Picture supply: Getty photographs

I simply added these UK shares and exchange-traded funds (ETFs) to my Self-Invested Private Pension (SIPP). Right here’s why.

Shopping for on the dip

Like billionaire investor Warren Buffett, I really like buying high-quality shares after they’re going low cost. So I’ve used a current drop within the Authorized & Normal (LSE:LGEN) share worth to prime up my holdings.

The FTSE 100 monetary companies firm is now the single-largest holding throughout my whole shares portfolio.

My motivations for holding Authorized & Normal shares largely replicate my urge for food for passive earnings. The corporate’s lengthy been one of many UK’s most reliable dividend shares, rising annual payouts yearly (bar 2020) because the begin of the final decade,

And following current worth weak spot, its ahead dividend yield has nipped again above 9%, to 9.2%. To place that into context, the FTSE 100 common sits approach again at 3.2%.

Dividends are by no means assured, after all. However the agency’s spectacular Solvency II capital ratio of 217% bodes properly for the short-to-medium time period, not less than.

Over an extended horizon, I feel earnings and dividends might rise strongly as Authorized & Normal leverages its immense model energy in rising markets like asset administration, pensions and insurance coverage. I’m particularly excited by its alternatives within the UK pension danger switch (PRT) market, although competitors right here — like in its different product classes — is a significant risk traders want to contemplate.

Safety guard

Having strong on-line safety programs isn’t a luxurious however a downright necessity. During the last month, assaults have halted carmaker Jaguar Land Rover’s manufacturing and shut down a number of European airports, underlining the rising hazard of malicious actions.

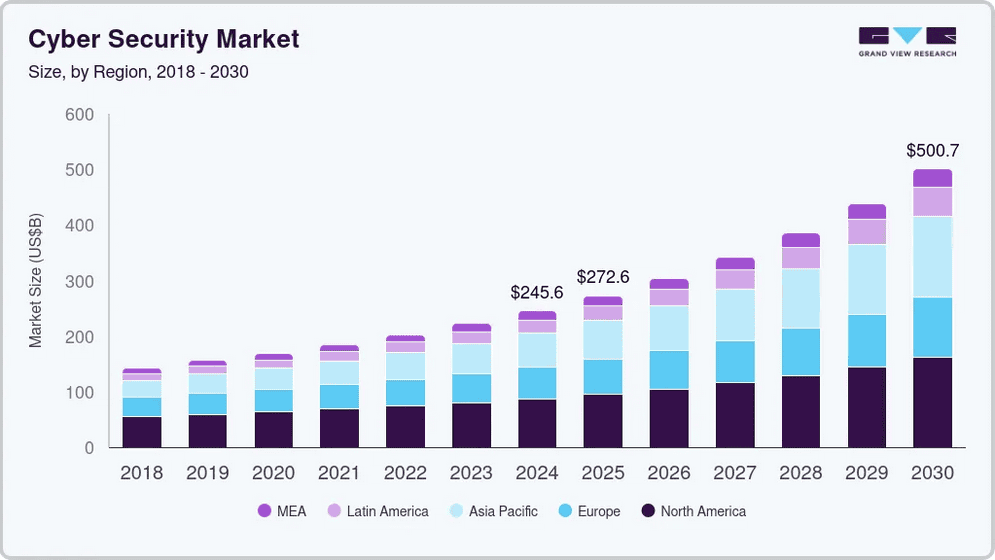

Given this, it’s no shock that analysts are tipping speedy long-term progress for the cybersecurity sector. Grand View Analysis analysts predicted annualised market progress of 12.9% over the subsequent 5 years, as an example.

Supply: Grand View Analysis

Supply: Grand View Analysis

UK share traders have a mess of ETFs they will purchase to grab this chance. I maintain the L&G Cyber Safety fund in my SIPP, and final week added the iShares Digital Safety ETF (LSE:LOCK) alongside it.

The previous offers me extra targeted publicity to market leaders Cloudflare and Palo Alto. In complete, it holds 34 shares in its portfolio. By including the iShares ETF beside it, I take pleasure in a extra diversified strategy that helps me to cut back danger. It carries a lot of the identical massive hitters however boasts a a lot bigger pool of 111 corporations.

One added sweetener is the fund’s decrease complete expense ratio of 0.4%. On Authorized & Normal’s fund, this sits at 0.69%.

Like every tech-based ETF, each of those funds might underperform throughout financial downturns when customers and companies minimize spending. These two are denominated in US {dollars}, too, which leaves my returns susceptible to change price modifications.

However on stability, I’m extraordinarily optimistic they are going to nonetheless ship wonderful long-term returns. iShares Digital Safety’s produced a mean annual return of 10.6% since its creation in 2018.