Picture supply: Getty Pictures

For many people who make investments by a Shares and Shares ISA, the long-term objective is to achieve a stage the place we are able to take a passive earnings. This might permit us to retire earlier or perhaps have a extra snug retirement.

Even when investing began later in life, it’s nonetheless doable to construct significant wealth with a transparent, disciplined strategy.

After opening an funding account, ideally an ISA, the following step is to contribute commonly to construct a capital base: set an inexpensive month-to-month quantity, deal with contributions like a invoice, and improve them when doable.

With a rising capital base, focus shifts to investing properly. For me, this implies utilizing information to tell funding selections. Nothing ought to be left to luck.

After which it’s about letting compounding do the work. Small returns reinvested over years create materials good points.

Briefly, a disciplined financial savings plan, mixed with prudent inventory choice and compounding, can remodel a late begin right into a retirement-boosting ISA. It’s by no means too late to start.

Operating some maths

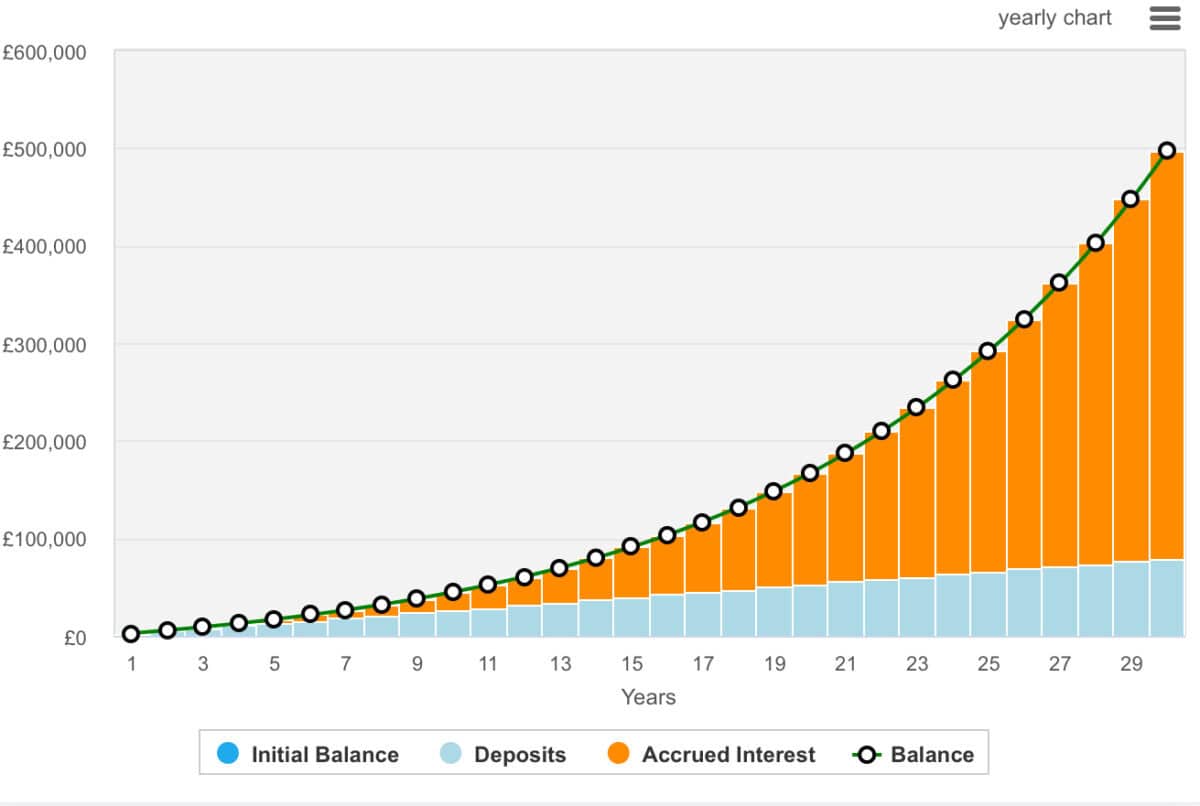

The principle variables in terms of make investments are time, returns, and contributions. With that in thoughts, I’ve created a desk highlighting how a lot an investor would wish to contribute relying on the annualised return to achieve £500,000.

As we are able to see, the less the years till retirement, the extra money an investor would wish to contribute to hit this £500,000 determine. This month-to-month contribution falls relying on the annualised return and the time afforded for it to compound.

Years to retireAnnualised return (%)Month-to-month contribution (£)1053,2001072,90010102,4502051,22520795020106603056003074103010220

The ultimate quantity exhibits us one thing very telling. Good traders with time solely want a fraction of the cash to achieve their desired endpoint. The truth is, we are able to see from this graph beneath that compound curiosity is doing the entire heavy lifting.

Supply: thecalculatorsite.com

Supply: thecalculatorsite.com

The place to speculate?

Properly, as I mentioned earlier than, I like a data-driven strategy. And with that in thoughts, Hikma Prescribed drugs (LSE:HIK) seems undervalued relative to its progress prospects. I actually assume it’s value contemplating.

The inventory trades on a ahead price-to-earnings (P/E) of round 12 instances for 2025, falling to simply 9.3 instances by 2027. That’s effectively beneath the FTSE 100 common.

In the meantime, earnings per share are forecast to rise by roughly 31% between 2025 and 2027, supported by regular income growth from $3.32bn to $3.71bn and margin good points as new capability within the US comes on-line.

The corporate’s free money movement yield is projected to rise from 5.6% to over 8%, providing scope for additional dividend progress; payouts are anticipated to climb from $0.82 to $0.98 per share, implying a ahead yield above 4%.

With internet debt forecast to fall from $969m to $542m over the identical interval, Hikma is strengthening its steadiness sheet whereas sustaining a disciplined capital return coverage.

Along with the sturdy information, the corporate’s prospects are buoyed by upcoming alternatives in GLP-1s (weight reduction medicine) as patents expire.

Nevertheless, it’s value remembering that tariffs and foreign money fluctuations haven’t been working within the enterprise’s favour just lately.