This stay weblog is refreshed periodically all through the day with the most recent updates from the market. To search out the most recent Inventory Market In the present day threads, click on right here.

Comfortable Monday. That is TheStreet’s Inventory Market In the present day for Sept. 8, 2025. You may comply with the most recent updates in the marketplace right here with our day by day stay weblog.

U.S. fairness futures are up a small bit this morning as buyers marinate on Friday’s tepid jobs report and look ahead to this week’s coming jobs revisions and inflation reviews.

Replace: 8:17 a.m. ET

Three Cents to Begin your Week

Since there is a dearth of earnings and financial information at the moment, let’s check out three fascinating charts and tendencies to begin your week:

Manufacturing Jobs Hold Sinking

Final Friday’s job report was wildly disappointing, with June job additions being downward revised into the destructive and August outcomes coming in at a tepid 22K additions.

There’s extra disappointment if you happen to zoom out, although. Manufacturing payrolls had been significantly underwhelming, with a web lack of 12K jobs within the sector through the month. The BLS even referred to as out the 78K manufacturing jobs misplaced for the reason that begin of the yr, which continues a years-long development of declining manufacturing employment.

U.S. Manufacturing Employment has been declining since 2023

TradingEconomics

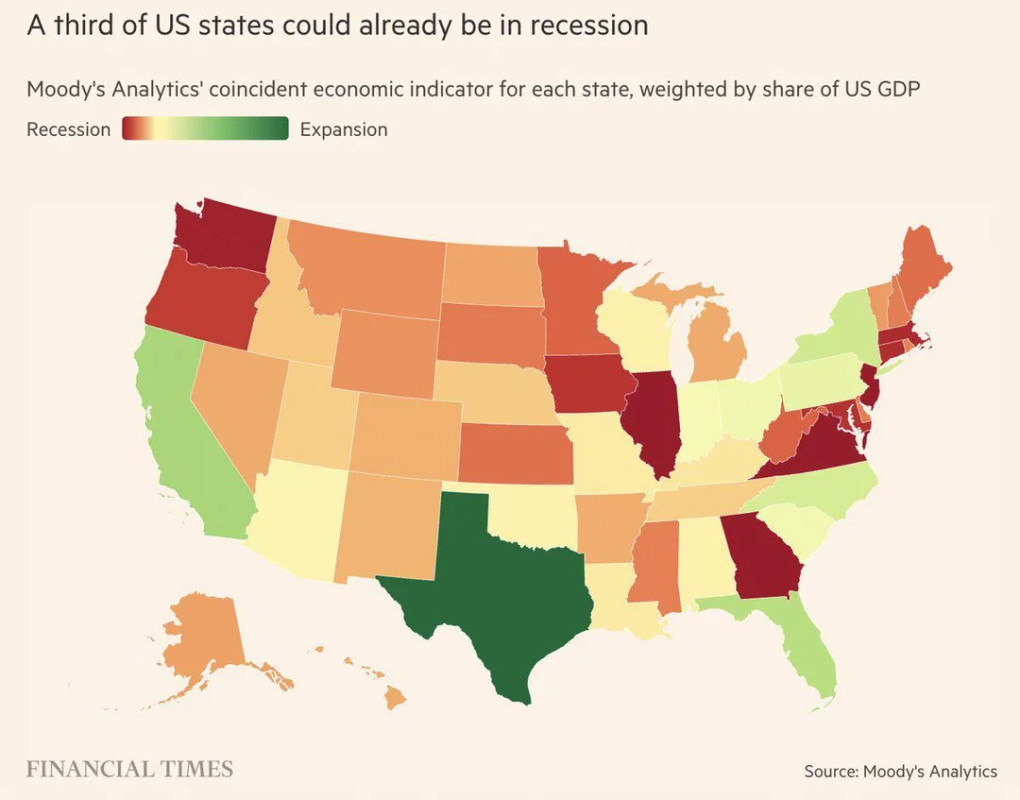

Moody’s: 1 in 3 States in Recession

Moody’s Analytics not too long ago revealed information which confirmed {that a} third of U.S. states might already be in recession. Amongst them are states equivalent to Georgia, Washington, and Illinois, amongst others. Different states, like Texas and California, have been extra fortunate.

