Picture supply: Getty Photos

The previous 12 months’s been something however uninteresting for THG (LSE: THG), having re-entered the FTSE 250 in September, simply months after a dramatic exit.

After the British diet and sweetness digital retailer’s rollercoaster 12 months, many are asking: is that this comeback for actual, or only a sugar rush for buyers excited about cut price looking?

A tough-earned turnaround

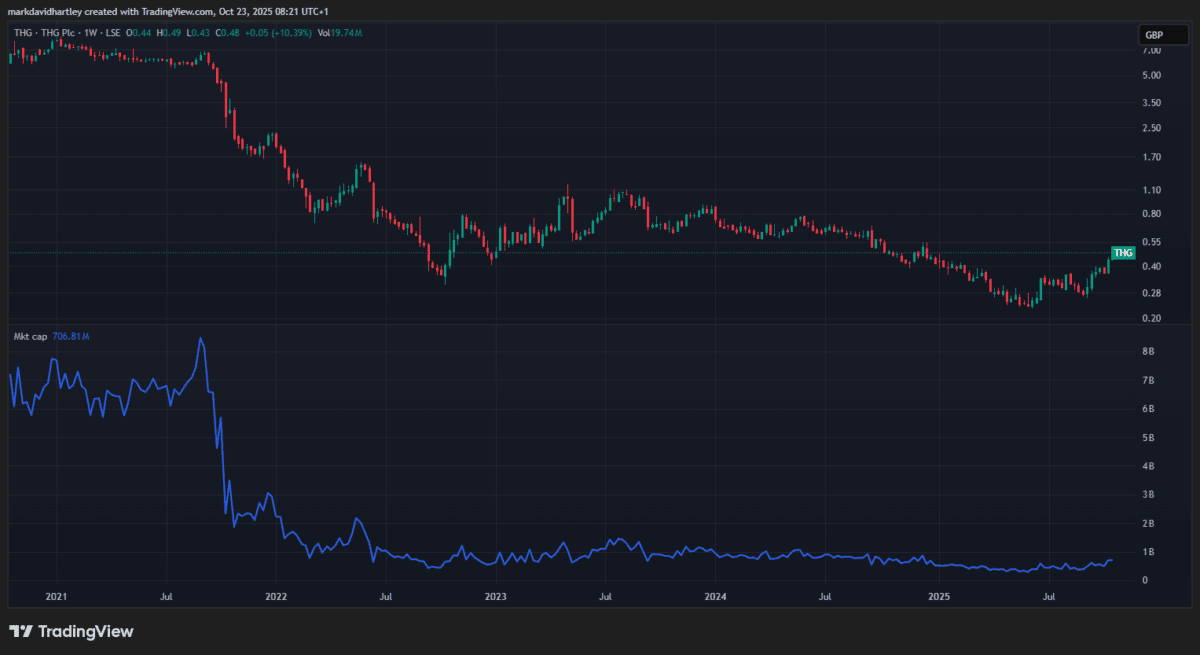

With a £664m market-cap, THG sits on the decrease finish of the index, on par with the likes of Aston Martin Lagonda and Shut Brothers. That’s a far cry from its peak, when it was value near £8.5bn.

Created on TradingView.com

Created on TradingView.com

Most not too long ago, income development in Q3 has shifted sentiment – it’s the strongest quarter of natural gross sales since 2021, with income up 6.3% to £405.2m. JP Morgan’s current ranking improve didn’t damage both, and CEO Matthew Moulding has known as this turnaround a hard-earned victory after years of chaos and restructuring.

The corporate, which owns manufacturers together with Myprotein and Cult Magnificence, suffered devastating losses in late 2021, with the worth crashing by over 70%.

Now, after years of struggles, it appears decided to stand up via the ranks once more. So does that make the present worth a chance — or a worth lure?

Let’s take a better look.

Assessing worth

THG’s nonetheless loss-making, so there’s no price-to-earnings (P/E) ratio for buyers to weigh up. As an alternative, its price-to-sales (P/S) ratio is available in at simply 0.4, which may counsel undervaluation, however the price-to-book (P/B) ratio of 1.59 is a tad wealthy. It’s this mix of numbers that always attracts worth buyers to the story.

The share worth efficiency has actually been spectacular. It’s up 68% over the previous six months – however don’t overlook, THG’s nonetheless down greater than 90% from its all-time excessive. That leaves loads of room for development if the agency can ship constant outcomes.

However what’s the town saying?

Most brokers reviewing THG price it Impartial or Maintain, with a mean 12-month worth goal predicting little-to-no development within the subsequent 12 months. Some are optimistic concerning the operational enhancements and model portfolio, whereas others stay cautious amid profitability points and aggressive threats.

Dangers to contemplate

THG’s debt stands at £601m. It’s not large for a enterprise of this dimension, nevertheless it outweighs fairness, which isn’t excellent. Add in its fast ratio beneath 1, and it’s clear THG doesn’t have sufficient liquid belongings to cowl its short-term liabilities.

That’s value excited about, particularly as on-line retail’s a crowded territory and rivals are fast to pounce on any weak spot.

Analysts observe the corporate’s ongoing restructure – together with promoting non-core belongings and automating operations – ought to assist in the long run. However any slip in client demand or additional volatility may lower quick the rally.

My verdict

After years within the wilderness, THG seems to be getting its act collectively. Gross sales are up, and forecasts predict profitability by the top of fiscal 2025. Worth buyers searching for turnarounds would possibly wish to contemplate THG, because the low share worth and enhancing numbers may benefit a better look.

Personally although, it’s nonetheless a bit too dangerous for my portfolio simply but. The combination of weak liquidity, debt, and fierce competitors offers lots to weigh up. Nonetheless, I’ll be watching to see if it grows stronger because the 12 months ends.