Picture supply: Getty Photographs

Jet2 (LSE:JET2) shares have pulled again sharply in latest weeks after the corporate warned that annual earnings are prone to land on the decrease finish of market forecasts.

Administration pointed to a seamless pattern of shoppers reserving a lot nearer to departure, which reduces ahead visibility and clouds short-term earnings expectations.

Nonetheless, regardless of these near-term uncertainties, there are causes to consider the inventory could also be undervalued and price contemplating for buyers.

To the top of August, flown package deal vacation clients grew simply 2%, whereas flight-only passengers elevated 17%. Common package deal vacation pricing has remained modest, whereas flight-only yields have grow to be more and more engaging.

Ahead bookings stay decrease than common, prompting Jet2 to trim its deliberate winter capability barely from 5.8m to five.6m seats. Whereas this represents a 9% enhance in comparison with final winter, it wasn’t what the market wished to listen to.

Talking to the market, chief govt Steve Heapy stated versatile capability administration, mixed with award-winning service, will present a robust basis for long-term progress.

Nonetheless, what we’re seeing is a inventory buying and selling lots decrease.

Valuation stands out

From a valuation perspective, the numbers are compelling. With a market-cap of £2.66bn at present, Jet2’s web revenue is roughly 1.1 instances its enterprise worth, adjusted for web money.

The EV-to-EBITDA ratio stands at simply 0.83 — that’s materially decrease than friends equivalent to IAG (3.8) or TUI (1.7). That is all doable as a result of Jet2 has a fortress-like stability sheet and a web money place that’s anticipated to strengthen, doubtlessly reaching £2.4bn in 2027.

The stability sheet energy offers each resilience and adaptability, supporting ongoing fleet growth and operational funding.

Regardless of the difficult macroeconomic backdrop within the UK, earnings are anticipated to develop steadily, with EPS forecast to rise from 207p in 2025 to 254p in 2027.

That stated, dangers stay. Labour prices are rising — the corporate anticipates a £25m annual enhance attributable to adjustments within the UK Finances — whereas oil costs and client confidence might have an effect on margins. For now no less than, decrease jet gas costs symbolize a supportive pattern.

Ongoing investments

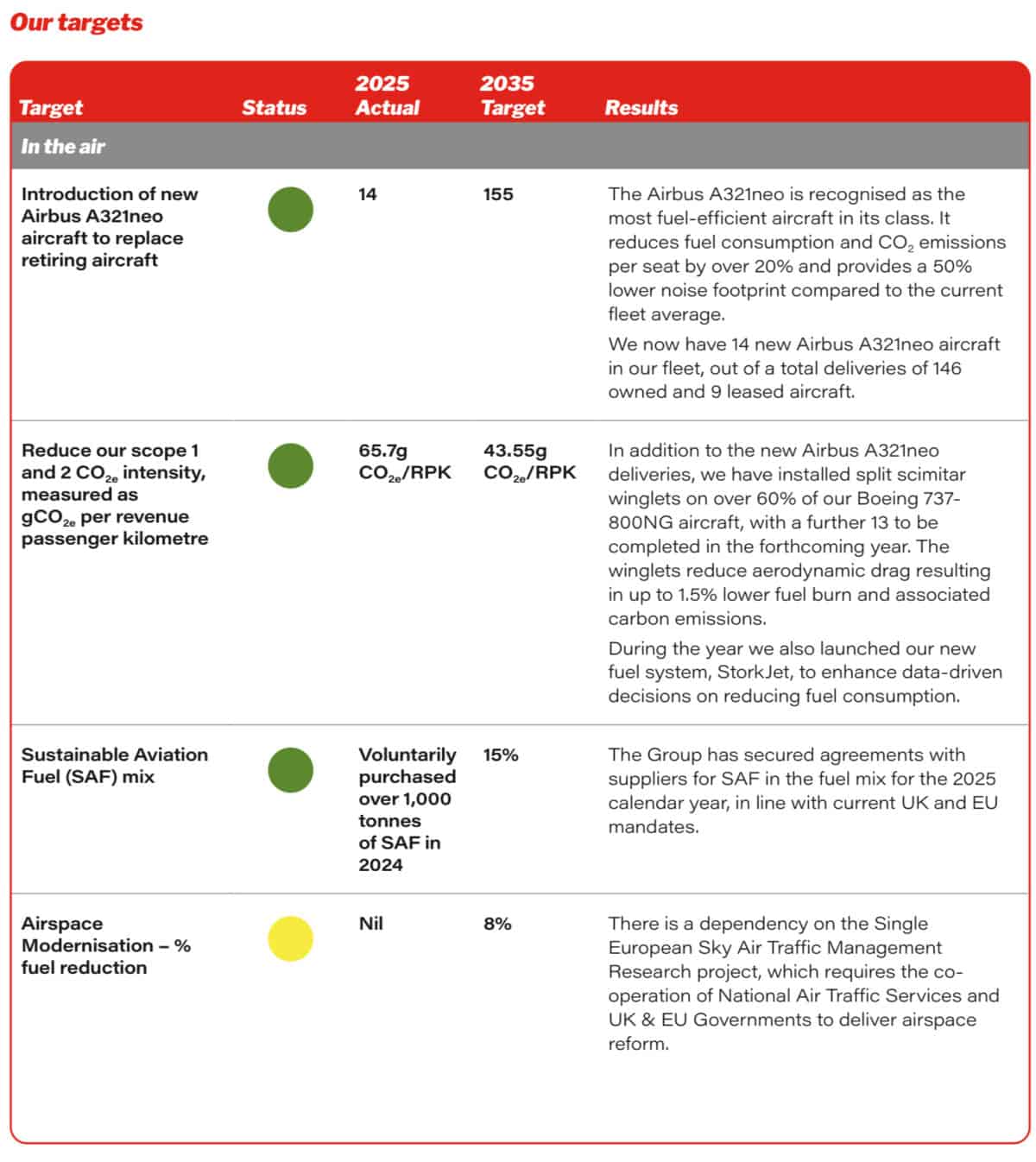

Operationally, Jet2’s investing in its fleet with a complete dedication of 155 Airbus A321neo plane by 2035. These plane provide 20% better gas effectivity and a 50% decrease noise footprint than older fashions, whereas progressively changing Boeing 737s and retired 757s.

Supply: Jet2

Supply: Jet2

In the long term, this could enable Jet2 to grow to be a extra environment friendly participant within the sector. It at the moment has one of many oldest fleets — round 13.8 years on common.

The underside line

Regardless of these challenges, Jet2 stays a extremely worthwhile enterprise with a wonderful stability sheet. What’s extra, the valuation metrics counsel the market could also be overlooking the inventory.

For long-term buyers, this mixture of robust fundamentals, ongoing fleet modernisation, and undemanding metrics imply it’s one to think about for his or her portfolios.

Furthermore, it’s now 48% under the typical share value goal.