Picture supply: Getty Photos

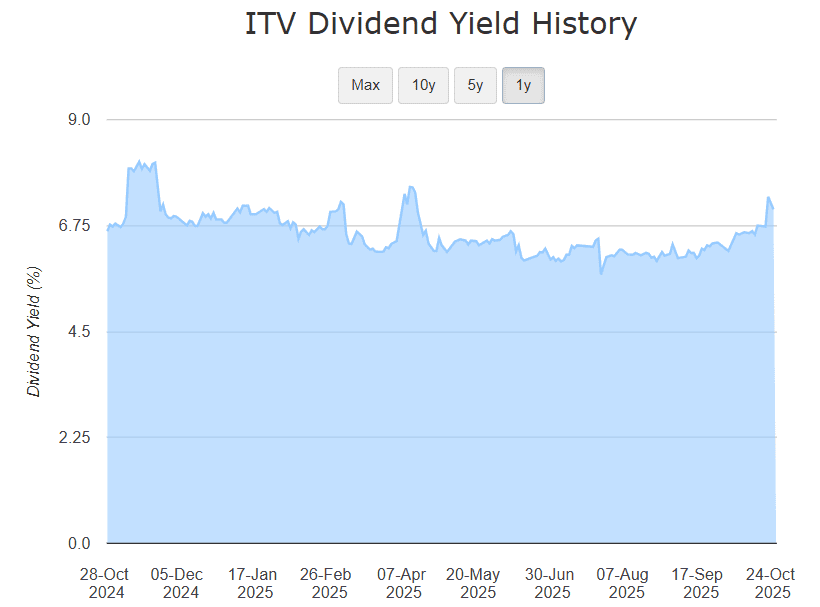

ITV (LSE: ITV) misplaced a little bit of its shine earlier this yr when its dividend yield fell under 6%. However because the share worth has slipped virtually 13% up to now six months, the yield has slowly climbed again above 7%.

That would current a chance for traders to scoop up some shares whereas low-cost and purpose to spice up their dividend revenue.

Screenshot from dividenddata.co.uk

Screenshot from dividenddata.co.uk

However what number of shares could be wanted? Effectively, for the previous three years, ITV’s paid out a full-year dividend of 5p per share. It hasn’t but declared its remaining dividend for 2025 however it seems to be prone to stay the identical.

Meaning 100,000 shares would usher in £5,000 price of dividends a yr.

With the shares now altering arms at round 70p every, that will require a hefty £70,000 funding. No small quantity — however achievable with common contributions compounded over a number of years.

How would that look? Let’s see.

Calculating returns

Say, for example, an investor buys 500 shares a month for £350. In simply over 10 years, by reinvesting the dividends, the pot would have grown to £70,000 (assuming the 7% yield held).

Within the funding world, that’s not a very long time to dedicate in the direction of constructing a good passive revenue stream.

However is ITV the perfect dividend inventory to decide on at this time? Let’s think about the professionals and cons of investing on this well-known British broadcasting firm.

Altering tides

ITV’s engaged on a brand new technique dubbed ‘More Than TV’ to diversify and develop past conventional broadcasting. Whereas there are some encouraging indicators, the enterprise stays uncovered to promoting cyclicality, regulatory shifts and margin pressures.

In its first-half outcomes to 30 June, it confirmed complete income of £1,848m. Promoting income dipped 7% to £824m whereas digital income rose 9% to £271m. That is indicative of the continued shift in media consumption developments.

It additionally introduced further cost-cutting measures to the tune of about £15m on prime of present financial savings, and trimmed its content material spend to £1.23bn to higher mirror shifting viewer patterns.

What does this imply for potential traders? From a monetary standpoint, ITV nonetheless has some strengths. Its manufacturing arm, ITV Studios, noticed UK income development of seven% to £420m in H1, for instance.

With streaming hours up and digital advert income rising, the technique to maneuver away from broadcasting and shift to digital is promising. Nonetheless, revenue earlier than tax for the interval fell markedly, revealing the challenges of this new enterprise mannequin.

With the dearth of a serious soccer event, promoting income took a success this yr. This was compounded by new UK laws limiting the promoting of less-healthy meals. These are simply two examples of the continued regulatory and cyclicality dangers the broadcaster faces.

Ultimate ideas

As conventional broadcasting continues to slide, future income rely fairly closely on the success of ITV Studios and its digital choices.

With restricted development potential, the 7% dividend yield is the important thing attraction right here. However I wouldn’t depend on it alone. ITV might make an amazing addition to an revenue portfolio, however ought to solely be thought-about as a part of a extremely diversified collection of shares.

Luckily, the FTSE 100 and FTSE 250 are chock-a-block with dependable, high-yielding dividend shares to select from.