Over the previous 10 weeks, Bitcoin Treasury Firms (BTCTCs) shares have plummeted by 50–80%, sparking widespread considerations amongst buyers.

The case of Metaplanet (MTPLF) highlights the tough volatility, as inside 18 months, it went by 12 “mini-bear markets.” This raises the query: do BTCTC shares mirror Bitcoin’s volatility, or do inside company components additionally drive them?

When BTCTCs’ Shares Are Riskier Than Bitcoin Itself

Up to now 10 weeks, Bitcoin Treasury Firms (BTCTCs) shares have recorded 50–80% declines, which has triggered a wave of concern throughout the funding neighborhood. Metaplanet ($MTPLF) is a transparent instance of this extreme volatility.

Sponsored

Sponsored

Value fluctuations of Bitcoin Treasury Firms’ shares. Supply: X

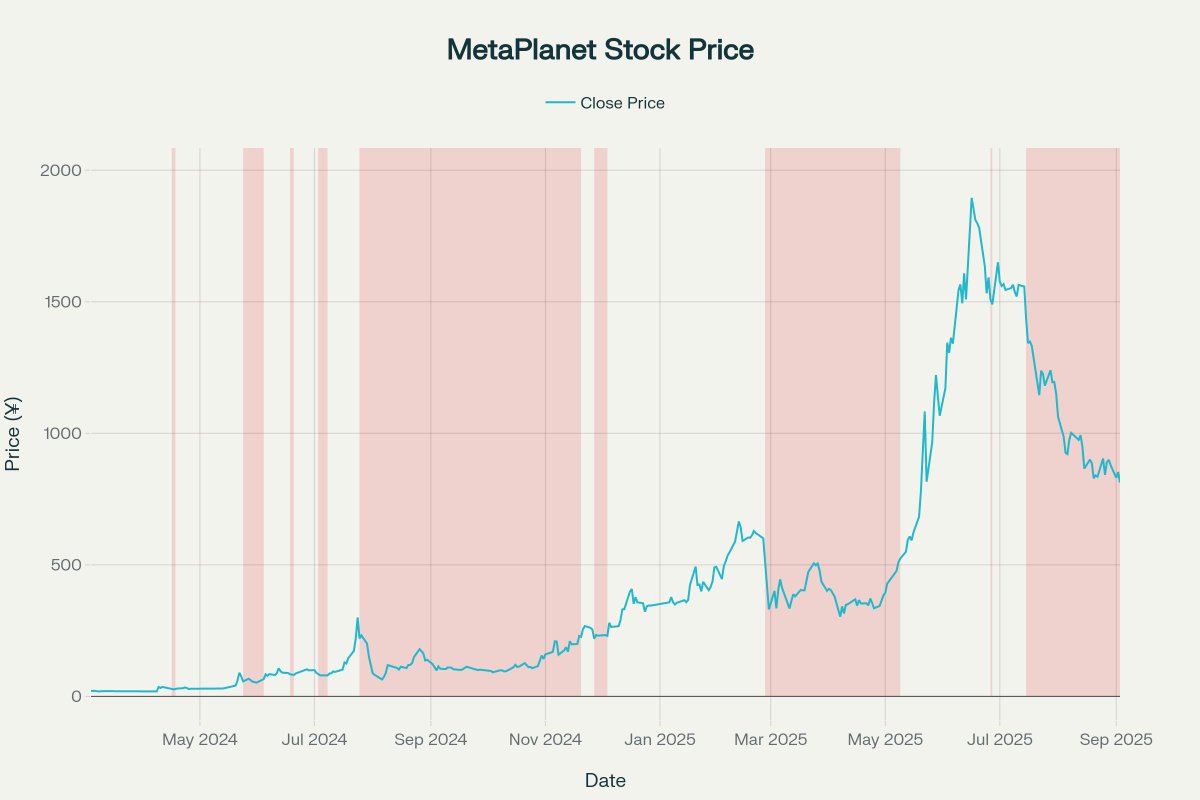

Inside 18 months, Metaplanet endured 12 mini-bear markets — starting from single-day drops to extended downtrends. On common, every decline was about -32.4% and lasted 20 days. Notably, the worst part noticed the inventory decline by 78.6% in 119 days (July 25 – November 21, 2024).

Metaplanet inventory value. Supply: Mark Moss

Metaplanet inventory value. Supply: Mark Moss

The query is whether or not these downturns totally have an effect on Bitcoin’s (BTC) personal volatility.

In keeping with analyst Mark Moss, information reveals that solely 41.7% (5 out of 12) of Metaplanet’s corrections coincided with Bitcoin’s down cycles. Conversely, greater than half had been triggered by inside company components, together with possibility issuance, capital elevating, or the shrinkage of the “Bitcoin premium” — the hole between the inventory value and the precise worth of BTC holdings.

Nonetheless, Mark noticed a partial hyperlink.

Particularly, Metaplanet’s deepest declines (reminiscent of -78.6% or -54.4%) tended to overlap with important Bitcoin drawdowns. This means that when BTC enters a high-volatility part, BTCTC shares usually stay weak for longer, struggling a double hit from each market and inside dynamics.

After all, Bitcoin stays the dominant affect. Nevertheless, company variables act as the true “leverage,” amplifying BTCTCs’ volatility far past that of BTC itself. If Bitcoin will be understood by a 4-year cycle, BTCTCs behave like “4 cycles in a single year.”

“So, in summary, the partial synchronization suggests that BTC vol does influence Metaplanet…” famous Mark Moss.

For buyers, holding BTCTCs is just not merely a guess on Bitcoin’s value, but additionally a big gamble on company capital administration, monetary construction, and enterprise technique.