Neighborhood Monetary System, Inc. (NYSE: CBU) reported internet earnings of $54.4 million for the quarter ended December 31, 2025. For the total yr 2025, the corporate reported internet earnings of $210.5 million. This fall 2025 internet earnings elevated 9.3 p.c from $49.8 million in This fall 2024. Full yr 2025 internet earnings elevated 15.3 p.c from $182.5 million in 2024.

- Market Capitalization

- Newest Quarterly Outcomes

- Full-12 months Outcomes Context

- Chart 1: Working Efficiency – Internet Curiosity Revenue Pattern

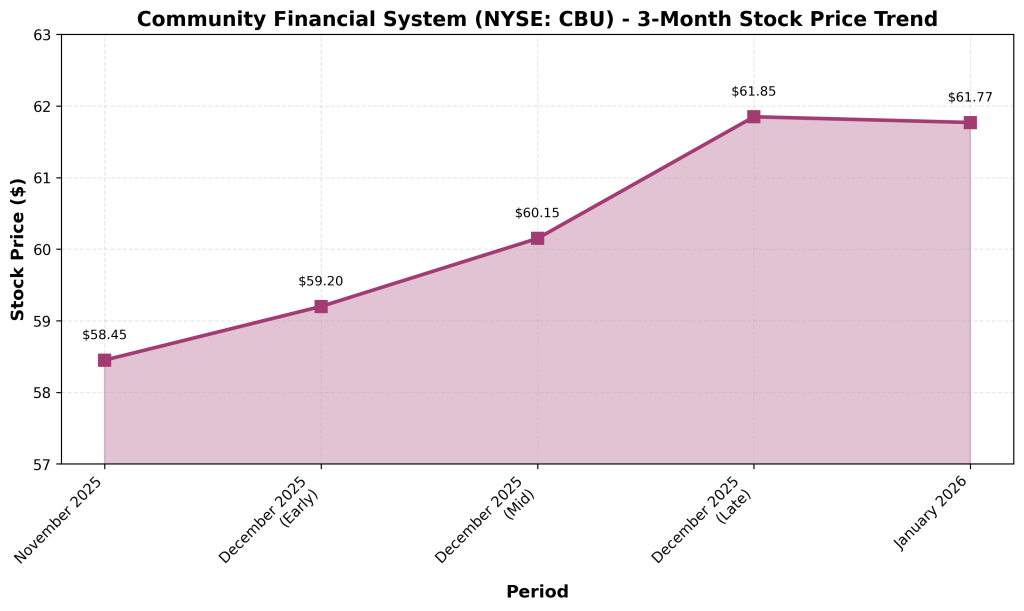

- Chart 2: Market Efficiency – 3-Month Inventory Value Pattern

- Enterprise and Operations Replace

- M&A and Strategic Strikes

- Fairness Analyst Commentary

- Steering and Outlook

- Asset High quality

- Efficiency Abstract

Market Capitalization

Neighborhood Monetary System held whole property of $17.30 billion at December 31, 2025, a rise from $16.39 billion at December 31, 2024. The corporate operates roughly 200 buyer amenities throughout Upstate New York, Northeastern Pennsylvania, Vermont, Western Massachusetts and Southern New Hampshire. Frequent shares excellent totaled 52.7 million shares at December 31, 2025. Shareholders’ fairness was $2.01 billion at December 31, 2025, in comparison with $1.76 billion at December 31, 2024.

Newest Quarterly Outcomes

Internet curiosity earnings in This fall 2025 was $133.4 million, a rise of $5.3 million from Q3 2025 and a rise of $13.5 million from This fall 2024. Internet curiosity margin was 3.37 p.c in This fall 2025, in comparison with 3.30 p.c in Q3 2025 and three.17 p.c in This fall 2024. Noninterest revenues have been $82.0 million in This fall 2025, in comparison with $78.9 million in Q3 2025 and $76.3 million in This fall 2024. Complete noninterest bills have been $138.6 million in This fall 2025, in comparison with $128.3 million in Q3 2025 and $125.5 million in This fall 2024. Provision for credit score losses was $5.0 million in This fall 2025, in comparison with $5.6 million in Q3 2025 and $6.2 million in This fall 2024.

Full-12 months Outcomes Context

Internet curiosity earnings for the yr totaled $506.6 million, a rise of $57.5 million from 2024. Internet curiosity margin was 3.27 p.c in 2025, in comparison with 3.08 p.c in 2024. Complete noninterest revenues have been $311.5 million in 2025, in comparison with $297.2 million in 2024. Complete noninterest bills have been $521.3 million in 2025, in comparison with $486.8 million in 2024. Provision for credit score losses was $21.4 million in 2025, in comparison with $22.8 million in 2024. Return on common property was 1.26 p.c in 2025, in comparison with 1.15 p.c in 2024.

Chart 1: Working Efficiency – Internet Curiosity Revenue Pattern

Chart 2: Market Efficiency – 3-Month Inventory Value Pattern

Enterprise and Operations Replace

Loans held in portfolio totaled $10.95 billion at December 31, 2025, in comparison with $10.43 billion at December 31, 2024. Enterprise lending loans totaled $4.73 billion. Shopper mortgage loans totaled $3.62 billion. Shopper oblique loans totaled $1.86 billion. Complete deposits have been $14.39 billion at December 31, 2025, in comparison with $13.44 billion at December 31, 2024. Borrowings have been $690 million at December 31, 2025, in comparison with $998 million at December 31, 2024.

M&A and Strategic Strikes

In November 2025, Neighborhood Financial institution, N.A. acquired seven department places from Santander Financial institution, N.A. within the Allentown, Pennsylvania market. The acquisition added $543.7 million of buyer deposits. On January 15, 2026, the corporate introduced an settlement to accumulate ClearPoint Federal Financial institution & Belief for about $40 million in an all-cash transaction. ClearPoint manages over $1.5 billion of property. The transaction is predicted to shut in Q2 2026. In December 2025, the Board accepted a inventory repurchase program authorizing the repurchase of as much as 2.63 million shares throughout the twelve-month interval beginning January 1, 2026.

Fairness Analyst Commentary

Administration said the corporate continued to execute on targets to ship sustainable development and above-average returns. Administration reported internet curiosity margin growth throughout all durations. Noninterest revenues set a brand new quarterly file in This fall 2025.

Steering and Outlook

The corporate didn’t present formal earnings steerage for 2026. Administration indicated concentrate on executing strategic initiatives together with increasing the diversified monetary companies platform and managing natural development.

Asset High quality

Nonperforming loans have been $56.5 million at December 31, 2025, or 0.52 p.c of whole loans. Nonperforming loans have been $73.4 million, or 0.70 p.c of whole loans at December 31, 2024. Internet charge-offs have been $2.3 million in This fall 2025, or 0.09 p.c annualized. Allowance for credit score losses was $87.9 million, or 0.80 p.c of whole loans at December 31, 2025.

Efficiency Abstract

Neighborhood Monetary System reported This fall 2025 internet earnings of $54.4 million and full yr 2025 internet earnings of $210.5 million. Internet curiosity earnings elevated in This fall 2025 and full yr 2025. Internet curiosity margin expanded in each durations. Complete loans elevated 5.0 p.c throughout the yr. Nonperforming loans declined. Shareholders’ fairness elevated 13.8 p.c from year-end 2024.

Commercial