Picture supply: Getty Pictures

Tesco (LSE:TSCO) hit a milestone earlier this 12 months when its shares surpassed the value they have been at previous to the 2014 accounting scandal.

And whereas the street again has been lengthy and winding, the FTSE 100 inventory has taken a steep climb upwards up to now three years. Actually, add in dividends, and the three-year return simply exceeds 100%.

After this spectacular soar, the query now could be: what in regards to the dividend prospects over the following couple of years?

The forecasts

Wanting on the newest forecasts, issues seem fairly promising for shareholders. For the present fiscal 12 months (FY26), the dividend is predicted to rise virtually 4% to 14.2p per share. This consists of the interim dividend that was paid final week.

However issues get even higher subsequent 12 months (FY27), when Metropolis analysts count on a ten% bump, taking the payout to fifteen.7p per share.

FY25FY26FY27Dividend per share 13.7p14.2p15.7p

Wanting additional forward to FY28, I see a forecast for round 17.2p per share. That will be a big uplift from the 10p dished out through the pandemic in FY21.

Then once more, trying that far forward could be pushing it. Loads of issues may throw a spanner within the works within the meantime, together with one other spike in inflation or some random scandal (just like the horse meat certainly one of yesteryear).

Dividend yields

On the present 454p share worth, these forecasts translate into ahead dividend yields of three.1% and three.4%. That is solely across the FTSE 100 common, that means traders contemplating the inventory at present would ideally need some share worth progress alongside the earnings.

What are the probabilities of that? I’d say it’s doable, with CEO Ken Murphy saying in October that the grocery store was “betting on a good Christmas”. This follows a robust first half, the place like-for-like gross sales edged up 4.3% throughout the group.

Since October 2021, the corporate has purchased again £3.7bn price of its personal shares. Many of the present £1.45bn buyback programme is full, and the remaining might be accomplished by April.

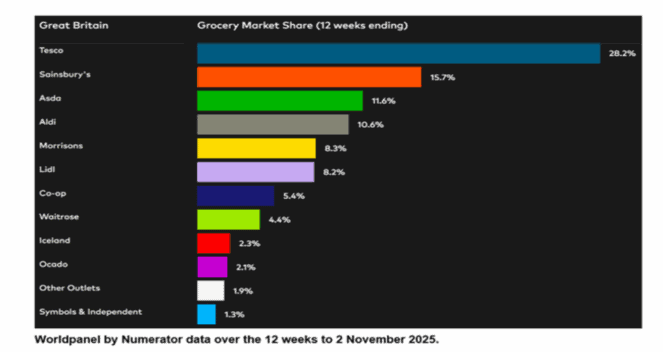

In the meantime, the corporate’s aggressive place stays very sturdy, regardless of the ever-present menace of the German discounters. In accordance with the most recent trade knowledge, Tesco instructions 28.2% of the UK’s grocery market.

Supply: Kantar/Worldpanel Plus by Numerator.

Supply: Kantar/Worldpanel Plus by Numerator.

On-line rival Ocado has been doing very well lately, quickly gaining market share. However as we will see, it stays a small participant, with simply 2.1% share.

And in September, it was reported that Amazon will shut all of its UK comfort grocery shops. A couple of years in the past Ocado and Amazon have been seen as disruptive digital threats to Tesco, however not a lot now.

Will I purchase Tesco for passive earnings?

I don’t personal any Tesco shares at present. And searching on the inventory at present, I feel it seems to be shut to completely valued at almost 15 instances ahead earnings. With the forecast dividend yield at 3.4%, the earnings on supply isn’t tempting sufficient for me to speculate.

Those that do personal a few of the shares ought to take into account holding them, I feel.

However weighing issues up, I consider there are higher shares for my cash elsewhere within the FTSE 100. And I’ve obtained my eye on a number of compelling alternatives proper now.