Picture supply: BT Group plc

The BT (LSE:BT.A) share value has been a gentle performer because the pandemic. In October 2020, its shares had been altering fingers for simply over 100p. At present (9 October), they promote for round 185p. This five-year efficiency nearly places it within the prime third of these at the moment on the FTSE 100.

Then and now

The sale of BT shares to the general public in 1984 was the primary main privatisation of the Thatcher authorities. The concept was to free the telecoms group from state management and let it compete internationally with out being held again by forms and union energy.

However a have a look at the 1984 gross sales prospectus means that the group’s made little progress since. On the time, it was valued at £7.8bn — or £25.6bn in at present’s phrases. Now, its market cap is ‘only’ £18.2bn.

Throughout the 12 months ended 31 March 1984 (FY84), it made a revenue after tax of £990m (£3.25bn in present cash). Forty years later, in FY25, it reported adjusted post-tax earnings of £1.83bn.

So in actual phrases, it’s now price much less and isn’t as worthwhile because it was over 4 a long time in the past. Additionally, its dividend is much less beneficiant. In 1984, the inventory was yielding 7.1%. Based mostly on quantities paid over the previous 12 months, it’s now providing a return of 4.4%. This can be a reminder that payouts are by no means assured.

Sectoral challenges

This disappointing efficiency is symptomatic of the telecoms trade, the place the infrastructure is pricey and the returns are poor.

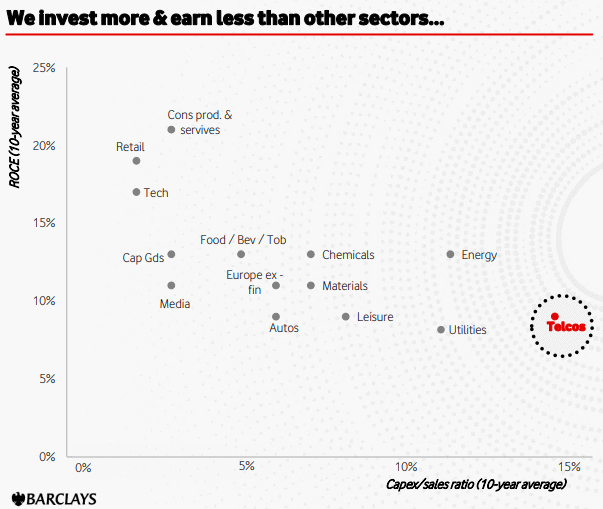

In 2023, Vodafone revealed analysis from Barclays that confirmed the ratio of capital expenditure to gross sales was the best of any trade. The sector additionally had one of many lowest returns on capital employed (ROCE).

Supply: 2023 Vodafone investor presentation

Supply: 2023 Vodafone investor presentation

That is additionally evident from BT’s accounts. On the finish of FY84, it had fastened belongings of £8.8bn and debt (together with leases) of £3.9bn. By the tip of FY25, these had elevated to £42.6bn and £23.3bn, respectively. Over the identical interval, its ROCE has fallen. And it’s remained largely unchanged over the previous 5 monetary years (FY21-FY25) fluctuating between 8.3% and eight.7%.

Professionals and cons

One shiny spot has been its adjusted EBITDA (earnings earlier than curiosity, tax, depreciation and amortisation). It’s elevated from £7.42bn in FY21 to £8.21bn in FY25. Though that is the group’s most popular measure of profitability, it may be controversial. Warren Buffett has described it as a “very misleading statistic” that “can be used in pernicious ways”. Pithily, he as soon as requested: “Does management think the tooth fairy pays for capital expenditures?” This appears to be a extremely related query in an trade the place, as we’ve seen, the infrastructure isn’t low cost.

Adjusted earnings per share might be a extra dependable indicator. However in FY21, this was 18.9p. In FY25, it was barely decrease at 18.8p. The enterprise seems caught to me.

However brokers are optimistic. They’ve a 12-month share value goal that’s 15% greater than its present worth. And BT has some spectacular names on its share register. The most important chunk of inventory (24.5%) is held by Bharti Abroad. For my part, the group additionally retains a robust model.

Nonetheless, this isn’t ample to make me need to make investments. BT seems like an excessive amount of of a plodder in an trade that calls for deep pockets. I feel there are higher alternatives for me elsewhere.