FT visualizes the Moody’s information in a current article

Monetary Instances

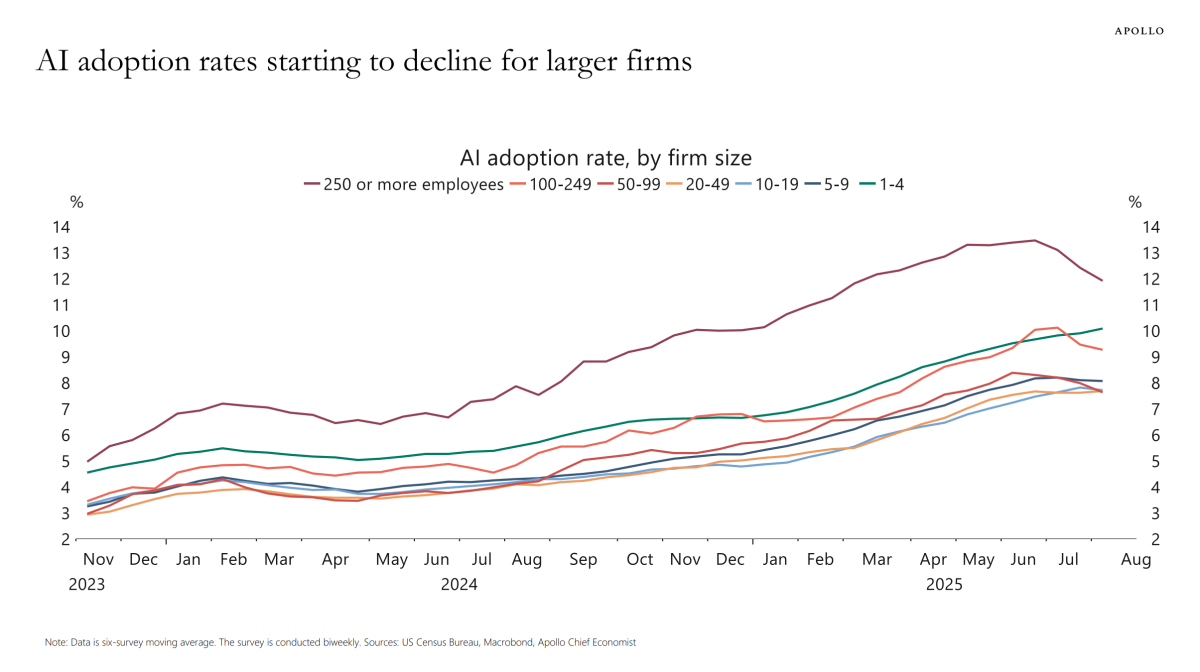

AI Adoption Charges Decline

Traders on Wall Road have been in search of clues as as to whether the AI increase goes bust.

Contradictory papers from MIT (which mentioned corporations weren’t turning a revenue on pilots) and Stanford (which mentioned AI was having a “significant and disproportionately impact” on entry-level workers) have made headlines, alongside earnings from outstanding names like Nvidia.

However this weekend, researchers at Apollo added a brand new information level: they are saying that AI adoption charges at the moment are slowing, per a Census Bureau survey, after hitting an all-time excessive in July.

Apollo International visualizes the outcomes from the biweekly Census survey

The Each day Spark / Apollo Academy

Wanting Forward

To get acquainted with what awaits this week in financial reviews and information, you would possibly glaze over a few of Charley Blaine’s weekend observe, reflecting on the place issues are going after Friday’s disappointing jobs report.

Associated: Inflation is the week’s watchword