Picture supply: Getty Photos

In these financially difficult instances, saving and investing for the long run is taking a again seat for a lot of. Authorities statistics present greater than a 3rd (38%) of individuals within the UK aged 40-75 don’t even have any financial savings. Investing within the FTSE 100, FTSE 250, or different UK shares is even additional down the checklist of many peoples’ priorities.

This leaves thousands and thousands of residents sitting on a timebomb, given the hovering value of residing in retirement. The potential for seismic adjustments to the State Pension provides one other layer of hazard.

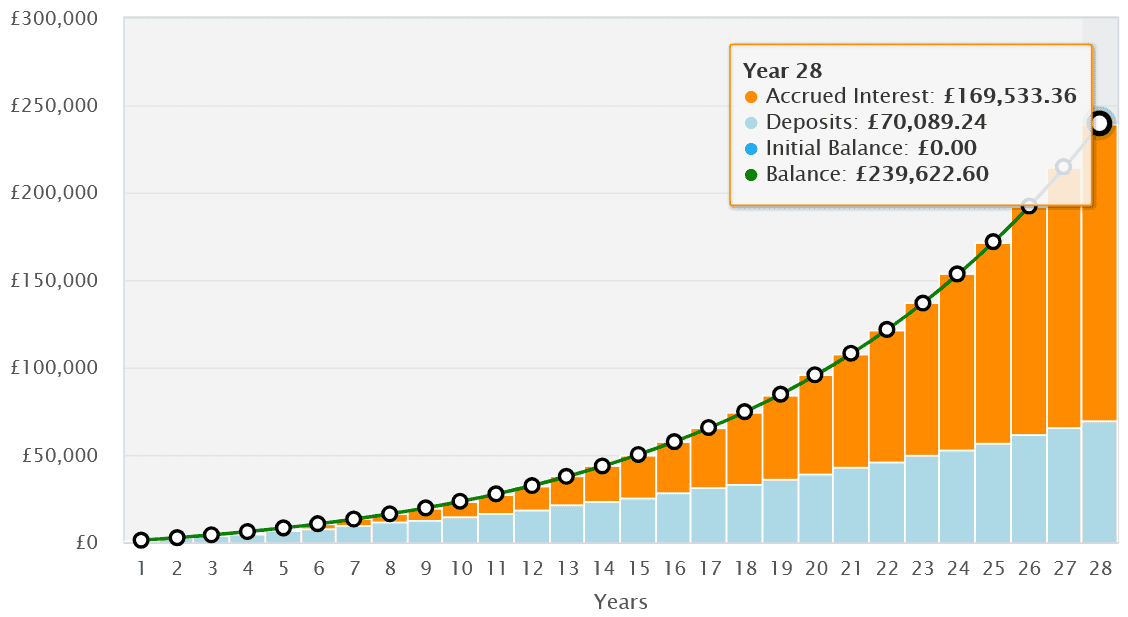

Even a modest month-to-month funding can present a buffer in opposition to such risks, although. Let me present you the way a middle-aged investor might flip a £100 month-to-month funding into roughly £240,000 by retirement.

Small acorns

A typical false impression is that those that begin their investing journey late should take greater dangers to construct retirement wealth.

With a diversified portfolio and a tax-efficient product like a Shares and Shares ISA — and a dedication to steadily rising month-to-month contributions — people don’t must take pointless dangers with their money, even when they solely have small sums to take a position at first.

Let’s say we’ve got a 40-year-old who can make investments £100 a month in FTSE 250 shares. They’ll enhance their contribution by 5% every year, reinvest all their dividends, and plan to retire once they hit the State Pension age of 68.

Since 2004, the FTSE 250 has delivered a mean annual return of 9%. If this continues, our investor would have a nest egg of practically £240k (or £239,623, to be actual). Keep in mind the index’s return might fluctuate from 12 months to 12 months.

Supply: thecalculatorsite.com

Supply: thecalculatorsite.com

A strong portfolio

I believe a well-diversified portfolio to focus on this type of a return may very well be achieved with as few as 10 shares.

For development, I imagine software program developer Softcat, Georgian financial institution Lion Finance, defence contractor QinetiQ, and retailer Greggs (LSE:GRI) may very well be prime shares to contemplate. Funding belief Allianz Know-how Belief would additionally benefit an in depth look.

And for dividends, I believe property inventory Tritax Large Field REIT, water provider Pennon, wealth supervisor Investec, and renewable vitality inventory Greencoat UK Wind benefit an in depth look.

I purchased Greggs shares for my very own portfolio for long-term development. What makes it value contemplating is its bold retailer goal — it plans to finally have 3,000 shops up and working — and heavy investments in distribution and manufacturing to drive gross sales and defend margins.

Earnings also needs to be helped by the agency’s rising presence within the night and supply segments. The enterprise also can lean extra closely into leveraging its app and loyalty programme to bolster revenues.

Greggs faces aggressive threats within the food-to-go market, and gross sales can cool throughout financial downturns. This has been a problem during the last 12 months (like-for-like gross sales rose simply 1.5% in the latest quarter).

However over the long run, I believe the corporate it has the recipe to thrive.

Concentrating on long-term wealth

With one house left in our portfolio, I believe an index tracker just like the Vanguard FTSE 250 ETF may very well be value critical consideration. This might enable our investor to unfold threat throughout your complete share index.

Whereas returns aren’t assured, I’m assured a collection of shares like this might flip even an preliminary £100 month-to-month funding right into a wholesome retirement fund.