium time period and an assumption that enormous language mannequin, or LLM, suppliers will seize a few of the digital promoting market.)

The financial institution notes a number of choices to shut the hole, together with dramatically ramping up the proportion of paid subscribers (going from 10% to twenty% might add $194 billion in income), capturing a bigger share of digital advert spending, or extracting extraordinary efficiencies from compute operations. However even underneath bullish conversion and monetization eventualities, the corporate would nonetheless want recent capital past 2030.

OpenAI’s survival is intently tied to its monetary backers and the AI ecosystem. Microsoft and Amazon should not solely cloud suppliers but in addition main buyers, and cloud gamers similar to Oracle, NVIDIA, and Superior Micro Units all stand to realize—or lose—relying on OpenAI’s fortunes. The dangers, nevertheless, are appreciable: unproven income fashions, potential market saturation for AI subscriptions, the specter of regulatory scrutiny, and the sheer scale of crucial capital injections.

HSBC means that OpenAI might increase extra debt to fund its compute necessities, however this could be “possibly the most challenging avenue in the current market conditions,” as Oracle and Meta have not too long ago raised a “significant amount” of debt to finance AI-related capex, “raising market concerns about the general financing of AI.” The financial institution notes that is an exception as a lot of the so-called “hyperscalers” have funded themselves with free money stream, as famous by JPMorgan’s Michael Cembalest not too long ago. HSBC additionally famous a “sharp increase” in Oracle’s credit score default swaps in latest days, which Morgan Stanley’s Lisa Shalett voiced alarm over a number of weeks earlier, in a earlier interview with Fortune.

HSBC, like many different banks writing on the AI revolution, returned once more to the well-known quote by Nobel prize winner Robert Solow that “You can see the computer age everywhere but in productivity statistics,” noting drily that “poor productivity gains driven by weak total factor (labour and capital) productivity are an unfortunate characteristic of today’s developed economies.” In truth, the financial institution notes that some aren’t satisfied of a significant return but from the 30-year-old web revolution itself, noting Federal Reserve Governor John Williams’ 2017 remark that “productivity provided by modern technologies like the internet has so far only influenced our consumption of leisure – and hasn’t yet trickled down to offices or factories.”

Financial institution of America Analysis’s Head of US Fairness & Quantitative Technique, Savita Subramanian, instructed Fortune in August that she sees a “sea change” for productiveness rising out of the economic system of the 2020s in ways in which aren’t essentially about AI. By means of a mix of things, together with post-pandemic wage inflation, she mentioned that corporations have been prompted “to do more with fewer people,” changing folks with course of in a scalable and significant means. A consideration that was giving her pause, although, was a shift from an asset-light to an asset-heavier focus, as most of the most modern tech corporations have found a near-unquenchable thirst for a form of {hardware} that carries lots of threat with it: information facilities.

Just a few months later, Harvard economist Jason Furman did a back-of-the-envelope calculation and located that with out information facilities, GDP progress would have been simply 0.1% for the primary half of 2025. OpenAI appears to be asking markets a query: simply how lengthy can progress be constructed on the query of future returns—and a productiveness revolution—from AI which are under no circumstances ever assured to reach?