Ondo Finance has captured main consideration after finishing its acquisition of Oasis Professional, a agency holding a number of SEC-registered licenses.

This transfer marks a strategic milestone for Ondo within the quickly rising Actual World Belongings (RWA) sector, but the important thing query stays: Does ONDO have the momentum to interrupt out?

Sponsored

Sponsored

From DeFi to TradFi: The Strategic Leap with Oasis Professional

Ondo Finance (ONDO) has formally accomplished the acquisition of Oasis Professional, together with its broker-dealer, Different Buying and selling System (ATS), and Switch Agent (TA) licenses, which had been authorised by the US Securities and Trade Fee (SEC).

“This acquisition enables Ondo to expand access as the tokenized securities market rapidly accelerates, predicted to exceed $18 trillion by 2033,” the announcement famous.

The acquisition represents a pivotal step that permits Ondo to deepen its presence within the regulated digital asset area, successfully bridging the hole between conventional finance (TradFi) and blockchain. What was as soon as a DeFi protocol issuing RWA tokens is now evolving into an infrastructure participant that may legally function inside US monetary frameworks, a prerequisite for attracting institutional traders into on-chain belongings.

Throughout the DeFi ecosystem, Ondo’s Complete Worth Locked (TVL) just lately reached an all-time excessive of $1.74 billion, with Q3 income and charges totaling round $13.7 million.

Ondo’s TVL. Supply: DefiLlama

On the similar time, BeInCrypto reported that Ondo International Markets surpassed $300 million in tokenized belongings, reflecting robust inflows into tokenized treasuries, shares, and stablecoins.

This pattern reveals the surging demand for real-world on-chain merchandise as traders search yield-bearing, comparatively safe options amid persistently excessive actual rates of interest.

Sponsored

Sponsored

Technical Alerts Value Watching

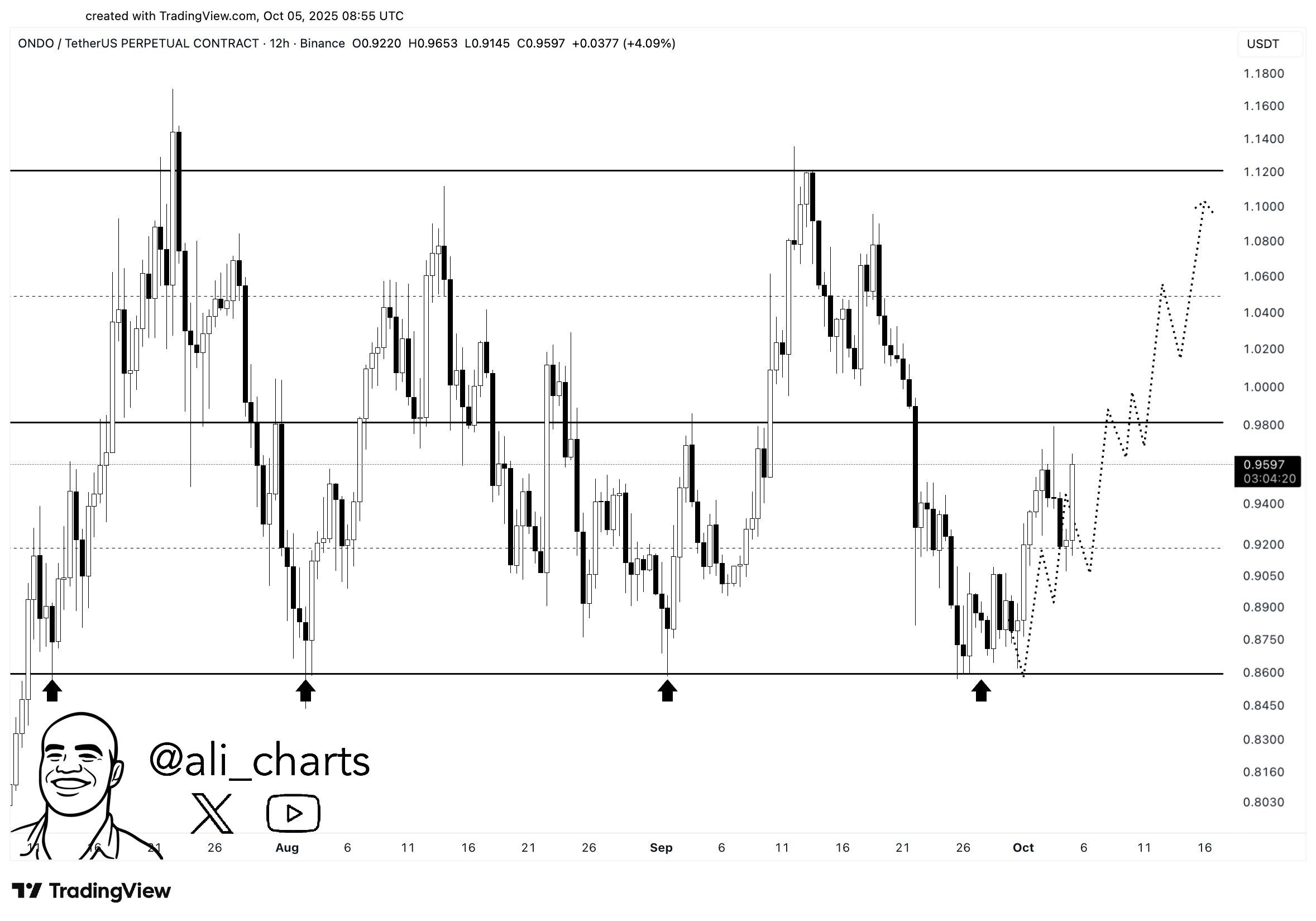

When writing, BeInCrypto information reveals that ONDO is buying and selling at $0.94, up 2.84% previously 24 hours. From a technical perspective, crypto analyst Ali highlights a strong assist zone round $0.86, with the following upside goal at $1.12 if bullish momentum continues.

