Picture supply: Getty Photos

Shares in FTSE 100 knowledge firm RELX (LSE: REL) have been completely crushed not too long ago. Amid investor considerations over the specter of synthetic intelligence (AI) know-how from the likes of Anthropic and OpenAI, the inventory has fallen round 50% during the last six months.

Might we be a serious cut price right here? Let’s check out at this time’s full-year 2025 outcomes for clues.

Strong efficiency in 2025

RELX’s outcomes for 2025 have been strong. For the yr:

- Income was up 7% on an underlying foundation to £9,590m

- Adjusted working revenue was up 9% on an underlying foundation to £3,342m

- Adjusted earnings per share (EPS) have been up 10% at fixed foreign money to 128.5p

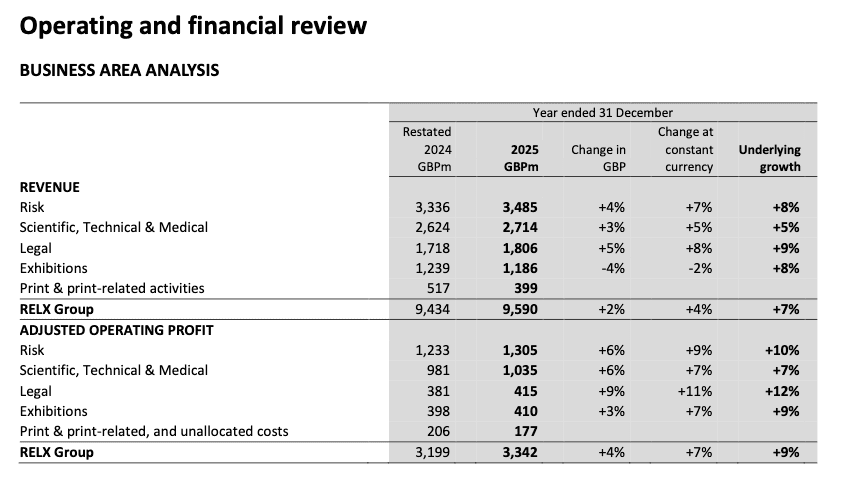

The desk under reveals a breakdown of efficiency within the firm’s totally different divisions. Its largest section, Threat, carried out effectively, delivering 8% development, as did Authorized, with 9% development.

Supply: RELX

Supply: RELX

Upbeat steerage for 2026

In fact, that is all backward trying and the specter of AI is a future problem. So, what did the corporate say concerning the future?

Nicely, for 2026, it highlighted “positive momentum across the group”, and expectations of “another year of strong underlying growth in revenue and adjusted operating profit.”

In the meantime, for each the Threat and Authorized segments in 2026, the corporate mentioned: “We expect continued strong underlying revenue growth with underlying adjusted operating profit growth exceeding underlying revenue growth.”

On the subject of AI, CEO Erik Engstrom added that it’s enabling it so as to add extra worth for patrons, “as we embed additional functionality in our products, and to develop and launch products at a faster pace, while continuing to manage cost growth below revenue growth”. It’s going to “remain a key driver of customer value and growth in our business for many years to come.”

All of this implies that the corporate doesn’t see AI as a lot of a menace within the close to time period. If something, administration seems to consider that AI will assist to drive development.

It’s price noting that the corporate elevated its dividend by 7% to 67.5p per share. Would it not have completed that if it noticed AI as an existential danger?

A FTSE 100 worth play?

So, are we a cut price within the Footsie right here? I believe so.

For a begin, the corporate’s forward-looking price-to-earnings (P/E) is simply 14. That’s low for a knowledge firm rising at a wholesome charge.

Secondly, with a relative power index (RSI) of simply 17, the inventory appears massively oversold. The RSI is a technical evaluation indicator that measures the magnitude of current share worth actions (a studying beneath 30 signifies oversold).

Third, the agency mentioned that it plans to purchase again £2,250m price of inventory in 2026 (versus £1,500m in 2025). That means administration sees the inventory as undervalued.

In fact, AI does add uncertainty as a result of there are some components of its enterprise that may very well be disrupted by the likes of Anthropic and OpenAI. An instance is its Lexis+ platform, which permits attorneys to draft briefs.

General although, I like the chance/reward proposition at present ranges. I believe this inventory is price a more in-depth look proper now.