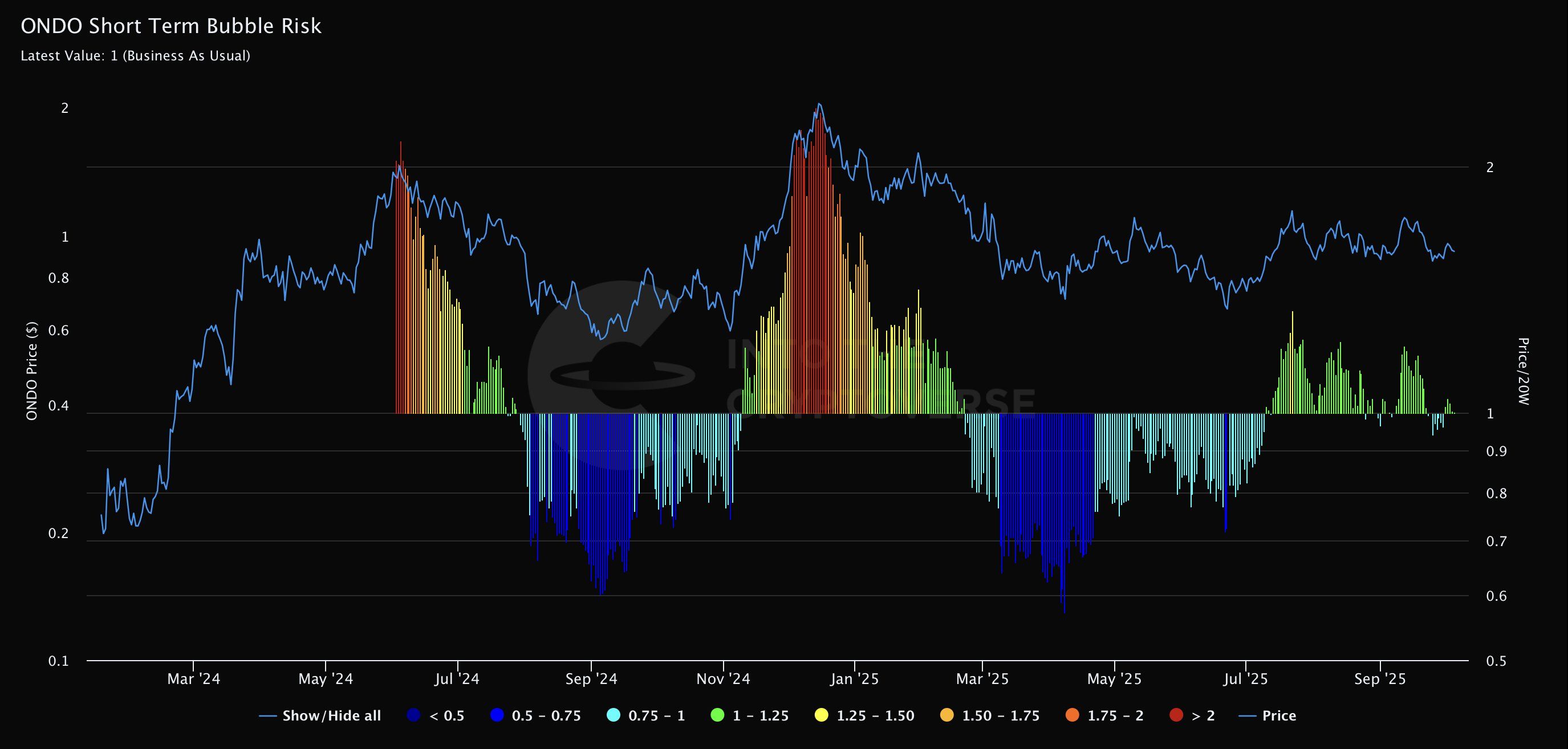

On-chain metrics additional add context. The ONDO Brief Time period Bubble Danger (STBR) indicator, the ratio between worth and the 20-week easy shifting common (20W SMA), helps determine overextension ranges.

An STBR worth under 1 alerts a bearish part, whereas readings between 1.25 and 1.5 point out rising momentum, and above 1.75 recommend excessive bubble danger. When the ratio exceeds 2.0, it implies that the asset is buying and selling at twice its 20W SMA — a stage traditionally adopted by corrections.

Knowledge reveals that ONDO has already accomplished a full market cycle, from its bubble high to a capitulation part, and has stabilized. As of late September 2025, the market seems balanced, however analysts warn of potential overheating if quantity spikes additional.

From a basic standpoint, the SEC licensing is the true catalyst — legitimizing Ondo’s tokenization mannequin inside the U.S. regulatory framework. This reduces compliance dangers and opens the door for institutional capital, which has traditionally prevented non-regulated DeFi protocols.

Nevertheless, for ONDO to realize a sustainable breakout, three key situations should align: efficiently integrating Oasis Professional’s infrastructure, continued capital inflows into tokenized merchandise, and stability amongst massive holders (whales) to stop promote strain.

If these elements falter, the rally may stay short-lived earlier than reverting to consolidation.